Well, here we go again. I have some exciting news! I just bought a beach condo – again. I’ve wanted a beach condo since 2019. During that time I was locked into a contract that I cancelled earlier this year. But, there’s no use crying over spilt milk. I kept watching the market and after a few declines, my latest offer on a unit was accepted.

If you are interested, you can check out some of my previous posts for more background information. These include I Bought A Beach Condo, I Lost The Beach Condo, and Minimum Contribution to Dividend Portfolio Paused. So, I won’t rehash the background here. Sufficed to say that I’ve had an itch to buy a beach condo for some time now. So, without further adieu, let’s jump in to see what I bought, how I’m going to pay for it, and why I still want another one!

What I Bought?

For some reason, I did what I thought I would never do! I bought a one bedroom, 2 bathroom condo on the beach. Technically, it’s a one bedroom condo with a bunk area and a sleeper sofa, so it sleeps 6 people. If I put a murphy bed in the unit, it can sleep 8. There are several reasons why I chose this particular property. So, let’s dive in to some of the pros and the cons. In this particular case, let’s start with the cons of the unit and then we will look at the pros.

CONS

A. Only One-Bedroom

The condo only has one-bedroom. That to me is both good and bad. Here’s the bad. I really wanted a three bedroom condo or at least a 2-bedroom condo. Getting a 2-bedroom condo was well within my price range and I looked at a few. However, I either didn’t like the building, or the area, or if I did like both of those, my offer wasn’t accepted. Certainly, I could have waited for another 2 bedroom condo, as technically, I really wasn’t in any rush, but I got a bit impatient! Haha.

That being said, I am single and the one-bedroom is plenty enough space for me to use when I go on vacation.

B. The Master Bedroom Is Not Facing The Beach

This matters a lot to some people when they go on vacation, but the master bedroom is not facing the beach. So, when you wake up in the mornings, you won’t be waking up to a water view (unless you sleep on the sleeper sofa in the living room). In an ideal world, the master bedroom would be facing the beach, but alas, I did not find my perfect condo with this deal.

To drive the point home, since the master bedroom is not facing the beach, there is no direct entry onto the balcony from the master bedroom. So, that was a bit disappointment.

C. The Unit Is Small

The total square footage of the unit is under 1000 square feet! Ouch. It is definitely smaller than I would have preferred. The good news is that once you’re in the unit, it feel spacious. The other good news is that a small unit means a smaller HOA. But, again, there’s only one bedroom, a bunk area, 2 bathrooms, a kitchen, a very small area for an eating table, the living room, and a balcony.

The balcony is definitely on the small side. It’s certainly not the smallest I’ve seen, but it by no means is the largest. However, it works. As you will see in the PROS section, there is a pretty good view from the balcony, but in general, the size of the unit and the balcony is a con to me.

D. The Unit Is Expensive

The final con I’ll mention is that the unit is expensive. In fact, it is one of the most expensive one-bedroom, 2-bathroom units on the market. There were cheaper one-bedroom units that were even 70k cheaper, in relatively good locations as well. So, the price of this unit is a hard pill to swallow. Honestly, after writing all these cons, it makes me wonder why I even bothered purchasing this unit in the first place. I guess I could still walk away if I really wanted to, but I don’t think I’m going to do that.

We will talk numbers later on in this post, but for now, I’ll just mention that the purchase price for this unit is approximately 440k! Yea, probably not the best financial decision! You Only Live Once (YOLO) right?

PROS

Well, I’m not going to lie. Those were some significant cons!!! However, there are some pros to buying this particular unit. I will say though that I made the mental decision to not try and get my dream condo with this purchase. I decided to compromise on some of my criteria and I just hope it all works out in the end. In any case, lets explore the pros to this deal.

A. Location Location Location

Perhaps you’ve heard the saying that the number one rule in real estate is location, location, location. Well, if so, then that is definitely a pro to this unit. In essence, I’m in the Manhattan area of the beach. Now, don’t get me wrong. Some people don’t like the hustle and bustle of Manhattan. But a lot of people do! This particular location is THE tourist spot on the beach. Of course, there are other areas on the beach to find entertainment, and this by no mean is the only area for a guest to enjoy themselves. In fact, almost anywhere on the beach is good.

But here’s why this particular location is exceptional! My guest will be able to drive to my location, park there cars in the garage and never have to get back into their cars again until they are ready to go back home! You heard that correctly. This particular building is about a block away from all restaurants, shops, bars, nightlife, movie theatres, a Ferris Wheel, etc!!! Not only that, but on the beach itself, my guests can rent jet skies or sign up to go on dolphin tours etc. There are so many things to do here, it’s mind-boggling!

Technically, I could have bought a similar sized unit half a mile walk down the road for about 50k less (although in one of these units, it’s listed at $10k more than the property I just bought). I was tempted believe me. But ultimately, I made the decision that while I can change a lot about the inside of the unit, I really can’t change the location. Even though half-a-mile (it’s slightly longer than that, but not by much) is not that far to walk to all the restaurants etc, the convenience of my unit is vastly superior.

For what it’s worth, this particular unit is in the same complex as the one I previously had a contract in – though that unit was across the street. So, I’m very familiar with the building, and I love the area. Only time will tell if it’s worth it, but I think it is.

B. The Cost Of Entry Is Reasonable

Although I indicated above in the cons section that the unit is expensive (it is), a pro is that the price of entry is reasonable. In other words, in order for me to afford the down payment and closing costs, I would either need to a) cash out of only one retirement account, or b) selloff my stocks in my Dividend Portfolio AND all of my bitcoins. Notably, had I gone for a 2 or 3 bedroom beach condo, I probably would have to dip into (or even cash out) a second retirement account. In case you were wondering, I’ve chosen NOT to selloff my stocks in my Dividend Portfolio at this time.

Given that this is my first vacation rental, I figured I would start small (relatively speaking) and not break the bank! So, rather than go all in on my first deal, I would first try to show proof of concept. If I am profitable, I could save up and somehow leverage my second retirement account to get my second deal. So, even though I didn’t get a 3-bedroom beach condo now, my goal is to get one later. But, I’ll just have to learn to crawl and walk before I run to get my 3-bedroom unit.

Of course, if there is a market crash where prices drop, that would hurt, but it may also provide an opportunity for me to get a 3-bedroom corner unit (hopefully a penthouse) at a more affordable price. In any case, this one-bedroom unit allows me to get started. I’m sure I’ll make mistakes, and if so, I’d rather make mistakes on a small deal than a large one. Overall, I thought the cost of entry was reasonable.

In case you were wondering, I’ve chosen NOT to selloff my stocks in my Dividend Portfolio at this time.

C. The Condo Is Right On The Beach

Back in 2019 when I was locked into a contract, I chose a unit that was a 3-bedroom 2-bathroom condo, but it was across the street from the beach. The view was good, but I really wanted something right on the water! Well, I finally was able to get a unit that is right on the water!!!

This is going to help with rentability. Although I mentioned that the master bedroom was not beachfront, the fact that the unit itself is beachfront, given the location, helps to compensate for that short coming. Quite frankly, the location of the unit itself compensates for a lot of the cons mentioned above in the cons section.

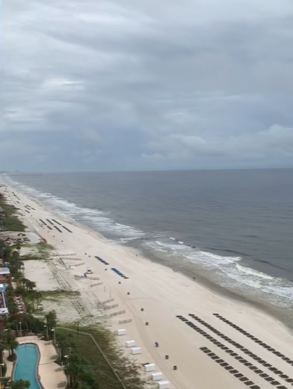

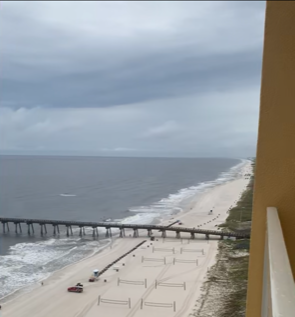

Not only is the condo right on the beach, but a guest will enjoy a full 180-degree view of the beach. They can look to their left and look to their right and see one edge of the city and the other right from the balcony. More over, because the condo is right next to a pier, not only will guests be able to fish if they so choose, but during the fourth of July or other holidays, they will be able to see the fireworks right from the unit!!!

With Vacation rentals, it’s all about creating a good experience for your guests, and I feel this unit will do just that!

D. The Unit Will Cash Flow

No matter how much I like the unit or the location or the furniture or whatever, it doesn’t make sense to buy real estate unless I am going to make a profit. I try to invest in real estate for cash flow. Don’t get me wrong, I love appreciation, but that’s hard to predict and it’s not guaranteed. It’s really hard to stay afloat if I am in a negative cash flow situation, and so I try to avoid that at all cost.

Based on my calculations, this particular unit is expected to cash flow. Let’s talk numbers. These are back-of-the-napkin calculations, but it’s fine for purposes of this particular section.

Let’s Do Some Math

Purchase price is approximately $440,000. The monthly payment with most costs (including principal, interest, taxes, HOA, utilities) is approximately $2500 per month. This does not include maintenance costs at the moment, but it does include an overestimation of the electric bill. So, to break even, I would need to generate $30,000 a year from the unit.

A conservative and realistic estimate is that the property can generate $40,000 per year. In actually, $50,000 is also realistic but I am trying to use conservative numbers. With a 20% down payment and assume $15000 in closing costs (it should be less, but definitely won’t be more), if the property provides $10,000 per year in profit, I am looking at a cash on cash return of approximately 9.7%

This is also a good time to point out that I do not plan on using a property manager (which is another reason why I went with the small one-bedroom). I think the one-bedroom will be easier to manage when I am starting out. The costs will be less to maintain it. The cleaners (fees paid by the guests) will be able to clean the property quicker, etc. If I decide that I don’t have the time or otherwise don’t want to manage the property myself, then I can realistically expect to pay a property manager 20% of the gross revenue. That’s standard in the area (although I’ve found one willing to manage it at 10%). At $40,000 income with a property manager, I am really breaking even at that point. At least I get to use the property whenever I decide to go to the beach.

How Am I Going To Pay For It?

As indicated earlier, I have two options. Option 1 is to cash out an old 401k account. Option 2 is to cash out of my dividend portfolio AND my bitcoins. After much deliberation, I’ve decided to go with Option 1. Here’s why.

Because its an old 401k account, I can’t contribute to it anymore. That’s a bummer. If I withdraw the money from this old account, I will have to pay both taxes and a penalty. The taxes that will be withheld is 20% and the fees will be another 10%. So, in essence, I will be getting 70% of the money that’s in there to use as a down payment and for closing costs. Notably, if I simply sell my stocks and bitcoins, I would only have to pay taxes later during tax time. There would be no fees. So, from a numerical stand point, selling off my bitcoins and my dividend portfolio seem like the more inexpensive option because there is no associated penalty.

It’s Not All About The Numbers

That being said, I’ve decided to go with the more expensive option and pay the penalty. The main reason is that I didn’t want to cash out of my position in bitcoins. Granted, bitcoin is more of a gamble, but to me the upside potential of my cryptocurrencies are much higher than what I could expect to receive in my old 401k account. So, even though my bitcoins (and other cryptocurrencies) are more volatile, and more risky, I am betting in the long run that they will be worth a lot more. If I’m wrong, then so be it.

The other reason is that I’ve already cashed out of my Dividend Portfolio the last time I wanted to buy a condo. When that didn’t happen, I realized that I kept using the money to do stupid things. In fact, I wasted a lot of money over the last few months. I wasn’t ready to mentally cash out my Dividend Portfolio again, especially since it wasn’t the condo of my dreams. So, my Dividend Portfolio is safe for the foreseeable future.

Why I Still Want Another One

Although buying this 1-bedroom, 2-bathroom beach condo has scratched the itch that I’ve had for so long, it’s still not my perfect condo. I’ve decided that I want a 3-bedroom CORNER UNIT beach condo directly on the beach. It would be nice if it was a Penthouse Unit, but that’s not required. I would settle for a 2/2 CORNER Unit!

So, over the course of the next few years (probably sooner than you think), I will attempt to purchase a unit with those specifications. Because I bought this particular one-bedroom unit in the PERFECT location for me (and most of my guests), location of the next building would be less of an issue. Of course, I would still want it to cash flow, but I would be perfectly happy if it’s on the quieter side of the beach – especially as I get older in years. After I buy my corner-unit condo, I think that will be it for me buying properties on the beach for a while.

If this purchase I just made turns out to be a horrible experience, then I’ll simply won’t buy another unit. So, here’s to me praying that a hurricane does not wipe out my unit the month after I buy it.

CONCLUSION

I’ve been wanting to buy a beach condo for the longest while. Thankfully, the bank is allowing me to close on the property in the name of my LLC. So, the mortgage and the title will be in then name of the LLC. Of course, I will have to provide a personal guarantee. But, I will still be able to do vacation rentals with such sites like Air Bnb, VRBO, Booking.com, etc. The condo is a bit expensive, but I know what I am paying for. The location just can’t be beat! Once I’ve shown proof of concept with this deal, I will move on to the next. But right now I am re-organizing my finances to ensure that I have sufficient reserves to weather almost any storm.

I should be closing on the condo in about 30 days. Wish me luck!

Finally, I anticipate being able to resume my contributions to my Dividend Portfolio in around November. The problem with this purchase is that we are going into the quiet season so it’s probably the worst time to buy. However, given the relative affordability of the monthly payment, I should be able to cover the costs of the unit until the property is able to start paying for itself.

What do you think of this post? Think I made a good decision or a bad one? Let me know your thoughts by commenting below.

Pingback: Dividend Income Report - September 2021 - Dividend Portfolio

Pingback: Dividend Income Report - November 2021 - Dividend Portfolio

Pingback: Minimum Contribution Restarted - Dividend Portfolio

Pingback: $10,000 Milestone Reached - Dividend Portfolio

Pingback: $10,000 Milestone Reached Again - Dividend Portfolio

Pingback: Vacation Rental Report - Quarter 1, 2022 - Dividend Portfolio

Pingback: Business Credit - Dividend Portfolio

Pingback: Vacation Rental Report - July 2022 - Dividend Portfolio

Pingback: $50000 Savings Goal - Dividend Portfolio

Pingback: Cancer Update - The Worst News - Dividend Portfolio