Wow, what a month it has been. A lot has happened to me personally. I’ve had some health scares and working through some of those issues now. In addition, I’ve had some financial setbacks as well. But, I am resolved to fulfill my 2022 New Year’s resolutions this year. Overall, I am working diligently on meeting my financial goals and grinding through this journey towards financial freedom. One aspect of that journey is dividend growth investing. Every month, I purchase additional shares of stocks in my portfolio. Every month, I earn dividends from a portion of my portfolio that goes towards buying more shares. The process repeats and over time I experience compounding growth. It doesn’t get much better, or more passive than that. So, without further adieu, let’s see how much dividends I earned in this dividend income report for March 2022.

Dividend Income

In March, I earned $35.05 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | ED | Consolidated Edison | $3.52 |

| 2 | EMR | Emerson Electric | $2.07 |

| 3 | GWW | W.W. Granger | $1.59 |

| 4 | IBM | Intern. Bus. Machines | $4.75 |

| 5 | JNJ | Johnson & Johnson | $2.99 |

| 6 | LMT | Lockheed Martin | $2.80 |

| 7 | MCD | McDonalds | $2.57 |

| 8 | MMM | 3M Company | $4.18 |

| 9 | MSFT | Microsoft | $0.79 |

| 10 | O | Realty Income | $1.71 |

| 11 | PFE | Pfizer | $3.01 |

| 12 | XOM | Exxon Mobile | $5.07 |

| $35.05 |

This is a respectable amount. What’s very interesting is that this almost represent the exact dividends I received when I first started this blog! That amount was $30.13, which represents my blog’s logo. So, in effect, it’s almost as if I am starting over. It’s ok though. It may not seem like it, but I’m in a much stronger financial position today than I was when I first started.

Annual Income

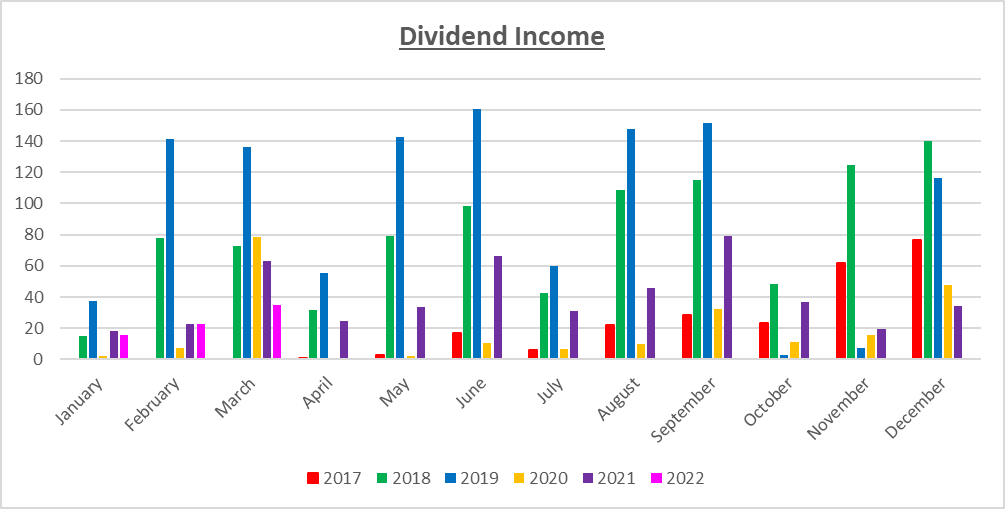

Here is a graphical representation of the dividends earned in March in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | $18.18 | $15.62 | -14.08% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | $22.94 | $22.58 | -1.57% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | $63.35 | $35.02 | -44.72% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | $24.85 | ||

| May | $2.85 | $79.33 | $142.69 | $2.23 | $33.69 | ||

| June | $16.89 | $98.51 | $160.47 | $10.29 | $66.08 | ||

| July | $5.99 | $42.32 | $59.68 | $6.67 | $31.22 | ||

| August | $21.95 | $108.44 | $147.73 | $9.72 | $45.79 | ||

| September | $28.72 | $111.15 | $151.66 | $30.19 | $78.88 | ||

| October | $23.21 | $48.09 | $3.00 | $11.46 | $36.62 | ||

| November | $62.11 | $124.92 | $7.18 | $15.84 | $19.33 | ||

| December | $76.51 | $140.24 | $116.51 | $47.57 | $34.11 |

I made nearly 45% LESS in dividends this March than I did in March of last year. Clearly my portfolio did not move in the direction I would have hoped. But, with consistency and dedication, I fully expect March 2023 to exceed the income generated in March 2022.

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $318.45! A month ago, my forward annual dividends was $311.63 This represents a 2.19% growth from the previous month. I’ll take it. Right now, I am focused on getting out of credit card debt. More on this later in this post. Once that happens, I will concentrate on rebuilding my portfolio. Wish me luck.

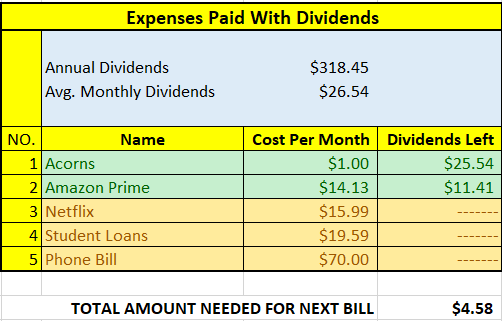

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$318.45 per year is $26.54 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Amazon Prime. I cancelled my Hulu Plus subscription. I hadn’t used it in months. The next bill I am targeting is Netflix. The total amount needed until I can pay the next bill is $4.58 in dividends. I hope to cover this bill during the first half of 2022.

The following is a list of expenses I am targeting:

Credit Card Balance Report

This is a new section. In my previous post, entitled, Credit Card Payoff Series, I reported that my credit card balance was $11,107.33.

I promised to be both transparent and diligent towards of my efforts to payoff my credit card debt. It won’t be perfect, and it won’t be easy, but I am determined to get it done. In fact, I indicated that I want to payoff my credit card debt by the end of the year. I’ve upgraded the timeline, and now aim to get rid of my credit card debt by October 2022. I might explain why in a later post, but that’s the timeline I am now focused on.

Since my last post, my credit card balance has increased to a total of $11,249.15. However, I’ve also made a payment on my credit card of $2350. So, the new balance on my credit card is: $8899.15.

I plan on making another payment around April 15, 2022. I won’t be able to make such a substantial payment every time, but I am determined to payoff this credit card debt by October 2022.

Conclusion

A lot has happened since my last dividend income report. Life is full of twists and turns, and I wish I could get into it all in this post. Notwithstanding the health scares, I am doing ok. Notwithstanding the financial setbacks last month, I am still doing ok. My dividends are working for me in the background and I’m grateful. Dividend growth investing may not be the most exciting way to invest. Believe me, there are more exciting ways out there, namely, real estate, crypto currencies, etc, which I’m also doing. But dividend growth investing, to me, is a worthwhile strategy. It just requires patience.

Although the amount of dividends earned in March seems low, and it is, what’s important at this stage is that I am building good habits. Every month, I am automatically invest in my portfolio. Additionally, I am constantly focused on my financial future. Too many people go through life not thinking about retirement until it’s too late. I don’t want that to be me, and I don’t want that to be you.

Dividend growth investing is certainly not the only strategy I am pursuing, but it is nonetheless an important part of my overall portfolio. Ultimately though, I hope you find value in this report.

Finally, although I am posting this on April 1, 2022, it is NOT intended as an April Fool’s report!

What did you think of this post? Let me know your thoughts by commenting below.

Nice month DP! 12 great companies paying you. The snowball will just keep on growing. Great job putting a nice dent in your credit card debt! Keep it up! 🙂

My Dividend Dynasty recently posted…March 2022 Dividend Income and a New Bed

Thanks MDD. That’s the plan. I hope to payoff my credit card debt by October. I’m planning on making another payment in the next couple of weeks!

As you said, “a respectable amount.” Any dividend amount is a good amount as it’s passive income hitting your wallet. Nothing wrong with that. I like that you are shuttling your subscriptions. They are, for the most part, a silent drain on finances. Kudos on the CC front too. Credit card debt should be eliminated as soon as possible so congrats on your expedited timeline. I also like that you are into the crypto world. Don’t get sucked into the nonsense there. Focus mostly on BTC on that front. Thanks or sharing.

DivHut recently posted…April 2022 Stock Considerations

Thanks for the comment Div Hut. There are definitely a lot of competing interests for my money. But, like you said, I am focused on paying down the debt and building a solid financial foundation going forward.

DP,

Despite the setbacks you’re still looking good. Out of curiosity, have you considered to sell more of your dividend portfolio to get out from the credit card debt ASAP? I assume the interest rate is pretty high on the balance there. I know you probably don’t want to take another hit to your portfolio, but trying to counter a 10%+ rate on the credit card is pretty hard mathematically speaking. Of course if the portfolio is also acting as a bit of an emergency fund then I get not wanting to make that move.

JC recently posted…Dividend Update – March 2022 #Dividend

Hi JC,

Thanks for the comment.

I haven’t seriously considered selling more of my divided portfolio, although I know that would make the most mathematical sense. However, I have seriously considered, and have not ruled out, selling some of my cryptocurrencies to payoff my debt. Investing is digital currencies is a risky endeavor, and it’s debatable which one is the better approach, but for better or for worse, I’ve decided to hold on to my digital currencies for now.

My self-imposed deadline is to get rid of my debt by October of this year. If for some reason I can’t do that, and the debt remains high (close to $10,000 or so), then I am more inclined to liquidate some of my cryptocurrencies to payoff the debt. But, as you will see from some of my later posts, I am chipping away at the debt at a somewhat aggressive manner, where I hope I won’t need to sell any assets to payoff the debt.

It was a great suggestion though, so thank you. And, for what it’s worth, my dividend portfolio isn’t really acting as my emergency fund. If anything, the credit card is, BUT, I am slowly getting away from that and slowly building up cash to serve as my emergency fund – the better strategy.