The struggle is real. The idea of owning a beach condo sounds great in theory. But, in practice, it’s expensive! Lots of people get excited about the vacation rental market. They get excited when they hear about revenue and how much money they can make.

Sometimes, the revenue generated is several times that of a long-term tenant. For example, at one of my rental properties, my long-term tenant pays $1500 a month. Yet, as indicated in my vacation rental report for Quarter 1, 2022, I received $4283 in rental revenue in March 2022. That is nearly three times as much revenue generated as my long-term property. And, we really aren’t yet in the busy season. In June, I am already booked to received 7,762.62 in revenue! And, there is still room on the calendar in June to receive one or two more bookings. Sounds great right? Well, revenue is NOT the same as profit! Afterall, there are expenses too. So, let’s dive in to see how much profit I made in April 2022.

Vacation Rental Profit / Loss

Let’s see how much profit or loss I made for the month.

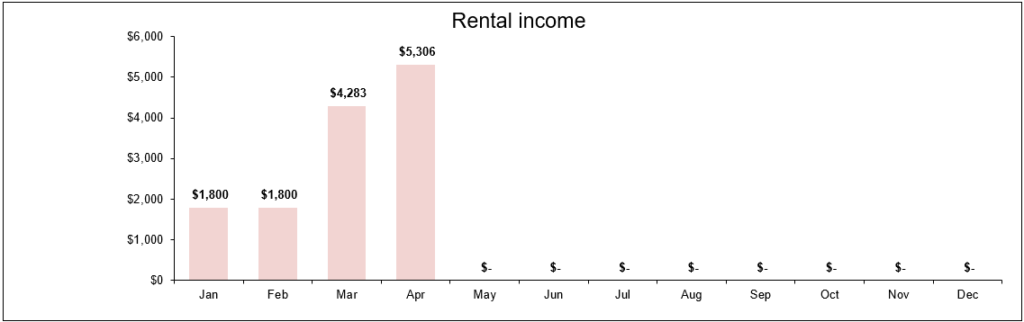

A. Rental Income

During the month of April, I earned $5,306 in short-term rental income as shown below:

$5,306 in income sounds awesome, right? I had pretty good occupancy in April. My calendar was pretty much vacant for only about a week that month. But, as I indicated in the introductory paragraph, I can’t just focus on the rental revenue. There are two sides to the equation, with the other side being expenses.

So here are the expenses.

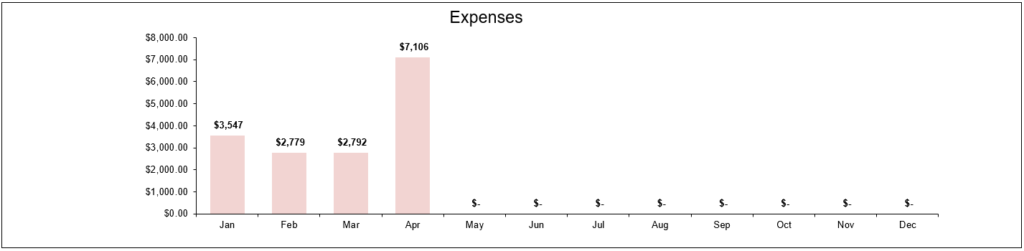

B. Rental Expenses

During the month of April, I incurred $7,106 in expenses as shown below:

Wow! That was a lot of expenses. The expenses were more than double that in March, and the most amount of expenses I’ve incurred since I started tracking in January. So how come?

Well, there are a couple of reasons for the increased expenses. For starters, my HOA was due. The HOA is due quarterly, beginning with the first month of the quarter. So, for example, you will notice that January’s expenses were higher than those of February and March, and that’s because of the fact that my HOA was due in January.

But that’s not the only reason. I decided to buy a new washer and dryer for the unit. The total cost for the washer and dryer, including delivery fees, handyman fees, etc, was $1775. Additionally, there were some extra cleaning fees for that month, which were not passed onto the guest. There were also extra consulting fees, which will end in August 2022. So, all in all, it was a pretty expensive month.

Profit / Loss

Based on the rental income and expenses for April, I incurred a loss for the month. The total LOSS incurred was $1800. Quite frankly, if you look carefully, since January 2022, I’ve incurred year-to-date a loss of $3,035. So, as I mentioned, the struggle is real.

Of course, the year-to-date amount does not include things like ROI, cash-on-cash return or anything of the sort. It’s simply a straight income and loss calculation starting in January.

Although I am currently operating at a loss, I am encouraged. Certainly, there are other factors to consider as to whether this is a profitable investment. Additionally, it’s still early and the busy season is approaching. Moreover, I don’t plan on buying a washer or dryer every month. So, the huge expenses I incurred in April won’t likely be repeated any time soon.

I do want to make further improvements to the unit. For example, I almost bought a new fridge for the unit in April, but decided to hold off on that expense until later (perhaps after the summer). What I really liked was that all the money I am spending to improve the condo is based on the rental income I am receiving. So, I am no longer spending money from my W2 paycheck.

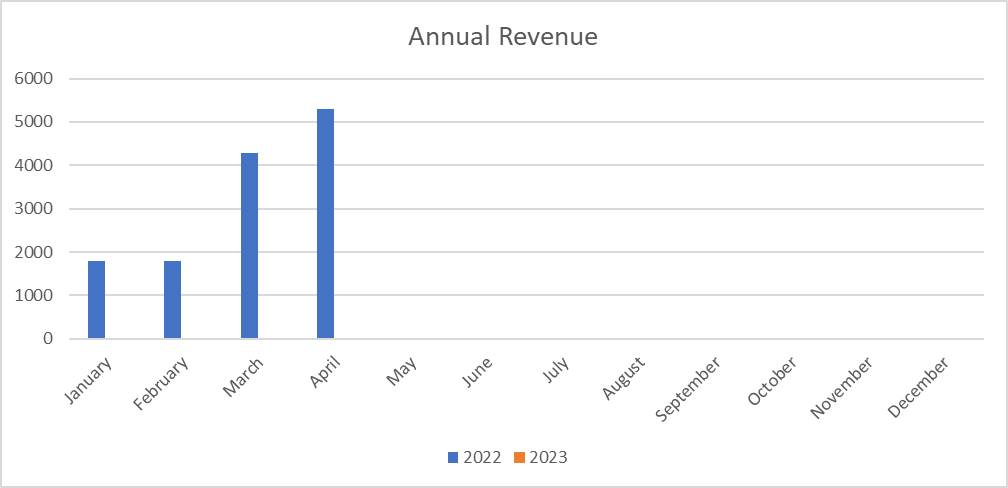

Annual Income & Expenses

As this is my first year investing in a vacation rental, I don’t have any annual income to compare it to. However, for purposes of this section, here is a graphical representation of the revenues earned in April 2022 in relation to the revenue earned in previous years:

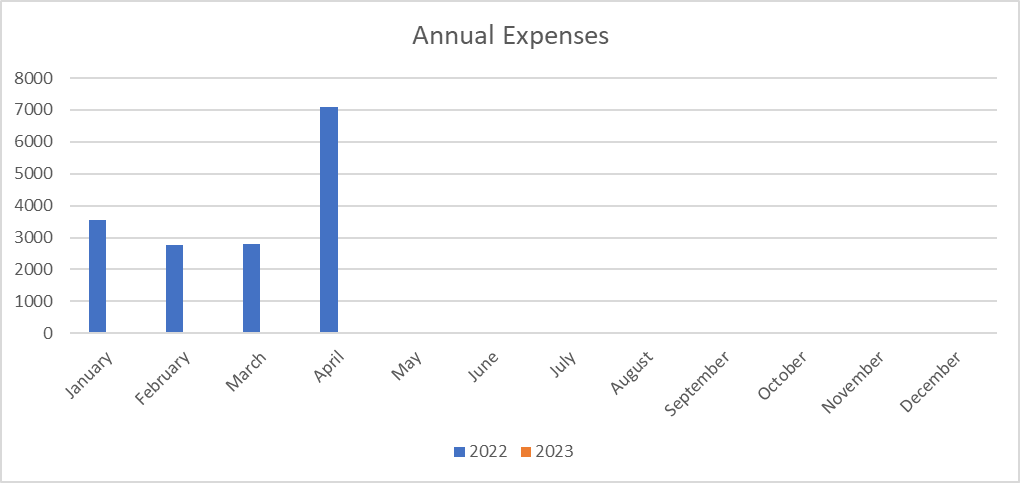

Here is a graphical representation of the expenses incurred in April 2022 in relation to the expenses incurred in previous years:

As you can see, the charts are exactly the same (except in style) as indicated above. This annual comparison section will make a lot more sense come 2023 when I am able to make a comparison. I will be able to see a trend not just from month-to-month, but also from year-to-year.

Conclusion

It is true that short term rentals generate more revenue than their long-term counterparts. But, it’s important to look at both sides of the equation. I made a lot of revenue in April, but I incurred more in expenses. So, that was a loss for the month. Moreover, I’m still operating at a loss from year-to-date. So, I’ve incurred more in expenses than income since January 2022.

The good news is that although my expenses were high in April, and will be elevated over the next several months, there is light at the end of the tunnel. Granted, I still want to make improvements to the unit beyond installing a new washer and dryer. Specifically, I want to buy a new fridge, and improve on the décor. But, once I take care of those one-off costs, I’ll be able to realize more profit on a monthly basis. The goal right now is to improve the condo with money coming only from revenue/profit, and not from my personal paycheck. So far, so good.

Wish me luck.

What did you think of this post?

Let me know your thoughts by commenting below.

DP,

Looks like some solid revenue which is good since you were still missing some potential rental days. Sadly those expenses were quite high. Out of curiosity how do the expenses look on a “normalized”/ongoing basis.

JC recently posted…Dividend Update – April 2022 #Dividend

Hey JC,

I think that the expenses in January, February and March are more in line with what I can expenses to be. Outside of the huge expense like buying a washer and dryer, my typical expenses include mortgage, insurance, taxes and HOA fees. I also pay an electrical bill because the HOA doesn’t include the light bill. What is a bit deceptive though, is that the expenses also include the cleaning fees. However, my rental revenue includes payment for the cleaning fees, so it’s not really coming out of my pocket, but that of the guests.

But, for simplicity, I include both the revenue I collected for the cleaning, and the expenses for the cleaning fees. Sometimes, I incur additional cleaning costs, but I choose not to pass it on to the guest, and those are additional fees are costing me money. But, to me, that’s the cost of business.

Let me know if you have any other questions. The expenses are easier to predict than the revenue. But, after the year ends, I’ll have a pretty good idea of what I can generate each month on the property.

I hope that helps.