Oh wow, I can’t believe it’s April already. I’ve been so busy at work, it’s crazy. So, unfortunately, I haven’t been able to post. However, I am excited to make this dividend income report for March 2021. The great thing about dividend growth investing is that the dividends are working hard for me, even while I’m busy doing other things. So, without further adieu, let’s dive in and see how much dividend income I earned in March.

Dividend Income

In March, I earned $63.35 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | ED | Consolidated Edison | $4.83 |

| 2 | EMR | Emerson Electric | $2.78 |

| 3 | GWW | W.W. Granger | $2.27 |

| 4 | IBM | Intern Bus Machine | $6.01 |

| 5 | JNJ | Johnson & Johnson | $3.57 |

| 6 | LMT | Lockheed Martin | $3.61 |

| 7 | MCD | McDonalds | $3.55 |

| 8 | MMM | 3M Company | $4.70 |

| 9 | MSFT | Microsoft | $1.09 |

| 10 | O | Realty Income | $2.21 |

| 11 | PEP | Pepsico | $4.75 |

| 12 | PFE | Pfizer | $4.45 |

| 13 | SBUX | Starbucks | $2.04 |

| 14 | XOM | Exxon Mobile | $17.49 |

| $63.35 |

Not too bad. 14 companies paid me dividends in March. I received a respectable amount. Although not as much as before, the portfolio is slowly rebuilding and I can’t wait to get back to making triple digits in March.

Annual Income

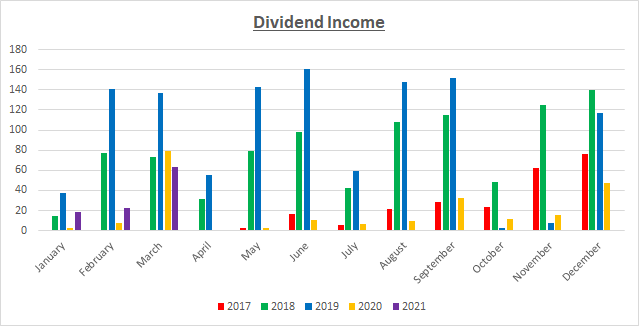

Here is a graphical representation of the dividends earned in March in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | 2021 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | $18.18 | 718.92% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | $22.94 | 206.28% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | $63.35 | -19.48% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | ||

| May | $2.85 | $79.33 | $142.69 | $2.23 | ||

| June | $16.89 | $98.51 | $160.47 | $10.29 | ||

| July | $5.99 | $42.32 | $59.68 | $6.67 | ||

| August | $21.95 | $108.44 | $147.73 | $9.72 | ||

| September | $28.72 | $111.15 | $151.66 | $30.19 | ||

| October | $23.21 | $48.09 | $3.00 | $11.46 | ||

| November | $62.11 | $124.92 | $7.18 | $15.84 | ||

| December | $76.51 | $140.24 | $116.51 | $47.57 |

Although I made almost 20% less dividends this year than last, I anticipate that next year March, I’ll be back in positive territory. The dividend snowball continues to get bigger and bigger.

Finally, the dividend tracker has been updated.

Forward Annual Dividends

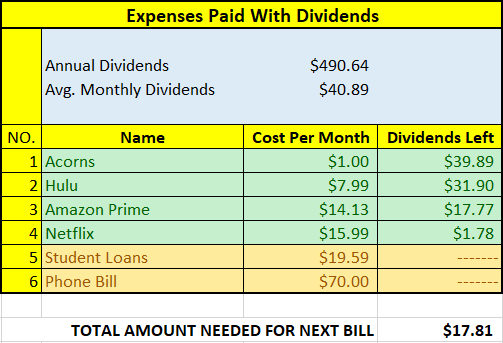

At the time of this writing, the forward annual dividends is $490.64. A month ago, my forward annual dividends was $477.19. This represents a 3% increase from the previous month. I’ll take it.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$490.64 per year is $40.89 dividends per month, on average. At present, I earn enough in dividends to cover Acorns, Hulu Plus, Amazon Prime and Netflix. The next bill I am targeting is my student loans. That amount is $19.59 per month. The total amount needed until I can pay the next bill is $17.81 in dividends. With any luck, hopefully I can cover this bill by the end of the year.

The following is a list of expenses I am targeting:

Conclusion

Dividend Growth Investing is a long term strategy. It’s hard to see much progress in the beginning, but every month, the dividend snowball gets bigger and bigger. Eventually, the power of compounding makes a huge difference. Along the way, I will continue to invest on a monthly basis. And, as I continue to earn dividends, more and more of my expenses will be covered by those dividends. I wouldn’t have it any other way.

How was March for you? Did you break any milestones? Let me know by commenting below.

In any case, Happy Easter!

Nice month DP! 14 great companies paying you, Congrats! And Happy Easter! 😀

My Dividend Dynasty recently posted…March 2021 Dividend Income

Thanks MDD. Happy Easter to you as well.

Pingback: Dividend Income from YOU the Bloggers! – March 2021