Can you believe it? We are already in the last month of 2021! Wow! It’s really hard to believe right now, but it’s true. We just had Thanksgiving and I hope you enjoyed yours if you celebrated it. I have a lot to be thankful for and that includes this blog and your support. 2021 has been a remarkably expensive year for me. I purchased two properties, got into credit card debt (over 10k), became cash broke, and even stalled the contribution to my dividend portfolio. I honestly can’t wait for 2022.

Quite frankly, I’ve started a mini resolutions the first of December and I hope to ease the transition into 2022 when I will make even more profound changes. Today is only the first day, but I will at least try to improve both my health and wealth in 2022. But let’s not put the cart before the horse. You came here to see how much dividends I earned in November 2021. So, without further adieu, let’s see my dividend income for the previous month.

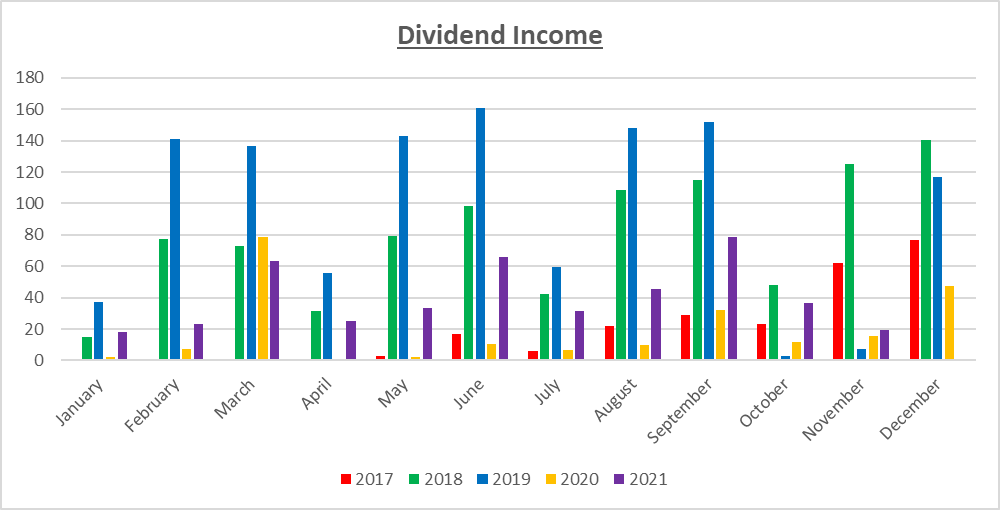

Dividend Income

In November, I earned $19.33 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | AAPL | Apple | $0.61 |

| 2 | ABBV | Abbvie | $4.64 |

| 3 | HRL | Hormel Foods | $1.86 |

| 4 | O | Realty Income | $1.42 |

| 5 | PG | Proctor & Gamble | $1.93 |

| 6 | SBUX | Starbucks | $1.39 |

| 7 | T | AT&T | $7.48 |

| $19.33 |

Nearly $20. Of course, this is LESS dividends than I earned the previous quarter and this was expected. As you know, I had to sell some stocks to purchase a beach condo. That was (and still is) an expensive ordeal. I’m generally not a fan of selling assets, but sometimes, even during the accumulation phase, I think it’s necessary. If the condo turns out to be an unideal investment, then I may sell it in 2-3 years, but only time will tell. For now, I’m grateful that I earned $20 in dividends and all I had to do was invest money in stocks. Over time, I plan to aggressively rebuild my portfolio. My next post will discuss how I plan to do just that, so stay tuned.

Annual Income

Here is a graphical representation of the dividends earned in November in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | 2021 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | $18.18 | 718.92% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | $22.94 | 206.28% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | $63.35 | -19.48% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | $24.85 | 7430.30% |

| May | $2.85 | $79.33 | $142.69 | $2.23 | $33.69 | 1410.76% |

| June | $16.89 | $98.51 | $160.47 | $10.29 | $66.08 | 542.18% |

| July | $5.99 | $42.32 | $59.68 | $6.67 | $31.22 | 368.07% |

| August | $21.95 | $108.44 | $147.73 | $9.72 | $45.79 | 371.09% |

| September | $28.72 | $111.15 | $151.66 | $30.19 | $78.88 | 161.28% |

| October | $23.21 | $48.09 | $3.00 | $11.46 | $36.62 | 219.55% |

| November | $62.11 | $124.92 | $7.18 | $15.84 | $19.33 | 22.03% |

| December | $76.51 | $140.24 | $116.51 | $47.57 |

22.03% increase from last year! The dollar amount is still way less than my portfolio was back in 2018, but I suspect that these numbers are going to be some of the lowest numbers my portfolio will ever show. The short term is going to be rough. I’m bracing for a massive tax bill in April. But that’s going to be the next and largest expensive for a while! After I clear that up, it should be clear sailing from there. The long-term prospects for my dividend portfolio is still quite good. That’s because I will not just keep contributing to my portfolio, but I will continue to increase those contributions as well. It’s going to be tough but the benefits are going to be worth it during retirement!

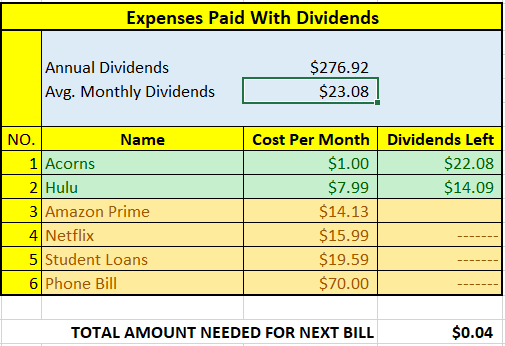

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $276.92. A month ago, my forward annual dividends was $267.75. This represents a 3.42% growth from the previous month. I suppose it could be worse. Right now, I’m just slowly contributing a small amount to my portfolio ($10 a week). I am waiting for another month or two to start aggressively contributing. Also, there is a slight chance that I may sell a small portion of my stocks to cover expenses associated with the condo. However, I am 100% certain that come 2022, I will be prioritize my portfolio like never before!!!

I anticipate a slower growth rate for the next couple of months, as I try to figure out how to deal with increased expenses. Additionally, because I bought a beach condo, I’ve effectively paused the minimum contribution to my dividend portfolio. So, as the saying goes, the struggle is real.

Finally, the dividend tracker has been updated.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$276.92 per year is $23.08 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Hulu Plus with Amazon Prime in sight. The next bill I am targeting is Amazon Prime and then Netflix. Amazon Prime is $14.13 per month. The total amount needed until I can pay the next bill is $0.04 in dividends. I definitely will be able to cover this bill by the end of the year.

The following is a list of expenses I am targetting:

Conclusion

I am limping along to cross the 2021 finish line. But, I am still going. My overall dividend portfolio is small. My contributions to my portfolio are also small. But, my expectations and plans for the future are huge! I usually wait until the start of the year to make huge changes. But, those in earnest began yesterday on December 1, 2021! My next post will be how I can jump start my contributions to the portfolio. As a hint, it won’t be income from the beach condo! So, to figure out how, make sure you check out my next post, which should be released over the weekend.

So, how was November for you? Did you break any records? Let me know by commenting below.

You accomplished a lot this year and have two property purchases in the books that should put these struggles in the rearview mirror. You are definitely setting yourself help for a great 2022!

Thanks SD Growth. I’m also announcing an exciting new project. So, stay tuned for my post to be released on Sunday!

Pingback: Dividend Income from YOU the Bloggers - November 2021

Pingback: Dividend Income from YOU the Bloggers – November 2021 – Dividend Growth Investors Daily