We have one more month before 2020 is finally over! It’s been a crazy year! For those who have been impacted by COVID-19, my heart goes out to you and I wish you and your family all the best. As you know, earlier this year I had to sell most of my stocks to fund the purchase of a condo. So, now I am trying to rebuild my portfolio better than it was before. October’s Dividend Income Report showed a positive increase for the first time since I started to rebuild my portfolio. So, let’s see if the trend can continue for November. Here are my dividends earned in November 2020.

Dividend Income

In November 2020, I earned 15.84 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | AAPL | Apple | $0.61 |

| 2 | ABBV | Abbvie | $4.20 |

| 3 | HRL | Hormel Food | $1.25 |

| 4 | O | Realty Income | $1.30 |

| 5 | PG | Proctor & Gamble | $1.49 |

| 6 | SBUX | Starbucks | $1.38 |

| 7 | T | AT&T | $5.61 |

| $15.84 |

Slowly but surely the dividends are increasing. Last year, I note that 8 companies paid me dividends, but I’ve since sold out of GIS. $15.84 is a small amount, but it’s money that I didn’t have before. What’s more, these are funds that will be reinvested into the portfolio so that the growth can compound.

Annual Income

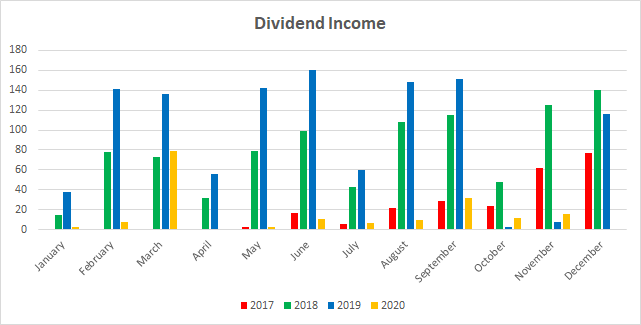

Here is a graphical representations of the dividends earned in November in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | -94.09% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | -94.69% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | -42.34% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | -99.40% |

| May | $2.85 | $79.33 | $142.69 | $2.23 | -98.44% |

| June | $16.89 | $98.51 | $160.47 | $10.29 | -93.59% |

| July | $5.99 | $42.32 | $59.68 | $6.67 | -88.82% |

| August | $21.95 | $108.44 | $147.73 | $9.72 | -93.42% |

| September | $28.72 | $111.15 | $151.66 | $30.19 | -80.09% |

| October | $23.21 | $48.09 | $3.00 | $11.46 | 282.00% |

| November | $62.11 | $124.92 | $7.18 | $15.84 | 120.61% |

| December | $76.51 | $140.24 | $116.51 |

Yes! Another positive report and still in triple digit territory no less. As you can see, I earned 120.61% more dividends in 2020 than I did in 2019. Although this is no where near what the portfolio was generating before, it’s the second straight month where I’m back in positive territory.

Part of me just wants to throw every last bit of money I have into my portfolio. But, sadly, I have many competing goals. However, one of the things I am working on is trying to figure out how I can increase the monthly contributions to my portfolio. Stay tuned!

Forward Annual Dividends

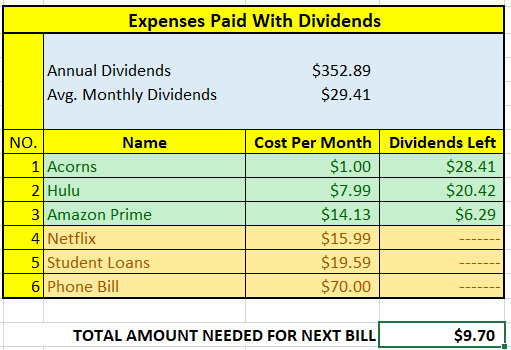

At the time of this writing, my forward annual dividends is $352.89. A month ago, my forward annual dividends was $286.75. This represents a healthy 23% increase from the previous month. I’ll take it.

Finally, the Dividend Tracker has been updated accordingly.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$352.89 per year is $29.41 dividends per month, on average. At present, I pay $1 per month to use Acorns. Also, my Hulu Plus bill is $6.41 per month. I earn enough in dividends to cover Acorns, Hulu Plus and Amazon Prime. The next bill I am targeting is Netflix. That amount is $15.99 per month. The total amount needed until I can pay the next bill is $9.70 in dividends.

The following is a list of expenses I am targeting:

Adopt A Stock Project

For the month of December, XOM has been identified as the most undervalued stock of the month, again. Therefore, I will attempt to buy at least one additional share of Exxon Mobile during the month of December.

After the end of the year, I will be evaluating whether to continue and/or modify the adopt a stock project.

Conclusion

Just like that, 2020 is coming to a close. We have one more month to go. This month’s dividend income report showed a health increase in terms of the forward annual dividends. Although I’m no where close to where I ultimately want to be, it’s clear that the dividend portfolio is moving in the right direction.

How was November for you? What did you think of this post? Let me know by commenting below.

We share ABBV and T from the list above but you’ve got all solid payers in your portfolio. With the 100% plus increases yr over yr you’ll be back to your prior income levels in no time. I like that you’re looking at the dividend income as what bills you’d be able to cover. I do this myself sometime though I haven’t posted it on my site.

Cheers

Divs4

Divs4Jesus recently posted…DIVIDEND REPORT :: OCTOBER 2020

I hope to get back to my prior income levels too as well. Glad you’re tracking the dividends in terms of the expenses they can cover. I think that’s just a great way to look at it.

Nice month DP! Love that 120% plus growth from last year. It won’t be long before you cover your Netflix, loans, and phone expenses! Keep it up! 🙂

My Dividend Dynasty recently posted…November 2020 Dividend Income

Thanks MDD. I’m really watching those expenses closely and the extent to which the dividends are able to cover those expenses. I will definitely keep the community informed.

Great to see the significant YoY dividend growth!

Exxon looks cheap indeed, but their dividend coverage is very worrying. Dividend not covered by cash flows and the company needs to take on more debt or sell assets to afford it.

Dividend Athlete recently posted…2 Most Undervalued Stocks with Sustainable Dividends

Athlete it is a bit disconcerting for sure, but as of right now, I’m going to hold firm and see what happens, but it definitely makes me hesitant to keep buying into the stock. All the adages that we know such as “be greedy when other are fearful and fearful when others are greedy” are great in theory, but very different to accomplish in practice. It’s all about the fundamentals, etc. But we’ll see. Thanks for the comment.

Nice month Dividend Portfolio. I enjoyed looking at the expenses paid with dividend table. Gotta love how dividends are covering for these monthly expenses right?

Oh absolutely Tawcan. I really puts financial independence in a more realistic perspective.

As always love your positive posts DP. Great growth rate!

I’m curious about how you will be able to expand your monthly contributions, it will make a lot of difference in your progress!

I’m not sure yet Mr. Robot, but I’m looking at and working on increasing that amount to a $1000 minimum contribution. Usually, I have a lot of momentum at the beginning of the year and hope to use that increased motivation to get the ball rolling, which in turn will create a new habit for me that hopefully will last the entire year. In order to increase the amount of money to a $1000 minimum contribution, that will necessitate further reduction in expenses. Additionally, and more importantly, I plan on starting a YouTube channel in 2021! I don’t think it will be tied to this blog, but it will be focused on personal finance. I’m hoping that this will eventually be a side hustle that can help generate income that will be used to invest in the stock market to generate more dividends.

So, for example, my sister had asked what I wanted for Christmas and the options I gave her were different kind of microphones. I intend on using whichever microphone she purchases to start my YouTube channel. Wish me luck.

Thats a big step DP! I’ve seen a few blogs incorporate youtube channels en there are already a few with some big personas en following.

Will you be anonymous or a new YouTube personality? 🙂 I’ll be checking it out for sure!

Well, I don’t think I will be anonymous – that’s too much work! So, I’ll just be another YouTube personality. The bigger question is whether I will reference this blog or just have the YouTube as a stand alone venture. I’m not sure yet. I’m still trying to figure out what the name is going to be of the YouTube Channel but I’ve essentially ruled out Dividend Portfolio as I will be talking about personal finance and investments as well and not just dividends. But, since I’m starting a YouTube Channel about finance, there seems to be little reason not to publicize it here. I still have a few weeks to figure it out. The plan is to upload my first video January 1, 2021!

Ultimately though, I am leaning towards linking the two (even if I call it something different). Maybe that will either increase traffic to the blog or increase traffic to the YouTube channel, who knows. I’ll be using it like I do the blog to sort of document my experiences in finance, and talking about things like getting out of debt and building wealth. Although a lot of videos will be just about documenting my financial life, I hope to provide educational and entertaining videos that will be useful to others as well. It’s definitely scary for sure! But thank you for the support!