Well, if you have been paying attention to my posts, you would have noticed that my 6-months of financial hell has started. My debt is super high and my income is super low. Sometimes I feel like I am robbing Peter to pay Paul. I just realized recently that I was 2-months delinquent on a debt that I am not tracking on this blog. The monthly payment for that debt is over $800! So, in order for me to remove the delinquency, I had to come up with 2 months payment. Also, they will take another $800 for December. So, yea, it’s financial hell for me right now. I know so many Americans are struggling right now. Credit card debt is at an all time high and quite frankly, I am one of those Americans. But, I am committing to getting through this next six months. So, without further adieu, let’s see how where my debt payoff currently stands.

Debt Payoff Progress

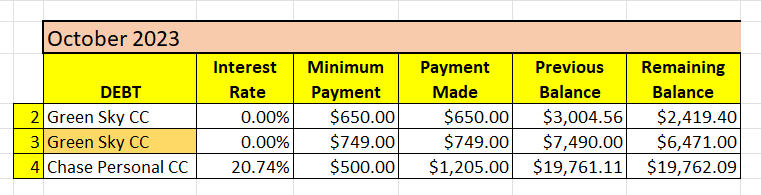

Here is the current status of my debts.

Wow. There’s a lot to discuss but I will try to keep it brief.

You’ll notice that one of my debts is missing. That’s Synchrony Bank. That debt has been paid off to zero dollars! The monthly payment was $650. I initially was going to apply the debt snowball method, but I’ve decided not to do that right now. I just have so much debt right now that my head is barely above water. I’m struggling to pay the minimum balances and so I really don’t have that much extra to pay on some of my debt.

The other thing you’ll notice is the huge payment I made to my Chase credit card, but the negligible effect that the debt has on my balance. I really haven’t been using my chase credit card, so that’s not the problem. The problem is the huge interest rate I have on a high debt amount. So, the interest payments are killing me.

One solution is to get another credit card with a zero percent interest rate, but I doubt I will be able to get one with a high enough balance to transfer all my debt to one card. So I would probably have to try to get multiple credit cards.

Another thought process is to concentrate all my efforts on paying down the credit card, given the high interest rate, and thereby using the avalanche method. But, if I did that, I would owe interest on the remaining debts, since I am currently on a zero percent promotional rate with both Green Sky credit cards. It might be more financially feasible to go with this approach, but we will see.

A. The Plan

The plan right now is to keep doing what I am doing with my debt payoff plan. I will continue to pay the minimum payments on the Greensky cards, so I eliminate those debts before the promotional period ends.

If by some chance I get any extra amount of money, I will use the extra amount to try and pay down the credit card.

I really intend on keeping my expenses low for the two condos that I operate as a short term rental. But even if there were no extra expenses, the minimum monthly payment to service the mortgage payments and HOA fees for both condos is right around $9000 a month. I don’t make that much money in income and that doesn’t include the above minimum payments on my debt.

So, starting in January, I will be liquidating all my remaining retirement funds. I am waiting for January so that I can worry about those tax consequences in 2025. Speaking of tax consequences, I am expecting a HUGE tax bill next year.

Woe is me!

B. The Good News

For starters, I am hoping to be in a better financial position six months from now. At least one of the Greensky credit cards will be paid off. Additionally, I will be in the busy season for the condos and so they should make enough money to pay for themselves, at least for a few months.

Additionally, I am really hoping to get the dream job that I applied for. It’s just a waiting game to see if I get approved. I am giving myself until February 1, 2024, and if I don’t hear anything by then, I will just assume I didn’t get the position. But if I do, then that additional income would virtually eliminate all my financial woes and allow me to get back on the path to rebuilding my financial reserves.

Final Thoughts

There is a lot for me to be financially stressed out about. But, there is some hope for the future. While my plan is to liquidate my remaining retirement accounts, the goal is to not touch my dividend portfolio. Of course, it makes A LOT of sense for me to cash out of my dividend portfolio before my retirement accounts.

If I do get notification that I got the position sooner rather than later, I might liquidate (temporarily) most of my dividend portfolio first, with the goal of replenishing it quickly with the income from my job (as soon as my credit card debt is paid off). I think both could be accomplished within a year if I get the job. But only time will tell.

In any case, as I mentioned earlier, I am dedicated to getting through this next six months. And, the goal is to do so without getting into more debt by borrowing more money. Regardless of my success or failure, I will let you know in these debt payoff reports.

What did you think of this post?

Let me know your thoughts below, and Merry Christmas to you all!