Happy New Year! Bye bye 2021, and hello 2022. I don’t know about you, but I for one am looking forward to 2022. I have lots of motivation and definitely want to start the year off right. So, stay tuned for future posts. I intend to recap how I did in 2021 with my resolutions, and then post about what my resolutions will be for 2022. It’s all just so exciting! But of course, that’s not why you’re here. It’s also the first day of the month, and during this time, I post about the dividends I earned the previous month. This of course will be the final dividend income report for 2021. So, without further adieu, let’s see how much dividends I earned in December 2021.

Dividend Income

In December, I earned $34.11 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | ED | Consolidated Edison | $3.32 |

| 2 | EMR | Emerson | $1.70 |

| 3 | GWW | W.W. Grainger | $1.59 |

| 4 | IBM | Intern. Bus. Machine | $3.93 |

| 5 | JNJ | Johnson & Johnson | $2.59 |

| 6 | KO | Coca-Cola | $3.12 |

| 7 | LMT | Lockheed Martin | $2.58 |

| 8 | MCD | McDonalds | $2.23 |

| 9 | MMM | 3M Company | $3.28 |

| 10 | MSFT | Microsoft | $0.68 |

| 11 | O | Realty Income | $1.48 |

| 12 | PFE | Pfizer | $2.93 |

| 13 | XOM | Exxon Mobile | $4.68 |

| $34.11 |

That’s $34.11 that I didn’t have before. That $34.11 was added to my portfolio to purchase new shares so that the power of compounding can take effect. Right now, my portfolio balance is small. I am ending the year with a balance just under $10,000. I really want to prioritize the growth of my portfolio in 2022 and I will be writing about how to do just that in future posts. But for now, it’s good to know that my dividend portfolio is working for me on a monthly basis.

Annual Income

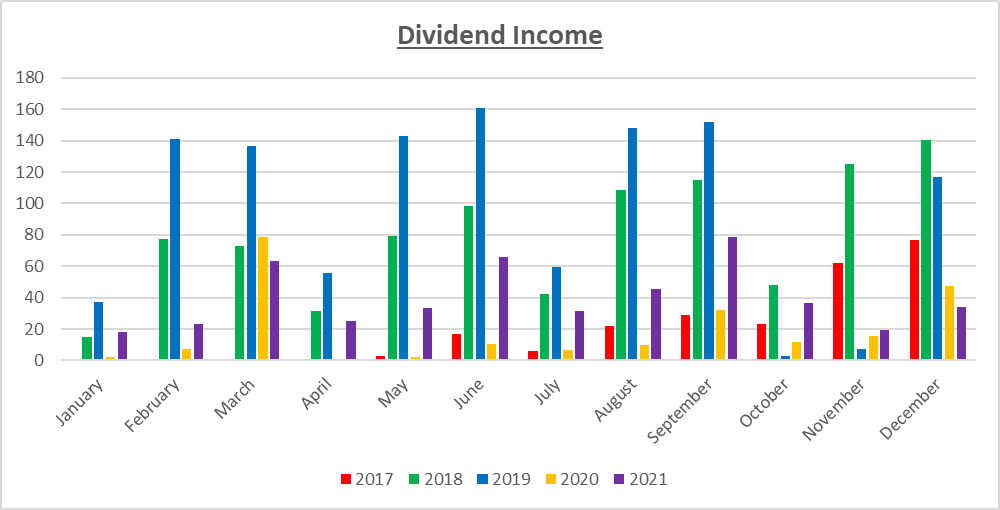

Here is a graphical representation of the dividends earned in December in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | 2021 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | $18.18 | 718.92% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | $22.94 | 206.28% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | $63.35 | -19.48% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | $24.85 | 7430.30% |

| May | $2.85 | $79.33 | $142.69 | $2.23 | $33.69 | 1410.76% |

| June | $16.89 | $98.51 | $160.47 | $10.29 | $66.08 | 542.18% |

| July | $5.99 | $42.32 | $59.68 | $6.67 | $31.22 | 368.07% |

| August | $21.95 | $108.44 | $147.73 | $9.72 | $45.79 | 371.09% |

| September | $28.72 | $111.15 | $151.66 | $30.19 | $78.88 | 161.28% |

| October | $23.21 | $48.09 | $3.00 | $11.46 | $36.62 | 219.55% |

| November | $62.11 | $124.92 | $7.18 | $15.84 | $19.33 | 22.03% |

| December | $76.51 | $140.24 | $116.51 | $47.57 | $34.11 | -28.30% |

As both the graph and data shows, I earned 28.30% LESS dividends in December than I did the previous year. In other words, I made more dividends in 2020, than I did in 2021. What gives? Afterall, I am pursuing the dividend growth strategy, not the dividend downward trend strategy! As you may recall, I had to liquidate my portfolio to buy real estate. So now, I am in the process of rebuilding my portfolio. It seems that 2019 was the golden years for my portfolio. But, it’s only a matter of time before I am able to rebuild my portfolio to a higher amount than it was in 2019.

Forward Annual Dividends

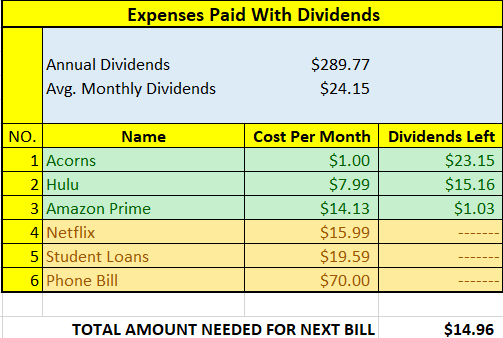

At the time of this writing, the forward annual dividends is $289.77. A month ago, my forward annual dividends was $276.92. This represents a 4.64% growth from the previous month. I’ll take it. Right now, I’m just slowly contributing a small amount to my portfolio ($10 a week). But, I just started a new project entitled Driving For Dividends. That helps to bring hundreds of dollars into my portfolio on a monthly basis. I just started the project in December 2021 and I plan on continuing with it throughout 2022. I am 100% certain that in 2022 I will be prioritize my portfolio like never before!!!

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$289.77 per year is $24.15 dividends per month, on average. At present, I earn enough in dividends to cover Acorns, Hulu Plus, and Amazon Prime. The next bill I am targeting is Netflix. The total amount needed until I can pay the next bill is $14.96 in dividends. I hope to cover this bill during the first half of 2022.

A word on my bills! One of the things I will be doing in short order is re-evaluate all the expenses I have. I haven’t watched Hulu in a long time, yet, I am paying a monthly subscription for it. I anticipate that I will be canceling Hulu Plus, as early as tomorrow. The point being is that I will likely do so for other things I am paying that I don’t need. Additionally, I will take a look at my insurance and other items I am paying for to see if I can get a better deal by shopping elsewhere. So, the next time I update this section, my bills might look a little bit different.

The following is a list of expenses I am targetting:

Conclusion

2021 is finally over! It was a rough year for my dividend portfolio, but the good news is that the portfolio is still here! I have exciting plans for 2022 and I will be sharing some of those with you soon.

Let me take this opportunity to thank you for reading and supporting this blog. I’ll try to do a better job of visiting your blogs in 2022. For now, from this small corner of the internet, Happy New Year and best wishes to you and your family in 2022.

What did you think of this post? let me know your thoughts by commenting below.

Happy New Year and best of luck over new year. 2021 was definitely a year of change for you and you’ll have that dividend portfolio built back up in no time.

JC recently posted…Dividend Increase | Realty Income (O)

Thanks JC. I have a feeling you’re right! Happy New Year!

Portfolio may have been a slow go but you have so much behind you now. 2022 is going to be an awesome year for you.

Funny thing is I started my oldest daughter with investing last year. The other day we sat down to review her 1 year performance and when we calculated her monthly dividends ($24) her first reaction was oh that pays my phone bill, which is what you have been doing on all your monthly reports. When she said that I thought of your blog.

SD Growth recently posted…December Dividend Income

Haha that’s awesome SD Growth. I’m glad that your daughter is getting into investing. It’s amazing what having the proper perspective can have when it comes to investing. The dividend growth investing strategy doesn’t have to be anything earth shattering. Using dividends to pay for one bill at a time is certainly one path to financial freedom. To me, it’s pretty motivating. The more expenses that dividends cover, the closer one gets to being financially free. Happy New Year to both you and your family!

Pingback: Dividend Income from YOU the Bloggers - December 2021

Pingback: Dividend Income from YOU the Bloggers – December 2021 – Dividend Growth Investors Daily