Happy New Year everyone. 2019 is over but there’s one more thing left to take care of: write the Dividend Income Report for December. Recently, I published my 2019 year in review. There, I showed how I met some goals and not others. 2019 was a very interesting year with twists and turns, but in the end, it will only make me stronger in 2020.

So, now let’s see how much dividend income I earned in the last month of the year.

Dividend Income

In December, I received a total of $116.51 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | EMR | Emerson | $19.87 |

| 2 | GWW | W.W. Granger | $0.55 |

| 3 | JNJ | Johnson & Johnson | $36.75 |

| 4 | KO | Coca Cola | $0.90 |

| 5 | MCD | McDonalds | $0.75 |

| 6 | MMM | 3M Company | $1.08 |

| 7 | O | Realty Income | $0.35 |

| 8 | PFE | Pfizer | $1.20 |

| 9 | XOM | Exxon Mobile | $55.06 |

| $116.51 |

Wow, $116.51. I can’t believe it. After all, last month’s dividend income showed a total of $7.18. The massive difference comes from the fact that most of my portfolio right now is weighted in 3 companies: EMR, JNJ & XOM. They all paid dividends in December. So, it looks like the months that EMR, JNJ & XOM pay dividends will be my highest months.

I have to admit, it’s a bit encouraging. I knew my portfolio took a hit after I sold stocks, and, as mentioned in previous posts, there’s a small possibility that I might sell some more to help with closing costs. Although, I think that’s becoming more doubtful, but we will see. In any case, getting $7.18 is better than nothing, but getting $116.51 for the month is outright inspiring.

So, all things considering, it looks like I finished the year on a strong note after all.

Annual Income

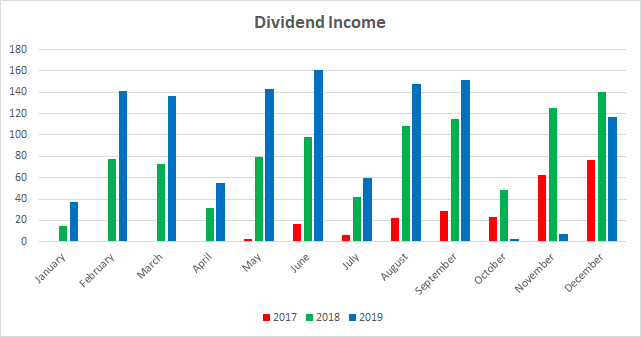

Here is a graphical representation of the dividends earned this month in relation to the dividends earned in previous years.

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | Rate |

| January | $0.00 | $14.93 | $37.54 | 151.44% |

| February | $0.00 | $77.66 | $141.16 | 81.77% |

| March | $0.00 | $72.93 | $136.45 | 87.10% |

| April | $0.41 | $31.47 | $55.39 | 76.01% |

| May | $2.85 | $79.33 | $142.69 | 79.87% |

| June | $16.89 | $98.51 | $160.47 | 62.90% |

| July | $5.99 | $42.32 | $59.68 | 41.02% |

| August | $21.95 | $108.44 | $147.73 | 36.23% |

| September | $28.72 | $111.15 | $151.66 | 36.45% |

| October | $23.21 | $48.09 | $3.00 | -93.76% |

| November | $62.11 | $124.92 | $7.18 | -94.25% |

| December | $76.51 | $140.24 | $116.51 | -16.92% |

As you can see, I earned a NEGATIVE 16.92% as compared to last year. However, that’s a much better loss than the rate was in the previous two months.

Regardless of whether I have to sell additional stocks, there won’t be any new funds going into the portfolio until after I close on the house. Then I will need to re-assess to see how much on a monthly basis I can contribute.

I have a lot of plans for 2020, including starting my own business. Given all my plans, I fully expect that I will slowly ease into the contributions, starting off small and then slowly increasing the amount over time. I want to ensure that I have sufficient funds to cover any unexpected expenses from the condo during the first year.

Also, because of the seasonality of this vacation rental, I want to ensure that I have enough reserves to last me during the slow winter season.

Forward Annual Dividends

At the time of this writing, my forward annual dividends is $501.79. This is a respectable amount. I’m hoping to get back to the days where I am projected to make $1000 a year and beyond. But slow and steady wins the race. I’m not on a sprint but a marathon.

Conclusion

That’s it. The final dividend income report for 2019 is complete. Now, I’m laser focused on 2020, with 2020 vision!

2019 was interesting, but I can’t wait to see what 2020 has in-store. How was 2019 for you? What are your thoughts on this post. Let me know by commenting below.

Nice report and Happy new year. It’s nice to see the progress you made since 2017. In your first year, you didn’t have 1 single 3 figure dividend month but in 2019 you had 7! Your progress inspires me to stay the course and keep investing in my dividend growth portfolio. Keep up the great work and looking forward to reading your dividend income reports in 2020!

Investor Trip recently posted…Tesla stock hits $453 record high! Will Tesla stock keep going up?

Thanks Investor Trip. I’m glad I was able to serve as an inspiration. I definitely have come a long way from where I started. I’m not giving up and I hope that the portfolio will aggressively grow in 2020. Looking forward to us supporting and encouraging each other in 2020.

Fantastic work mate, looks like things are starting to get back on track. Keep up the great work.

Buy, Hold Long recently posted…2019 Year Review – Buy Hold Long

Thanks BHL. Once I get past the first few months in 2020, and things calm down a bit, I should definitely be back on track.

Great month DP! Nice payout from JNJ! Even with the earlier sale, you kept very strong companies. Good job! We share 5/9 of those (the other 4 are on my watchlist). Keep up the great work and Happy New Year! 😀

My Dividend Dynasty recently posted…December 2019 Dividend Income

Thanks MDD. Those three companies that made me the most are very strong companies indeed. Glad we share several stocks that paid us dividends and it looks like we may eventually share more in the future if those additional 4 come off your watch list. Let’s hope that 2020 is an exciting year for both of us.

Fantastic month DP. You should absolutely feel encouraged with the progress. Sure, it was a decrease from last year and that has been well documented on your site. The important thing is you keep your head up and continue moving forward, one day at a time. Keep pushing and stay hungry.

Bert

Thanks a lot Bert. 2019 is behind us. I’m really looking forward to 2020.

Great month. and you will get back to where you were plus some. sometimes life happens. keep it up.

Thanks. It’s been very frustrating dealing with mortgages and I still haven’t finalized my financing for the condo. I hope it works out, but man, is it stressful. I’m eager to get this over with.

Pingback: December Dividend Income from YOU the Bloggers! - Dividend Diplomats

Thanks. I’m just REALLY HOPING that I don’t have to take another step backwards before moving forward. My current mortgage broker screwed me over and so I’m shopping for another one. I’ll write about this plight soon. Regardless, I’m working on 2020 being a good year.