We are already in June; nearly half the year is here already. For some reason, I am eager to write this dividend income report. I don’t expect anything earth shattering, but I am happy that I was able to recently increase the monthly contribution to my dividend portfolio. The effects of the increase likely won’t be reflected in these income reports for a few months. But, I am glad I was in a position to make them. Also, as you’ve seen in recent posts, I am heavily in consumer debt. But I feel good about being able to tackle my debt responsibly. So, all in all, I am in a good place financially. But, that’s not why you came here. Therefore, without further adieu, let’s see how much dividends I earned in May 2023.

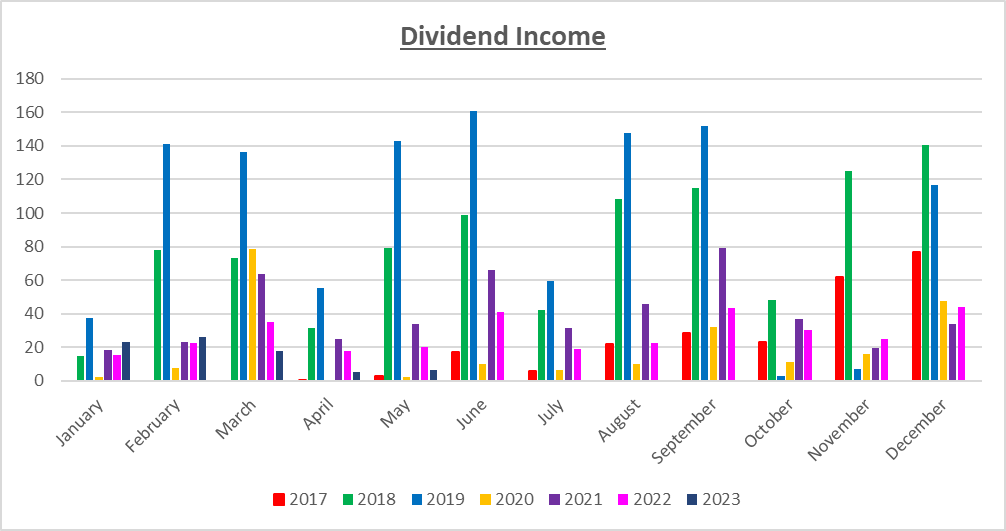

Dividend Income

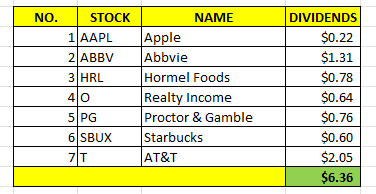

In May, I earned $6.36 in dividends broken down as follows:

There you have it. I made $6.36 in dividends in all of May! I am writing this post at Starbucks and I spent over $9 on a Frappuccino and a bagel. I also go to Starbucks pretty much every day and get the same thing!!! You can see why I increased the monthly contributions to my dividend portfolio. I am looking to increase it again in the future. So, it’s going to take some time to rebuild my portfolio, but I anticipate that these numbers will increase at a more rapid pace as the months go by.

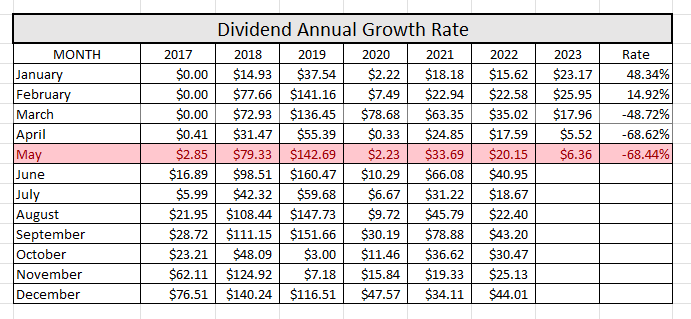

Annual Income

Here is a graphical representation of the dividends earned in May in relation to the dividends earned in previous years:

Here is the raw data:

As you can see, I earned 68.44% LESS dividends this year compared to last year. Of course, the reason for that is that I had to liquidate my stocks to fund the earnest deposit needed for my condo. The good news is that I hate seeing my account balance this low and my goal is to get it over $10k soon.

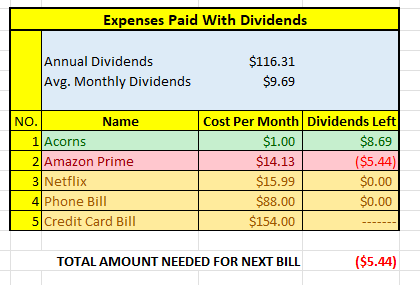

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $116.31. A month ago, my forward annual dividends was $101.31. This represents a 14.81% increase from the previous month. I think some of this double-digit increase may be due to my increased contribution to my dividend portfolio. I’ll take it.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$116.31 per year is $9.69 dividends per month, on average. At present, I earn enough in dividends to cover Acorns. I’ll take it.

The following is a list of expenses I am targeting:

I still need to reassess my expenses. My credit card debt is over $13,000. My goal is to pay this off by the end of the year, so we will see. More to follow in future months regarding the expenses I pay with my dividend income.

Also, as you’ve seen already, I created a debt reduction plan and started a debt payoff monthly report series that started in May. Wish me luck.

Final Thoughts

Now that it’s the beginning of the month, I am going to work on reviewing my budget and see where I can make additional improvements. I won’t begin to tell you how much money I spent playing bingo last month. It’s a bit embarrassing. The point being is that I think I can squeeze additional funds from my entertainment budget and apply it to either my debt payoff or my monthly contributions to my dividend portfolio.

What’s more is that I’ll be sitting pretty after I payoff my debt.

Granted, it makes mathematical sense to concentrate on the debt as my interest rate far exceeds the returns I am earning in my dividend portfolio. But I prefer to follow a balanced approach to my finances, even if it’s not the best thing mathematically.

I am excited about future monthly dividend income reports, so stay tuned.

What did you think of this post. Let me know your thoughts by commenting below.

Great job. Out of your list I like T, O and AAPL. And right now (July 2023) I think AT&T has tremendous upside potential for a bargain buy. For cellular I service I prefer Verizon and I hold that too but T just got better upside right now. It’s a steal right now getting it for under $15 per share. Just curious what you do use for a dividend tracker? Or are you just doing it manually? I have a broad enough portfolio that some weeks I receive dividend payments 3 or 4 times a week from many different holdings.

Growing My Stash recently posted…Why Dave Ramsey’s Advice on Acorns Investing is Misguided And Dumb

Hey Growing My Stash.

Thanks for the comment. I recently added Verizon to my portfolio (as well as Dividend ETFs). I also like T alot.

To answer your question, I use Google Drive to update my portfolio, but it is semi-automatic and manual. The “price,” “value,” “yield,” and “annual” fields are updated automatically. The only thing I update manually are the “shares” and “dividend” fields. I used to be able to update the dividends fields automatically, but somehow that functionality went away and I haven’t figured out how to get it back. It doesn’t take a long time and I actually like updating the number of shares every month in my portfolio. I also try to update the dividend field, but I’m not good at doing so on a monthly bases. I do try to update it at least once a quarter though.