We’ve now entered the final quarter of 2020. Can you believe it? I for one can’t wait until 2020 is in the history books. But let’s not put the cart before the horse. We still have 3 months left. Three months to work on our goals and do what we can to finish the year strong. My goal is to have my portfolio balance reach $10,000. That would be a nice round number to start 2021 with. It’s going to be tough. One of my goals is to earn at least $500 per month on average in dividend income. Once I reach that, then my goal will increase to $1000 per month on average and so on. Dividend investing is a very long-term strategy. But, it’s important to track your progress along the way. So, with that said, let’s see how much dividend income I earned in September 2020.

Dividend Income

In September, I earned $32.17 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | ED | Consolidated Edison | $2.09 |

| 2 | EMR | Emerson | $1.48 |

| 3 | GWW | W.W. Granger | $1.03 |

| 4 | IBM | Internal Business | $2.45 |

| 5 | JNJ | Johnson & Johnson | $1.71 |

| 6 | LMT | Lockheed Martin | $1.24 |

| 7 | MCD | McDonalds | $1.52 |

| 8 | MMM | 3M Company | $2.26 |

| 9 | MSFT | Microsoft | $0.49 |

| 10 | O | Realty Income | $0.96 |

| 11 | PEP | Pepsico | $1.98 |

| 12 | PFE | Pfizer | $1.80 |

| 13 | XOM | Exxon Mobile | $13.16 |

| $32.17 |

I just love the end of the quarter months. Twelve companies paid me over $32 in dividend income. That’s $32.17 that I didn’t have before and all I had to do for that money was invest. But, what’s more is that the $32.17 will only increase over time because of the companies I’ve invested in. That’s what I love about the dividend growth investing strategy.

Annual Income

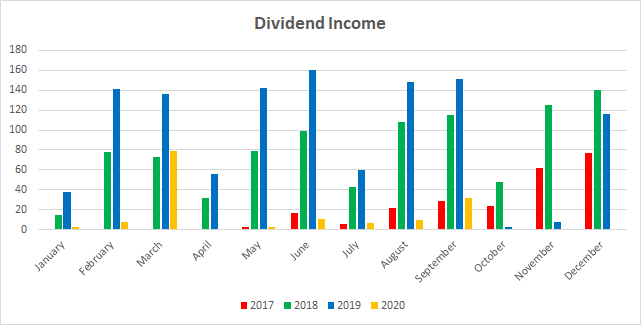

Here is a graphical representation of the dividends earned in September in relation to the dividends in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | -94.09% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | -94.69% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | -42.34% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | -99.40% |

| May | $2.85 | $79.33 | $142.69 | $2.23 | -98.44% |

| June | $16.89 | $98.51 | $160.47 | $10.29 | -93.59% |

| July | $5.99 | $42.32 | $59.68 | $6.67 | -88.82% |

| August | $21.95 | $108.44 | $147.73 | $9.72 | -93.42% |

| September | $28.72 | $111.15 | $151.66 | $32.17 | -78.79% |

| October | $23.21 | $48.09 | $3.00 | ||

| November | $62.11 | $124.92 | $7.18 | ||

| December | $76.51 | $140.24 | $116.51 |

As you can see, in September, I earned 78.79 LESS dividends than I did in 2019. In my opinion, this is a significant improvement in terms of percentage from my June 2020 Dividend Income Report, which was the previous quarter. There, I reported that the dividends I earned were NEGATIVE 93.59 from the previous year. So, that’s a 14.8% difference in the right direction. If that’s not motivation to keep going, I don’t know what is. I can’t wait to get back into positive territory.

Finally, the Dividend Tracker has been updated accordingly.

Forward Annual Dividends

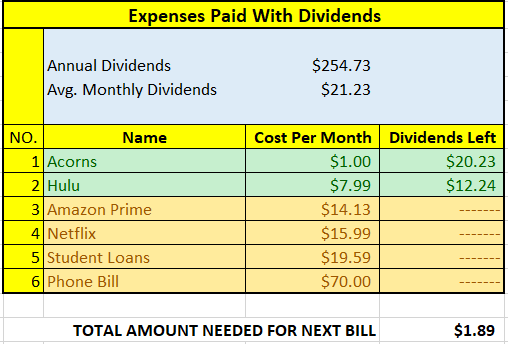

At the time of this writing, my forward annual dividends is $254.73. In my last dividend income report, my forward annual dividends was $226.36. This represents a 13% increase from the previous month. I can’t argue with this double-digit improvement.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$254.73 per year is $21.23 dividends per month, on average. At present, I pay $1 per month to use Acorns. Also, my Hulu Plus bill is $6.41 per month. I earn enough in dividends to cover both Acorns and Hulu Plus. The next bill I am targeting is Amazon Prime. That amount is $14.13 per month. In other words, the total amount needed until I can pay the next bill is $1.89 in dividends. My immediate goal will be to see if I can generate enough dividends to cover all three bills for the year. I suspect that’s going to be a resounding yes!

In other words, the total amount needed until I can pay the next bill is $1.89 in dividends.

Although the $254.73 was an increase from the previously reported forward annual income, I don’t yet earn enough in dividends to cover all 3. But, the dividends will keep growing and so at some point, I’ll get there – this year! The following is a list of expenses I am currently targeting:

Adopt A Stock Project

For the month of October, XOM has been identified as the most undervalued stock of the month. Therefore, I will attempt to buy at least one additional share of Exxon Mobile during the month of October.

I was supposed to buy at least an extra share of Exxon Mobile in September but I forgot. So, now I’ll buy an extra two shares (at least) to make up for the difference.

Conclusion

September has been a very motivational month for me in terms of dividend investing. I am inching closer to positive territory as compared to the previous quarter. I am also very close to now being able to pay another bill with my dividend income. Honestly, that section of this report is the most inspiring and motivational for me to keep going. If I think about it, I don’t have that many true expenses. I’m saying true expenses because currently, I count my investments as an expense (but they aren’t really). Although I may never get rich off dividends, I fully think earning enough dividends to cover all of my expenses is well within reach. At some point in the future, I’ll write more on this.

But, thank you for reading this post. I hope sharing my progress with dividend investing is helpful to you. I’m interested in knowing how much dividend income you earned in September? Also, what did you think of this post? Let me know by commenting below.

Finally, remember: Winter Is Coming!

Great to see you moving forward with great enthusiasm DP! Aren’t quarter ending months great? You set up a nice series of goals to achieve as well. One step at a time and it all adds up. Keep up the great work! 🙂

My Dividend Dynasty recently posted…September 2020 Dividend Income

Ya I love quarter ending months Dynasty. I do feel a renewed sense of motivation. I just hope it lasts.

Getting those bills paid is a good feeling. Right now all my current bills would be covered, but when I inherit the house I will have more so I’m gunning to hopefully have my dividends cover everything for that. Those are great companies. Lmt is one I’ve been looking at been buying more shares of company’s in my portfolio but might add a new one this quarter. Keep adding to your companies

Doug recently posted…September Dividend Review

That sounds awesome Doug. I would love to get to where you are some day. Good luck on getting your dividends to cover everything once you inherit the house. Thanks for stopping by.

You are clearly moving in the right direction. Positive territory is the way to go.

Yea. With any luck, I’ll be back in positive territory late next year, but that’s a lot of time between now and then. We will see.

nice port

Got to love that bill payment chart. Thats a great idea. You will have prime paid for in no time!

keep it up

cheers!

Passivecanadianincome recently posted…September 2020 Passive Income – $1,541.76

Thanks. I think I will be able to cover prime as early as next month but definitely by the end of the year!

Stay focused, keep moving forward DP. All you can do is continue focusing on achieving $500/month in dividend income. I loved the high quality companies that paid you in September. That is how you build a new dividend income stream from the ground up!

Bert

Dividend Diplomats recently posted…Dividend Stock Purchase: Lanny’s September 2020 Summary

Appreciate it Bert. I’ve been getting a lot of motivation for YouTubers who are doing the $0 to $100,000 dividend portfolio. Could that be me in the future? Only time will tell. But, for right now, ya, $500 is not a bad goal to have.

Congratulations. You’re starting to get back on track!

LegendOfIncome recently posted…Portfolio to python 2.0 – currency exchange rates

Thanks. I wish I never had gotten off track but no use crying over spilt milk.