I remember when 2021 seemed simple. I had a plan and I felt financially secure. Moreover, I was very focused on saving money, dividend income investing and planning for my future. Well, 2021 is not so simple after all. I bought two properties this year! One of the houses is the one I am living in. The other is a gigantic and expensive experiment owning beach front property.

I almost want to get rid of the beach condo already. Hahaha! My first mortgage payment is due in a couple of weeks and I still haven’t decided if I’m going to manage the property or turn it over to a property management company. I make money doing the former and barely break even doing the latter. Oh well. But alas, that’s not why you stop by. Despite it all, I’ve still decided to pursue dividend investing. So, despite the set back in selling shares to buy my beach condo, let’s see how much dividends I earned in October 2021.

Dividend Income

In October, I earned $36.62 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | KMB | Kimberly Clark | $8.17 |

| 2 | KO | Coca-Cola | $7.13 |

| 3 | MO | Altria Group | $18.09 |

| 4 | O | Realty Income | $3.23 |

| $36.62 |

Not bad. The first month of the quarter is usually my slowest. It looks like I have to get used to small numbers for a while. But, I promise that I am laser focused to getting my portfolio up to what it was prior to me selling my stocks! With a small portfolio, the compounding effect is small, but over time, it grows exponentially. I can’t wait.

Annual Income

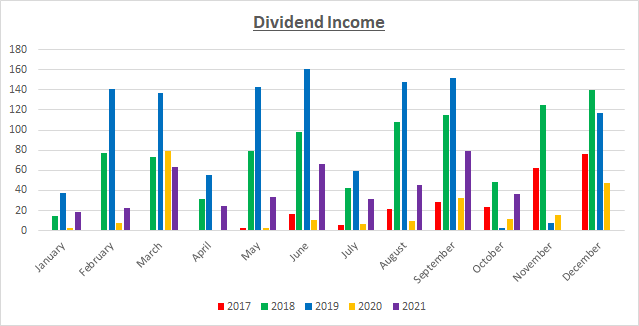

Here is a graphical representation of the dividends earned in October in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | 2021 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | $18.18 | 718.92% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | $22.94 | 206.28% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | $63.35 | -19.48% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | $24.85 | 7430.30% |

| May | $2.85 | $79.33 | $142.69 | $2.23 | $33.69 | 1410.76% |

| June | $16.89 | $98.51 | $160.47 | $10.29 | $66.08 | 542.18% |

| July | $5.99 | $42.32 | $59.68 | $6.67 | $31.22 | 368.07% |

| August | $21.95 | $108.44 | $147.73 | $9.72 | $45.79 | 371.09% |

| September | $28.72 | $111.15 | $151.66 | $30.19 | $78.88 | 161.28% |

| October | $23.21 | $48.09 | $3.00 | $11.46 | $36.62 | 219.55% |

| November | $62.11 | $124.92 | $7.18 | $15.84 | ||

| December | $76.51 | $140.24 | $116.51 | $47.57 |

219.55% is a healthy increase from 2020! It seems apparent that I’ve moved consistently into positive territory. I had rebuilt my portfolio quite nicely although admittedly quite slowly. Of course, now that I’ve sold some of my stocks, I have to work harder to rebuild my portfolio in the future. I imagine that next quarter might see negative results. In any case, every little bit counts, and I will continue to rebuild one dividend at a time. It’s only a matter of time before the dividends earned in October will exceed that of 2019!

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $267.75. A month ago, my forward annual dividends was $267.75. This represents a 0% growth from the previous month. I suppose it could be worse. Right now, I’m just holding my position. I haven’t really increase my contributions to my dividend portfolio. I am waiting for another month or two to start aggressively contributing. Also, there is a slight chance that I may sell a small portion of my stocks to cover expenses associated with the condo. However, I am 100% certain that come 2022, I will be prioritize my portfolio like never before!!!

I anticipate a slower growth rate for the next couple of months, as I try to figure out how to deal with increased expenses. Additionally, because I bought a beach condo, I’ve paused the minimum contribution to my dividend portfolio. So, as the saying goes, the struggle is real.

Finally, the dividend tracker has been updated.

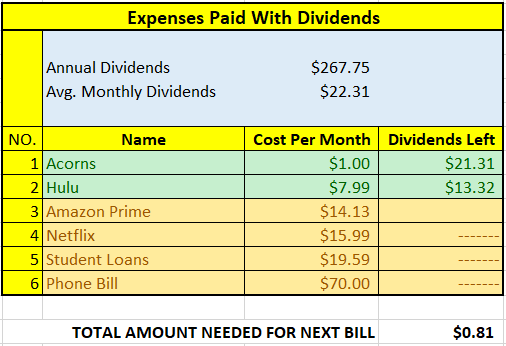

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$267.75 per year is $22.31 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Hulu Plus with Amazon Prime in sight. The next bill I am targeting is Amazon Prime and then Netflix. Amazon Prime is $14.13 per month. The total amount needed until I can pay the next bill is $0.81 in dividends. I hope to be able to cover this bill by the end of the year.

The following is a list of expenses I am targeting:

Conclusion

Dividend growth investing is a long-term strategy. My plan is to stick with this strategy for the long-term, even though I liquidated part of my portfolio again to buy the beach condo!!! Wish me luck. Life has been crazy recently, but I finally feel I’m in a good place. We’ll just have to see how long that lasts.

I hope you enjoyed the Halloween weekend.

How was October for you? Did you break any records? Let me know your thoughts by commenting below.

Good luck with the condo 🙂 personaly I avoid rental property, yes it can bring good return, but its not passive income. Managing tenant is a real and hard work and im not a RE guy. Some people like it and even enjoy bossing around as a landlord, but I personaly dont. I like for other to work for me in form of dividend paying companies 🙂 My streanth is financial analysis of companies, thatd what I like, that what I do. I thing there are many investment ways out there and none are bad (even p2p and crypto) just needs to find yours.

Fair point P2035. What I’m trying to do is build multiple sources of income. That way, if any one source took a hit, then I had other options. Dividend investing is great, but like you mentioned, there are other investments out there. I too am invested in crypto, albeit on a smaller scale. Additionally, I hate the idea of managing real estate myself and definitely lean more to hiring a property manager – but nothing is without risk or downsides. Thanks for the comment and support as always.

This is what I enjoy about your blog, trying to balance creating a life while creating income streams. Unless you have a head start with a pile of cash or super high income its never that simple.

I tried the landlord thing with a condo back in the 90s and just got tired of the late night tenant calls . The place was a 40 drive min away which sometimes wasn’t enough to respond to an emergency as I once had a hot water tank go and the renter didn’t know how to turn off the water. I sold that place in 2005 for a small profit, if I had to do it again I would hire a property manager or make sure it was close to me.

Awesome SD. You’re spot on. It’s a tough balancing act. I’m just an average guy trying to make ends meet like everyone else and trying to make sound investment decisions for the future. Each of our paths is going to be different. We are going to face different obstacles in life, but I’m hoping it will all pay off in the end.

Being a landlord isn’t for everyone. My default inclination is to rely on a property manager for this condo. My time is very valuable to me including my money, so in the end, it too is a balancing act. The good news is that I’m not stuck with either route, so regardless of which option I choose, I can always adjust as need me. Thanks for the comment and the encouragement.

Good luck with the condo and I hope you can get it cash flowing one way or another soon. We’re looking a bit a possible rental properties ourselves to diversify our cash flow a bit and take advantage of the ridiculously low interest rates and if we do ever proceed with that we’re definitely going with a property management company. Although I imagine it could be easier with a beachfront condo assuming it’s short term rentals that you’re after. For starters I’d guess it would take fewer days per month in order to breakeven and it kind of sells itself as long as it’s listed for a reasonable price. Keep grinding and you’ll get your portfolio back up to where you need it to be.

JC recently posted…Dividend Update – October 2021

Thanks JC. After weeks of going back and forth, I’ve decided to manage it myself at the outset. My thinking is that if it doesn’t work out or if I hate managing it on my own, then I can always turn it over to a property management company. I’m finding that managing it on my own, so far, is incredibly more involved than it seems at first. Sure, it’s easy to say just get a good system in place, but how do you actually do that? What system do you use? Right now I have to a) figure that out and b) pay for it all! The upfront costs are steep. I’ve already made some mistakes and they are costly.

So, for example, one of the important things to figure out is which smart lock to use. I initially had a kaba lock and it cost about $600 or so to purchase and install. Well, after installation, I realize that I didn’t like the back-end functionality of it. Moreover, it didn’t work well with the property management software that I intend to use. So, I have to replace that lock with another one, which costs around $700 to purchase and install!

But, all-in-all, I’ve given myself the best chance of being able to self-manage remotely. I anticipate I will be up and running within the next two weeks. Worst case scenario, if I turn it over to a property management company, at least I will appreciate more what they would have to do to manage the property and I know what I would be paying for.

Thanks for the comment. I may just write a post to discuss all that’s involved in self-managing a vacation rental remotely.

As always, love your positive attitude which shines through your entire report. I think you made the best call by doing the management yourself, that way you can familiarize yourself with the ins and outs.

And if you still don’t like it, you can always hire a property manager. 😉

On my side, no new records but a nice special dividend from ORI. You can check it in my report.

Mr. Robot recently posted…October 2021 Dividend Report

I will do Mr. Robot. For some reason I thought I approved this comment earlier but for some reason, it didn’t go through. But thanks as always for stopping by. Hopefully in 2022, I can be more active than I was in 2021.

Pingback: Dividend Income from YOU the Bloggers – October 2021 – Dividend Growth Investors Daily

Pingback: Dividend Income from YOU the Bloggers - October 2021