Well, it’s that time of the month for one of my favorite posts. Time to post my dividend income report. I hope everyone enjoys the upcoming 4th of July holiday. There are a lot of bad news out there. I could go down the list but I’m sure you know what they are. It’s good to know that despite all the negativity, I can count on my dividends being paid and re-invested every month. My portfolio may be small, but we all have to start from somewhere. Overtime, as I continue to contribute my own funds, and as the dividends get reinvested, the dividend portfolio will grow, and snowball, and get bigger. Patience, consistency, and discipline are key. It’s a long and slow road to financial freedom but a worthwhile one. So, without further adieu, let’s see how much dividends I earned in June 2022.

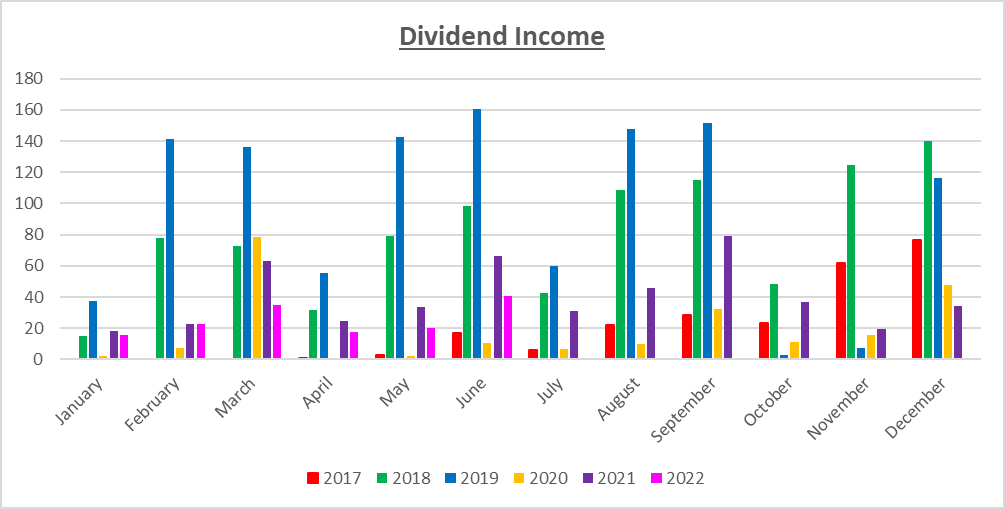

Dividend Income

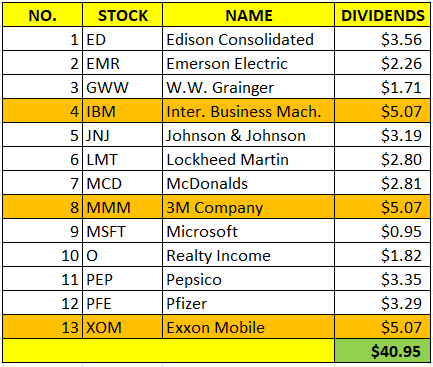

In June, I earned $40.95 in dividends broken down as follows:

I can’t tell you the last time I was excited about getting $40.95. I am so close to crossing the $50 threshold and then unto triple digits. One of the more interested things about last month’s dividends is that 3 companies paid me EXACTLY the same amount. Those companies, IBM, MMM & XOM, which are highlighted in orange above, all paid me $5.07 in dividends. Total coincidence. That has never happened to me before. Maybe I should buy a lotto ticket.

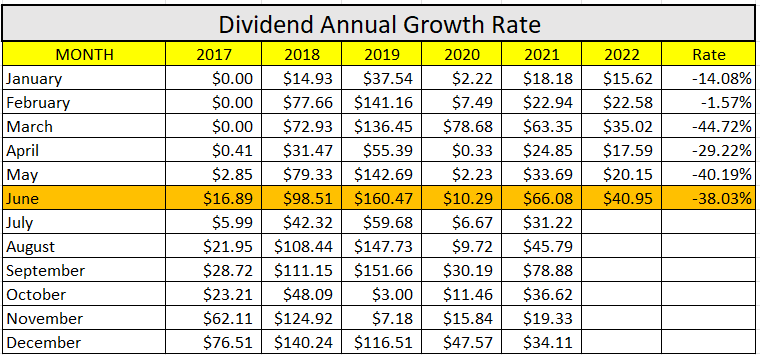

Annual Income

Here is a graphical representation of the dividends earned in June in relation to the dividends earned in previous years:

Here is the raw data:

I made nearly 40% LESS in dividends this June than I did in June of last year. It could be worse. Clearly my dividend portfolio did not move in the direction I would have hoped. But, with consistency and dedication, I fully expect June 2023 to exceed the income generated in June 2022.

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $348.43! A month ago, my forward annual dividends was $338.86 This represents a healthy 2.82% growth from the previous month. Still, I know that there this is much work to do.

I do have a few more priorities to focus on before I can start aggressively contributing to my dividend portfolio and thereby building my forward annual dividends. I’ve already paid off my credit card debt recently. Now I am concentrating on paying back a personal loan of $6000 (0% interest rate), and then build up my emergency fund. But don’t worry, I won’t be neglecting my portfolio. In fact, as soon as I pay off the personal loan, I anticipate announcing an increase to my contribution limit every month.

Finally, the Dividend Tracker has been updated.

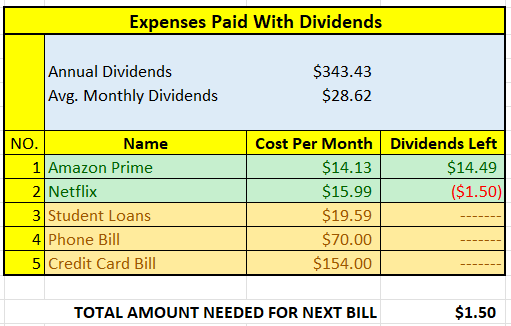

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$343.43 per year is $28.62 dividends per month, on average. At present, I earn enough in dividends to cover Amazon Prime. I cancelled my Acorns and Hulu Plus subscriptions. I hadn’t used those in months. The next bill I am targeting is Netflix. The total amount needed until I can pay the next bill is $1.50 in dividends. I hope to cover this bill during the second half of 2022.

The following is a list of expenses I am targeting:

Conclusion

I was excited the write this dividend income report. I feel as if the portfolio is in a good place. Given the fact that I don’t plan on retiring for another 11 years, I have plenty of time to build up my portfolio. What’s important to me is to have a solid foundation so that should there be a recession this year or in 5 years, I can weather the storm.

How was June for you? Did you break any new milestones? What did you think of this post?

Let me know your thoughts by commenting below.

Hahaha, I think you should definitely buy a lotto ticket!

Nice month DP! You will definitely cross $50 the next time around. Keep it up! 🙂

My Dividend Dynasty recently posted…June 2022 Dividend Income Plus New Facebook Page

Thanks MDD. I’m hoping to cross the $50 soon!

Curious why are your dividends less than last year?

Hey clotzyng,

Thanks for the question. The reason why my dividends are less than last year is because last year, I sold out of my dividend portfolio to purchase a beach condo, which is now the subject of my monthly vacation rental income report. I was pretty transparent about the whole thing and documented my thought process on the blog. So, now I am working on rebuilding my portfolio, with a long-term view, and hopefully, without the need to sell again any time soon.

Welcome to the blog and thanks for the comment.