Another month has gone by. I’ve had a very busy month. I moved to another state and was able to rent a studio. Basically, I’m paying $30 less for rent and all utilities. I’m only here for six months. During that time, I’m going to explore the possibility of buying a house to live in. That way, I can have roommates and lower my living costs even further. Obviously, I don’t need to buy a house to have roommates, but everything is on the table. Additionally, I’m trying to learn my new job. It’s a bit exciting, but it’s definitely keeping me busy. But, enough about me. That’s not why you’re here. You’re here because dividend growth investing is an awesome strategy for long term investors. So, let’s see how many dividends I earned in July!

Dividend Income

In July, I earned $6.67 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | KMB | Kimberly-Clark | $1.21 |

| 2 | KO | Coca Cola | $1.40 |

| 3 | MO | Altria Group | $3.40 |

| 4 | O | Realty Income | $0.66 |

| $6.67 |

That’s what I get for starting over. $6.67 is a small amount of money. Still, it’s $6.67 that I didn’t have before. AND, it’s $6.67 that has been re-invested to continue to work for me while I sleep. That’s just hard to beat. I didn’t use the money to buy Starbucks or anything. Dividend investing is a long-term strategy, and this is only the beginning. It just gets better from here. Besides, the first month of the quarter is usually my slowest month!

Annual Income

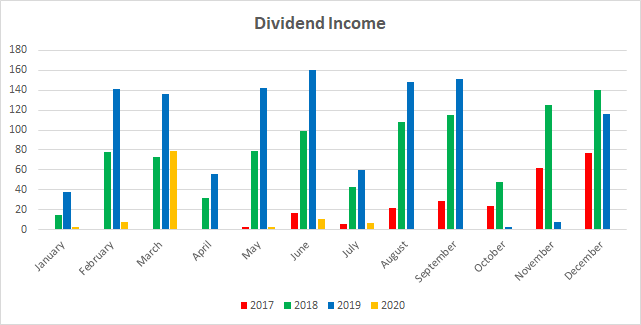

Here is the graphical representation of the dividends earned in July in relation to the dividends earned in previous years.

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | -94.09% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | -94.69% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | -42.34% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | -99.40% |

| May | $2.85 | $79.33 | $142.69 | $2.23 | -98.44% |

| June | $16.89 | $98.51 | $160.47 | $10.29 | -93.59% |

| July | $5.99 | $42.32 | $59.68 | $6.67 | -88.82% |

| August | $21.95 | $108.44 | $147.73 | ||

| September | $28.72 | $111.15 | $151.66 | ||

| October | $23.21 | $48.09 | $3.00 | ||

| November | $62.11 | $124.92 | $7.18 | ||

| December | $76.51 | $140.24 | $116.51 |

As you can see, in July, I earned 88.82 LESS dividends than I did in 2019. Notably, this is a slight improvement in terms of percentage from my June 2020 Dividend Income Report. The trend is moving in the right direction and eventually, I will get back into positive territory.

Finally, the Dividend Tracker has been updated accordingly.

Forward Annual Dividends

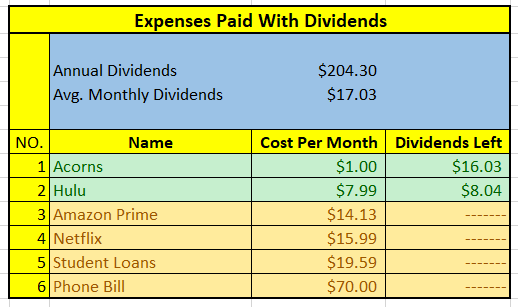

At the time of this writing, my forward annual dividends is $204.30. In my last dividend income report, my forward annual dividends was $183.75. This represents an 11% increase from the previous month. This increase is due in part to the additional contributions made in accordance with the adopt-a-stock project.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for.

$204.30 per year is $17.03 dividends per month, on average. At present, I pay $1 per month to use Acorns. Also, my Hulu Plus bill is $6.41 per month. I earn enough in dividends to cover both Acorns and Hulu Plus. The next bill I am targeting is Amazon Prime. That amount is $14.13 per month. The immediate goal will be to see if I can generate enough dividends to cover all three bills for the year.

Although the $204.30 was an increase from the previously reported forward annual income, I don’t yet earn enough in dividends to cover all 3. But, the dividends will keep growing and so at some point, I’ll get there. The following is a list of expenses I am currently targeting:

Adopt A Stock Project

For the month of August, XOM has been identified as the most undervalued stock of the month. Therefore, I will attempt to buy at least one additional share of Exxon Mobile during the month of August.

Conclusion

There you have it. July is over and I’m looking forward the rest of the year. I will try to post more frequently, but I suspect that won’t happen until at least around September or October. Of course, the monthly dividend income reports will always be posted on time.

I still haven’t closed on the condo yet. More delays due to COVID-19. I’m hoping August is the month I close, but I’m not holding my breath. I anticipate needing more money for the down payment, but I don’t plan on touching my dividend portfolio anymore.

I’m sort of at a cross-road in life. I have so many plans and goals, but not enough financial resources to do them all. I want to invest in real estate, dividend growth investing, payoff my house early and max out my contributions to my retirement accounts. The problem is, I can’t do them all. So, I actually have to prioritize. It doesn’t help that I’m contemplating also saving up for a down payment on my dream condo which I won’t be able to purchase until about 6-7 years from now. Such is life right?

Well, as soon as I make decisions, I will let you know. But, don’t worry. As I’ve indicated in previous posts, Dividend Portfolio isn’t going anywhere. In fact, as soon as I close on the condo, I will work to fulfill my goal of having my portfolio reach 10k by the end of the year. So stay tuned.

What did you think of this post? Let me know by commenting below.

DP –

I love seeing you get back to where you were. You are getting there. Close your eyes and envision where you want to be. Breathe. Take steps. Take action. Breathe.

-Lanny

Appreciate it Lanny. Patience is a virtue, and winter is coming!

It’s nice to see you back on track, DP! Keep going and you will surpass the dividend income you earned previously.

I really like your approach to see what bills your dividend income could cover if you decided to spend them. Looking forward to see when that Amazon Prime bill is in the bag 🙂

Glad you liked it BI. Crossing off Amazon Prime will add new motivation. I can’t wait. Thanks for the encouragement!

I really like your “1-6 levels” idea for how much your dividends are covering in terms of your personal expenses.

That’s a great way to look at it. If you can keep building that portfolio up, you can slowly knock out major life expenses–potentially forever–as the portfolio keeps throwing off dividends into the future.

Good, positive way to look forward.

Our dividends shrank pretty dramatically in July since most of our funds are tied up in index funds that go ex-dividend quarterly or annually. However, I do still have some Seagate (STX) sitting around (which I’m not super happy with) in an old trading account from several years ago. The shares pumped out nearly $200 in dividends for July.

Guess I can’t complain about STX this month!

Cheers, keep it growing!

Chris@TTL recently posted…Net Worth Revealed! Our July 2020 Income & Expenses.

Hey Chris,

Thanks for stopping by. Sorry to hear about the dividends shrinking but hopefully it comes back stronger than before!

Hey DP! Life sounds busy for you, alright. It’s not easy to juggle so many things, but you seem to have mapped it all out and are addressing items as they come.

Glad to see the portfolio is on the mend. Soon enough you’ll be surpassing previous monthly highs. Keep at it.

I shared MO and O with you in July. I was happy to see a small raise announcement from MO in July, too.

Engineering Dividends recently posted…Performance Check – Exxon Mobil (XOM)

Appreciate it ED. It’s going to be very tough, but that’s the goal: rebuilding the portfolio.

It’s always great when we our dividend stocks raise their dividends. Even though MO was a small increase, it added additional shares to the portfolio and helps big a bigger dividend snowball.

Pingback: Dividend Income from YOU the Bloggers – July 2020 | ResourceShark Blog

Hi! This is my first visit to this blog and it seems that you are on the beginning of your investing journey. Well, I’m in the same situation. Do you have any specific strategy to find good dividend stocks? Where do you find dividend stock ideas?

Marijan Sivric recently posted…With How Much Money Did Warren Buffett Start?

Hey Marijan, welcome to the blog. I would start by looking up Dividend Aristocrats. Those are stable companies with a long history or raising their dividends. You’ll find that most of the stocks in my portfolio are dividend aristocrats – companies that you will likely be familiar with, like Johnson & Johnson, Coca Cola and Pepsi. Good luck and definitely, don’t be a stranger.

Thanks! I have already checked some of them and I will definitely consider buying some of them.

Marijan Sivric recently posted…How To Find Good Dividend Stocks?