We are almost getting towards the end of the year. I can’t wait! 2020 has been crazy. But, while it’s easy to focus on the negative, it’s important to be thankful as well. There are many blessings in life, even in these dark times. I, for one, am thankful that I still have a job, that I am in relatively good health and that my friends and family are still alive and well. I am also thankful to all my reads to visit this blog. Now, I know why you’re here. Every month, I post on dividends earned the previous month. So, let’s dive right in to see the dividend growth investing strategy in action.

Dividend Income

In August, I earned $9.72 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | AAPL | Apple | $0.44 |

| 2 | ABBV | Abbvie | $2.33 |

| 3 | HRL | Hormel Foods | $0.75 |

| 4 | O | Realty Income | $0.84 |

| 5 | PG | Proctor & Gamble | $1.06 |

| 6 | T | AT&T | $3.31 |

| 7 | SBUX | Starbucks | $0.99 |

| $9.72 |

Almost double digits. Because I am rebuilding my portfolio from scratch, it’s going to take a while before I reach triple digits again. But, though the road might be long, it is definitely worth it. Dividend growth investing is just one of several strategies I’m pursuing towards financial freedom. Slow and steady wins the race.

Annual Income

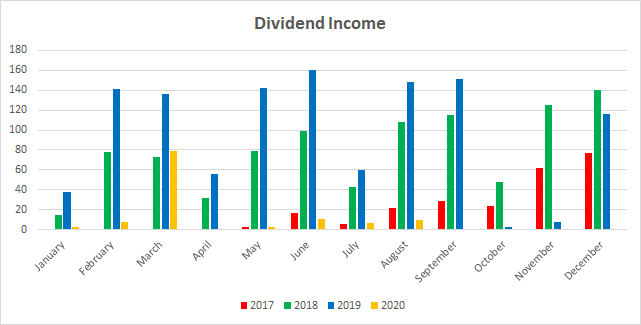

Here is a graphical representation of the dividends earned in August in relation to the dividends in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | -94.09% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | -94.69% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | -42.34% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | -99.40% |

| May | $2.85 | $79.33 | $142.69 | $2.23 | -98.44% |

| June | $16.89 | $98.51 | $160.47 | $10.29 | -93.59% |

| July | $5.99 | $42.32 | $59.68 | $6.67 | -88.82% |

| August | $21.95 | $108.44 | $147.73 | $9.72 | -93.42% |

| September | $28.72 | $111.15 | $151.66 | ||

| October | $23.21 | $48.09 | $3.00 | ||

| November | $62.11 | $124.92 | $7.18 | ||

| December | $76.51 | $140.24 | $116.51 |

As you can see, in August, I earned 93.42 LESS dividends than I did in 2019. Notably, this is a slight improvement in terms of percentage from my May 2020 Dividend Income Report, which was the previous quarter. The trend is moving in the right direction and eventually, I will get back into positive territory.

Finally, the Dividend Tracker has been updated accordingly.

Forward Annual Dividends

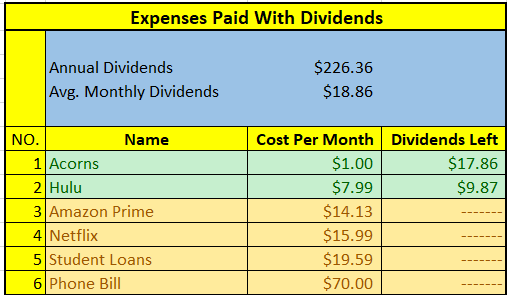

At the time of this writing, my forward annual dividends is $226.36. In my last dividend income report, my forward annual dividends was $204.30. This represents an 11% increase from the previous month. This increase is due in part to the additional contributions made in accordance with the adopt-a-stock project.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$226.36 per year is $18.86 dividends per month, on average. At present, I pay $1 per month to use Acorns. Also, my Hulu Plus bill is $6.41 per month. I earn enough in dividends to cover both Acorns and Hulu Plus. The next bill I am targeting is Amazon Prime. That amount is $14.13 per month. The immediate goal will be to see if I can generate enough dividends to cover all three bills for the year.

Although the $226.36 was an increase from the previously reported forward annual income, I don’t yet earn enough in dividends to cover all 3. But, the dividends will keep growing and so at some point, I’ll get there. The following is a list of expenses I am currently targeting:

Adopt A Stock Project

For the month of September, XOM has been identified as the most undervalued stock of the month. Therefore, I will attempt to buy at least one additional share of Exxon Mobile during the month of September.

Conclusion

Another month has gone by. I am slowly rebuilding my portfolio, one dividend at a time. August was somewhat of a quiet month. I didn’t make any grand buys or anything. I simply kept with my dollar cost averaging my way into my portfolio. Dividend growth investing will hopefully help me achieve my retirement goals. But, in the mean time, I will just keep investing so that the dividend snowball can keep growing and compounding.

How was August for you? What did you think of this post? Let me know by commenting below.

Slow and steady wins the race! Great to see you rebuilding your portfolio! Small steps eventually become large leaps forward. Keep it up DP! 🙂

My Dividend Dynasty recently posted…August 2020 Dividend Income

Thanks a lot MDD. I totally agree with you.

You are doing well. The amount coming in may be small but you have created a strong portfolio and those are all solid dividend payers you have. Keep on stacking and growing and before you know it your divvys will comver more and more monthly expenses.

DivHut recently posted…September 2020 Stock Considerations

That’s the plan DivHut. I like the portfolio, although sometimes I wish I had less stocks since I’m just starting out. Over the long run though I’m going to be happy! But until then I plan on stacking and growing as you indicated.

Pingback: Minimum Contribution Temporarily Increased - Dividend Portfolio

Awesome to see you rebuilding DP, keeping up the positive vibes and making moves. Hopefully you will close on that condo soon!

I hope so too Mr. Robot. Thanks for stopping by, as always.

Pingback: Dividend Income from YOU the Bloggers - August 2020

Pingback: Dividend Income from YOU the Bloggers – August 2020 | ResourceShark Blog