The first month of the new year has come to an end. January was a LONG month. I was able to keep my goal of making it a sober January. That’s right folks. Not a sip of alcohol for the entire month. I’ll write more about this later, but I’m sure that’s not why you’re here. Let’s see how much dividend income I earned in January 2020.

Dividend Income

In January, I received a total of $2.22 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | CSCO | Cisco | $0.92 |

| 2 | KMB | Kimberly Clark | $0.95 |

| 3 | O | Realty Income | $0.35 |

| $2.22 |

Well, I believe this is the lowest amount of dividends I’ve received in a very long time. That’s ok. I’m not demoralized. I’m actually very excited for the future. The portfolio will be small for the first half of 2020. Indeed, it might be even smaller because I will likely liquidate all my stocks in M1 Finance. However, this is just a bump in the road. I’m in it for the long haul, and as I increase my cash flow (hopefully), I will increase the rate at which I contribute to my portfolio – which is none-existent at this point.

Slow and steady wins the race and this is a race I intend to win.

Annual Income

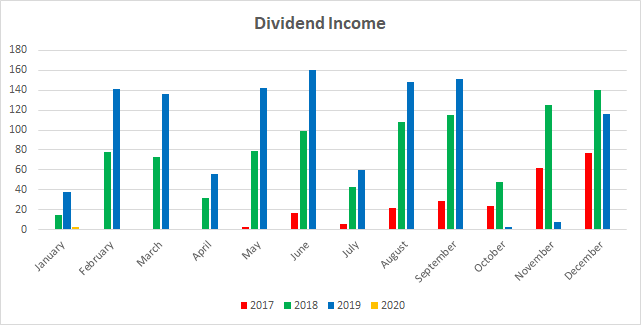

Here is a graphical representation of the dividends earned this month in relation to the dividends earned in previous years.

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | -94.09% |

| February | $0.00 | $77.66 | $141.16 | ||

| March | $0.00 | $72.93 | $136.45 | ||

| April | $0.41 | $31.47 | $55.39 | ||

| May | $2.85 | $79.33 | $142.69 | ||

| June | $16.89 | $98.51 | $160.47 | ||

| July | $5.99 | $42.32 | $59.68 | ||

| August | $21.95 | $108.44 | $147.73 | ||

| September | $28.72 | $111.15 | $151.66 | ||

| October | $23.21 | $48.09 | $3.00 | ||

| November | $62.11 | $124.92 | $7.18 | ||

| December | $76.51 | $140.24 | $116.51 |

As you can see, I earned a whopping NEGATIVE 94.09% of dividends as compared to last year. The good news is that when I start rebuilding my portfolio, the percentage increase is going to be EPIC.

Forward Annual Dividends

At the time of this writing, my forward annual dividends is $502.16 This is a respectable amount but is nearly identical to what it was last month. That’s because I’ve stopped contributions (for now) to my dividend portfolio. I’m hoping to get back to the days where I am projected to make $1000 a year and beyond. I’m not on a sprint but a marathon.

Conclusion

January has ended, but there’s a whole new year ahead of us. In personal finance, I hope to increase my cash flow. My net worth will likely go down because my debt on the condo will increase, but hopefully, the cash flow will be worth it. As soon as the condo closing is over (around April or May), and after a month or two, I will focus on rebuilding my portfolio.

If my strategy works, I should be able to rebuild my dividend portfolio at a faster rate than I have ever before.

How was January for you? Did you reach any milestones? What do you think of this post? Let me know by commenting below.

Good luck with a portfolio rebuild 🙂 it might end up that you sold high and now some buying oppurtunities should occure. Nice graph of dividend history. CSCO, KMB and O is on my radar.

P2035 recently posted…Guess what #2!

Thanks p2035. I probably should look at that in terms of whether I made a profit, which wouldn’t be a bad thing. If it was up to me, I wouldn’t sell at all. But I will definitely focus on rebuilding my portfolio before the end of the year.

I’m glad your still posting your results and that you have high spirits. You’re definitely in it for the lang haul! Looking forward to seeing your progress on the condo.

Thanks Mr. Robot. I can’t wait to post on that progress myself.

Congrats with the new condo! Also, quiting drinking was one of the best decisions of my life. I’ve been sober for almost 2 years now and I feel a lot better plus have much more money. You’re doing the right thing. Take it one day at a time and never look back.

My dividend income was pretty low in January too. That’s ok. You’ll bounce back with your portfolio rebuild.

I own Realty Income too and it’s nice to always see the dividend month after month. Definitely a stock I plan to hold for a long time.

Thanks IT. After a successful sober January, I celebrated midnight on February 1 by drinking alcohol. Now I’m doing a sober February, with the thought process of celebrating by

drinking alcohol midnight on March 1, 2020. So far so good.

Realty Income is a good company. I can’t wait to build up not just my portfolio but my position in the monthly dividend paying company.

Love O. Great company for a dividend investor.

It is one of my favorites.

Pingback: January Dividend Income from YOU the Bloggers! - Dividend Diplomats