It’s been three months since I start accepting guest reservations at my vacation rental. Having a beach condo sounds fun in theory. I remember watching HGTV nonstop and fantasizing about having a place by the beach. I also fantasized about having a place that I can do short term rentals, like Airbnb and VRBO. Well, last year, I got my wish. I was able to purchase a beach condo. Minor improvements were made to the unit. But, I pretty much put all my money into it. That included selling most of my dividend portfolio just to be able to afford to make that purchase. So, was it worth it? How is the condo doing? What are the lessons learned so far? Let’s take a look at my first vacation rental report.

Vacation Rental: Fantasy Meets Realty

It’s fun having a condo by beach. In theory, I get to go to it whenever I want and who doesn’t like sand between their feet on a nice and warm beach? While those things are true, the primary purpose of purchasing the condo was to make money. Sure, I plan on using it every now and again, and I have! But, if it’s not making me money, then what’s the point? I’m not yet rich enough to afford to lose money every month.

I love going to the beach. But, one of the things I realize quickly is that the beach can get boring fast. I suppose that’s why many locals don’t really spend all their time on the beach. Even when I’m on vacation, I want to enjoy the city, or the night life, and do other things other than swim.

Still, I use the condo sparingly so that it’s fun for me every time I go. Moreover, it’s walking distance to a lot of shops and restaurants and so it makes for an ideal vacation spot! That’s why I bought it. But, for what its worth, I don’t spend my time watching HGTV anymore!

The Numbers

This is an important section for a variety of reasons! It’s been often recommended that when purchasing investment property, that you should only do so when the numbers make sense. Well, that’s great to say, but what numbers are we talking about? Which metric should one use to calculate those numbers?

I imagine that no one would buy an investment if they thought it wasn’t going to work out, but I also imagine that not many people (myself included), adequately know how to do the math, so to speak. Although I had an idea how much money I could make from the condo, and a sense of what my expenses were going to be, I still felt like I did a back-of-the-napkin math when I made the purchase. I say that even knowing that I’ve spent probably more than a year looking at, and trying to understand the market where I bought.

A. Bookkeeping

For the first time ever, I decided to start to tracking my income and expenses on a spreadsheet! Can you believe that? The condo is the third real estate I’ve owned, yet, this is first time I’ve taken the time to really track my income and expenses.

Part of the reason it took me so long to track was because I didn’t know what system to use. I was looking for this app or that app, and I’ve tried a couple apps, but, none were to my liking. Unfortunately, I’m single and I don’t have a business partner, so I’m doing all this by myself. I even tried to just create my own spreadsheet, but I wasn’t a fan of that either.

Fortunately, I found a spreadsheet online that I like, and that does everything I want it to do. It’s not perfect, but it’s definitely adequate. More importantly, I can now confidently say what my expenses are for the month. The spreadsheet shows me trends, so I can see if my expenses are going up or down. It also clearly shows my profitability (or lack thereof) for the year.

Now that I know precisely what my expenses are, it makes planning for the future a lot easier! For example, I know exactly the number I need to have in the bank to setup a 3-6 month emergency fund. I can’t believe I’ve never done that before. It’s so helpful that I plan on doing the same thing for my own personal life!

B. Profitability

So, is the vacation rental profitable? So far, the answer is no! And, the answer is no for several reasons.

For starters, I’ve put money into the condo to make improvements. For example, I removed the carpet and redid the flooring. I also made minor improvements as well, such as purchasing a new couch, and washer and dryer for the unit. For purposes of my reporting, I won’t be counting some of the improvements I’ve made in my overall profitability. Of course, that will affect my overall return on investment. But, now that the condo is rent-ready, I want to see if I am profitable from that standpoint.

Can the condo generate enough income to pay for itself, and then pay me in profits?

From that perspective, the condo is still not profitable! Not yet anyway. It should be noted that the busy season is from March 1 through the end of September (approximately). So, it’s important that I make enough money during the busy season so that the expenses can be covered in the off season.

To that extent, I have to be careful with my expenses. There is a lot that I want to do to improve the unit, but I also want to ensure the condo pays for itself. Having a firm grip on on the expenses is very important to my sustainability and overall profitability. So far, so good.

C. Numbers

So, without further adieu, here are the numbers:

For the first quarter (January, February and March), the condo earned $7883 in income broken down as follows:

However, for the first quarter, the condo had $9118 in expenses broken down as follows:

Therefore, the condo had a total LOSS of $1235 for the quarter!

As you can see, I was not profitable in January or February. During those months, I had snowbirds rent the unit for $1800. That was part of the agreement when I purchased the unit. Those snowbirds had rented the unit for several years during the off season, and I agreed to honor their booking. I’ve since indicated to them that the price will be raised for next year. We will see what happens.

During the month of March, that was a profitable month. However, I’m still down for the year. In other words, my expenses so far has exceeded the income I’ve generated from the property.

Moreover, while I do have some bookings during the busy season, my calendar is still mostly empty. I’m sure this being my first year plays a huge part in that. It’s going to take a while to build a name for myself. Afterall, I am self-managing the unit. The reviews I’ve been getting are mostly good… but it’s too early for me to qualify as a Super or Premier host on the platforms. I’m hoping to get that status by the next quarter.

Finally, I realize I am not showing what the actual expenses are…but I assure you, those are being tracked and monitored on a monthly basis.

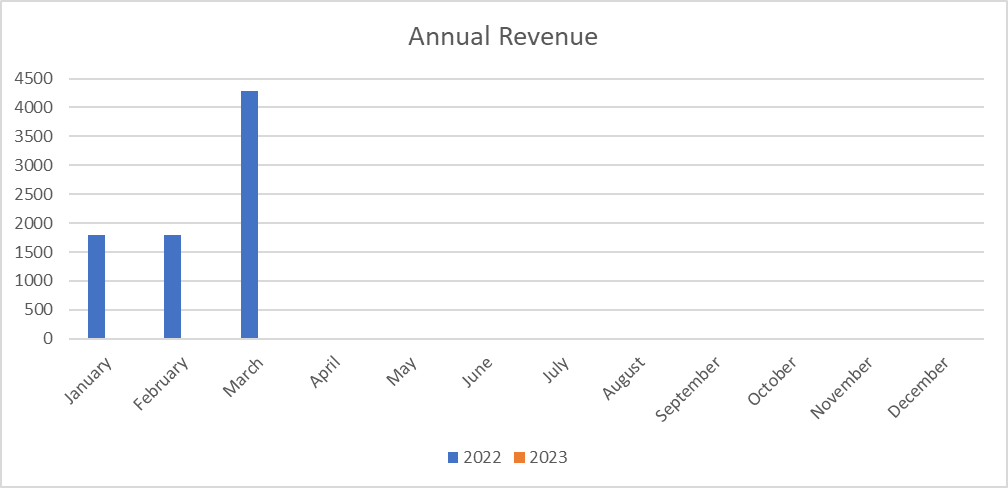

Annual Income

As this is my first report on my vacation rental income, I don’t have any income to compare it to. However, for purposes of this section, here is a graphical representation of the revenues earned in January – March in relation to the revenue earned in previous years:

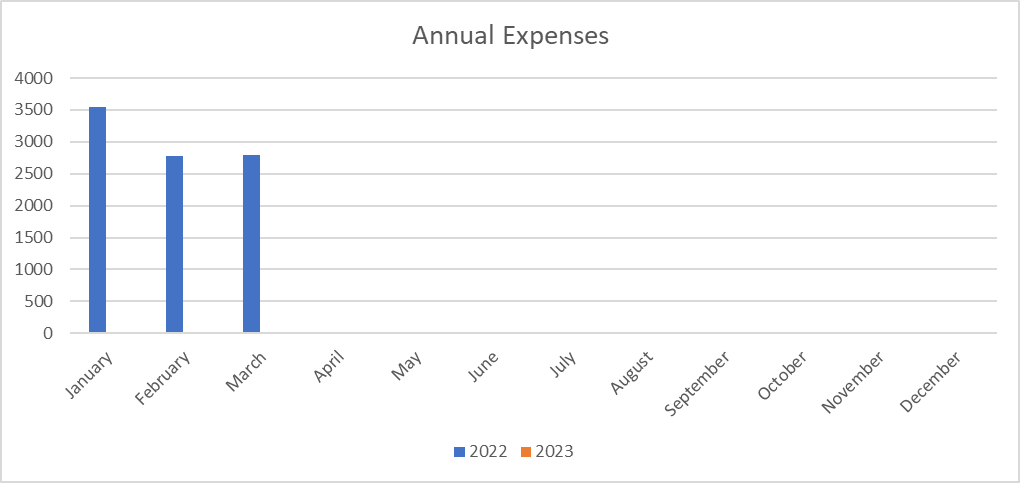

Here is the annual expenses:

As you can see, the charts are exactly the same (except in style) as indicated above. This annual comparison section will make a lot more sense come 2023 when I am able to make a comparison. I will be able to see a trend not just from month to month, but also from year to year.

Conclusion

There you have it, my first vacation rental report. You might be asking yourself why I am posting about my vacation rental when this is a dividend growth investing blog. Well, my long-term plan is to take some of the profits from my vacation rental and use it to purchase dividend growth stocks. So, to that extent, it’s all related.

Regarding the report, I am down for the quarter, but I am nonetheless encouraged, especially since March was a profitable month. It’s too soon to tell whether I will make a profit in my first year, but the bottom line is that I will be watching my income and expenses like a hawk. Win, lose or draw, I will report on my progress along the way. In fact, I may turn this into a monthly report, rather than a quarterly report, but we will see.

What did you think of this post? Are you interested in receiving a monthly report on my vacation rental?

Let me know your thoughts by commenting below.

First quarter is in the books and look forward to updates. For your expenses have you amortized future repair & replacement costs?

Hi SD Growth.

I have not amortized future repair & replacement costs. I was only reporting actual expenses incurred doing the month. Much of the expenses incurred are repeat or otherwise fixed expenses and so it gives me an idea as far as how much the property is costing me every month. Future expenses like maintenance costs, vacancies, etc, were not factored in the report.

Great to see someone working through this process especially for someone that’s been tempted several times to try and get some rental property, although I haven’t looked at vacation properties. Hope to see you fully booked up through the busy season to ramp up that rental income. Looks pretty good so far though all things considered.

JC recently posted…Dividend Update – March 2022 #Dividend

So far so good. My last guest sort of trashed the place. He caused no damage, but there was vomit left over. I incurred extra cleaning fees because of how difficult it was to get the condo back to a place that was suitable for the next guest.

I highlight this because a lot of times when you hear about investing via Airbnb, you tend to hear about how much money you can make. And while that’s true, there are downsides, and costs, with investing in vacation rentals. So, it’s not all rainbows and sunshine. I try to share the good and the bad to give a realistic idea of what it is like for me. Overall though, I’ve had good experiences investing in rental properties. That being said, my mom tried investing in real estate and had such a horrible time (bad tenants) that she got out of the strategy altogether. It’s definitely not for everyone! But, there is a reason why it’s been said that most millionaires (something like 90%) got their wealth by investing in real estate.

Good luck regardless of what strategies you choose, and thanks as always for the continued support.

Pingback: Vacation Rental Report - April 2022 - Dividend Portfolio