I am not sure I am looking forward to writing this vacation rental report for Emerald’s Corner. That’s because the last report I did for Calypso Memories was just dismal in terms of my profit/loss. May was not kind at all to Calypso. So far, my Calypso unit is operating at a loss of over $10,000 year-to-date. For what it’s worth, since I just bought Emerald’s Corner, I expect to start out with expenses. I finally was able to start bringing in revenue in May, but we shall see if it’s enough rental income to be operating at a profit. The reason why I am not optimistic is that I haven’t yet started paying my mortgage. That’s a HUGE expense and will likely wipe out any profit I have. So, I will be happy just to break even at the end of the year. So, without further adieu, let’s dive in to see how Emerald’s Corner did in May 2023.

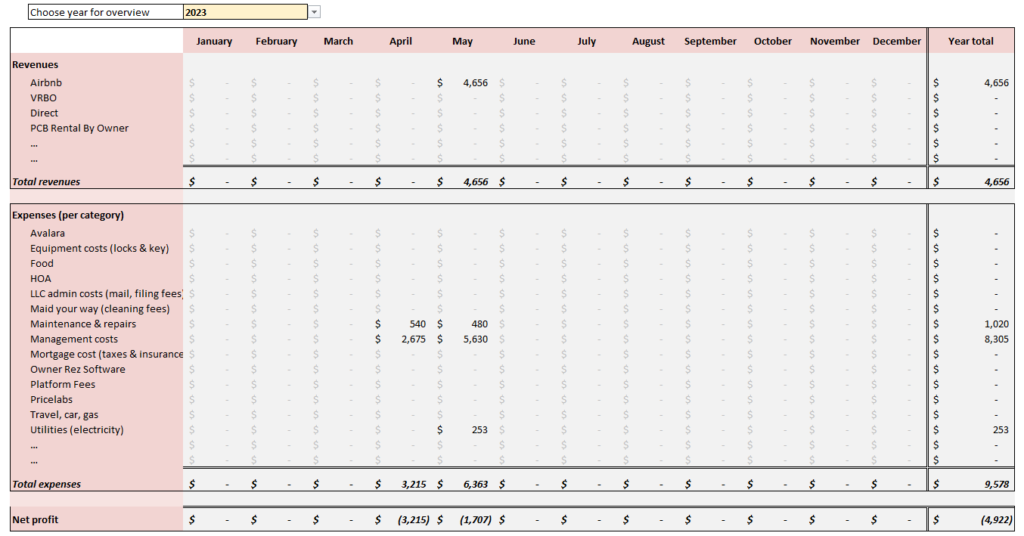

Vacation Rental Profit/Loss

May was the first month I was able to bring in revenue for Emerald’s Corner. Here we go.

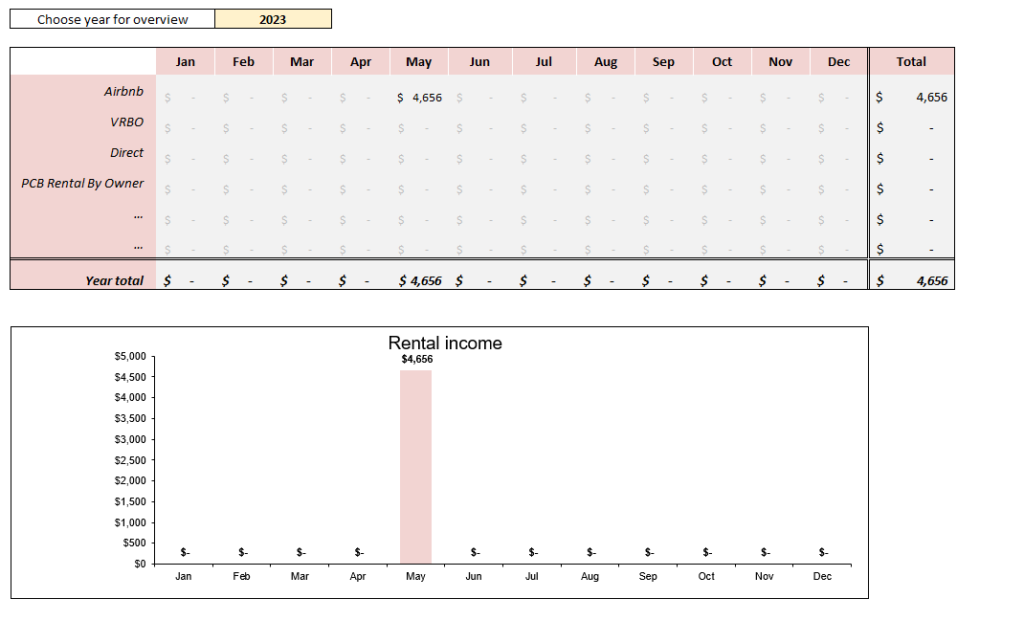

A. Vacation Rental Income

During the month of May, I earned $4656 in rental income broken down as follow:

May is the start of the busy season. So, the rental income earned is a bit low. Also, because Emerald’s Corner is a new unit, I offered a 20% discount to the first few guests to get bookings in so I could get reviews. Quite frankly, I think I offered too many discounts, as I did so on each platform I used to market the condo. So, my June calendar is currently filled, but at low rates. But, positive reviews on the property are an important marketing tool to get others to book the unit. I don’t regret offering discounts (albeit I regret offering so many), but I will have to live with the fact that I may not make enough revenue this year. In other words, it is what it is.

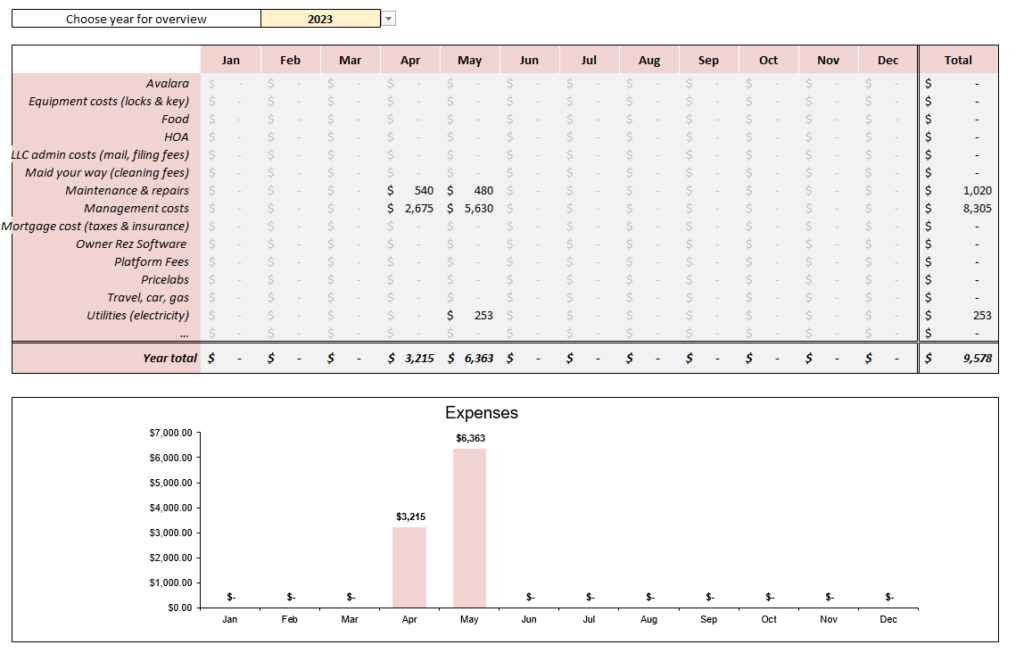

B. Vacation Rental Expenses

During the month of May, I incurred $6363 in expenses broken down as follows:

A bit of explanation is in order!

I had a lot of marketing expenses in May. I don’t just advertise my property on Airbnb and VRBO. There are a few other platforms that I use to market my condo and they all cost money. But, these are yearly cost, so I won’t incur these again next month. In fact, the total cost of my advertising and marketing for May was approximately $1300.00.

Additionally, I am still getting used to owning and managing two condos. I have separate bank accounts for each property and I try to keep things separate. But some of the expenses that I incurred were actually for the other condo (Calypso Memories). I even accidentally used the wrong card to withdraw personal funds. The total expenses I charged using the wrong account were about $1000. I will work towards using the right account going forward.

Finally, I will mention that my first mortgage payment (which is over $5000) is due June 1. The good news is that my mortgage was sold to another bank and they give a 60-day grace period where they don’t charge any late payments or report the account as late to the credit bureau. So, I’m going to look into the possibility of delaying my first payment for another couple of months! Wish me luck.

C. Profit/Loss Statement

Based on the fact that my expenses exceeded my income, my loss for May was $1707. I’m hoping to turn things around come June, but so far, bookings have been slow. AirDNA recently produced an article explaining why bookings are down and what can be done about it. Although my calendar for June is full, most (if not all) of those bookings came at a lower base rate AND with a 20% discount. I’ve since gotten rid of the discount, but my base rate remains lower. I will increase it soon and hopefully that will help my profit/loss.

So, I am starting off at a loss.

My year-to-date loss for Emerald’s Corner is as follows:

As shown above, my year-to-date losses are $4922. Ouch. That’s about half as much as the year-to-date loss of my Calypso unit which is $10646.

So, clearly this is not sustainable. This year-to-date loss however is a bit more understandable since I recently purchased the unit and May was the first month I was able to book the property.

It is still possible to make a profit for the year, but keep in mind that once I start paying my mortgage, my expenses are going to be HUGE! As indicated, the mortgage payment by itself is over $5000. So, I fully expect that I will have to keep paying money out of my personal pocket to help keep Emerald’s Corner afloat until about next year May. I knew this prior to purchasing the unit. I am keeping my fingers crossed that the unit will start to pay for itself by May of next year. When that happens, I will be excited to produce my profit/loss statement!

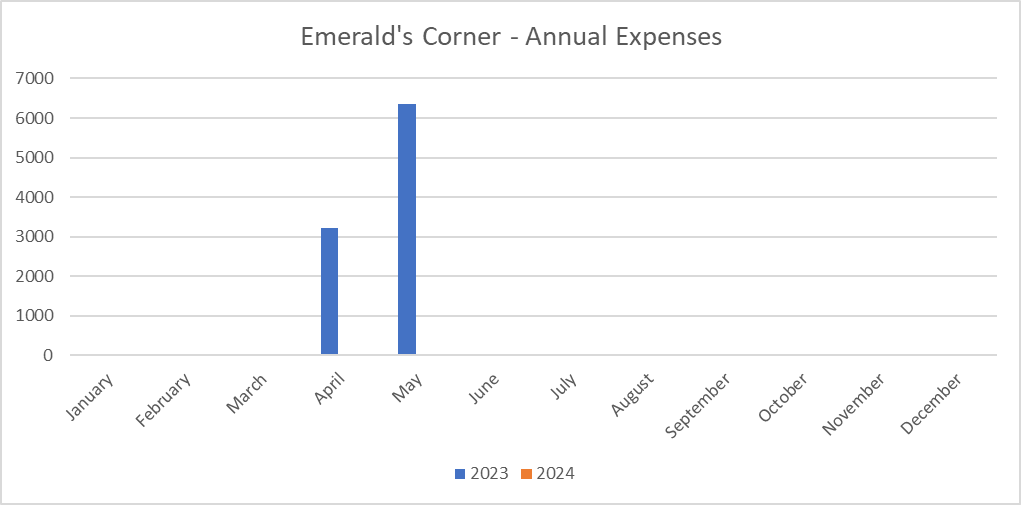

Annual Rental Income and Expenses

This is my first year owning Emerald’s Corner. So, I don’t have any income or expenses to compare it to. This section will make a lot more sense come May 2024.

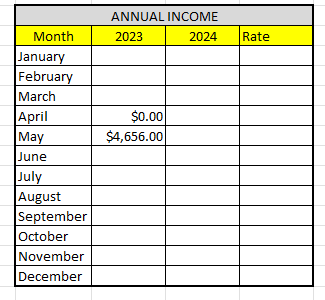

A. Annual Rental Income

Here is the raw data:

It’s good to finally be able to report revenue. Hopefully, this will increase as the months go by.

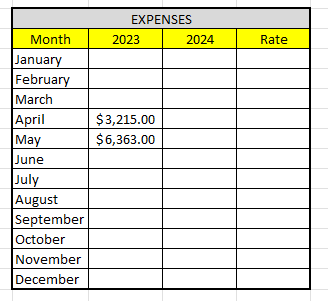

B. Annual Expenses

Here are my annual expenses:

Here is the raw data:

I can’t wait for a profitable month. But again, this section will make a lot of sense in 2024 when I am able to make an annual comparison.

Final Thoughts

The struggle is real. Not only did my expenses exceed my rental income in May, but I am expecting an increase to my expenses potentially as early as June. That’s because I haven’t started to pay my mortgage yet. Once that happens, it’s gonna take a miracle to have a profitable month. So, we will see how that affects my profit/loss statement.

Part of the reason why the mortgage payment is so high has to do with both the price of the property (which was super expensive) AND the massive interest rate I am paying at about 10%. Sufficed to say that I plan on trying to get a refinance as soon possible!!! I am also racing against the clock because, as I’ve stated in earlier post, I will be losing my job in the next few months. Wish me luck.

If I can’t refinance, I’m going to be in a world of financial hurt over the next year. Only time will tell.

What did you think of this post? Let me know your thoughts by commenting below.