Ladies and Gentlemen, Happy New Year! Another year has passed and it is time to produce the final dividend income report for 2022. I don’t know about you but I for one am very happy that 2022 is over and that I have lived to see another year. Dividend growth investing is a long term strategy and staying the course is the name of the game. Every month, I contribute money to my portfolio that buys shares of stock. Then those stock produce dividends, which in turn buys more shares. Over time, I get the benefit of compounding and that allows my portfolio to grow at an exponential rate. But you knew that already. So without further adieu, let’s see how much dividends I earned in December 2022.

Dividend Income

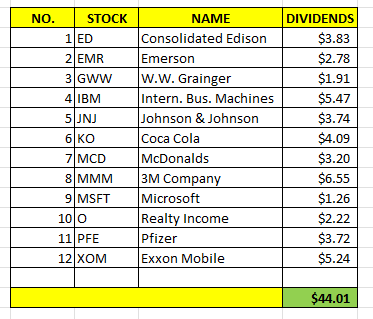

In December 2022, I earned $44.01 in dividends broken down as follows:

That’s $44.01 dollars that was reinvested back into the dividend portfolio. Although I was hoping that the amount would be over $50, I am confident that I will get to that point and beyond in 2023. There’s nothing like having 12 companies paying you reliable dividends every month, as in the case of Realty Income, or every quarter like my other stocks.

In relatively short order, I will be posting my 2023 resolutions. As a sneak peak, I plan on increasing my contributions to my dividend portfolio to $1000 per month sometime in 2023 (towards the latter half). I currently contribute about $220 per month.

There is a small but not insignificant possibility I might have to liquidate my dividend portfolio again to buy another beach condo but I am trying very hard not to do that. Even if I do, the plan will be to rebuild as quickly as possible. I am not unmindful that I am still trying to rebuild from where my portfolio was during the last time I liquidated it. But a lot has happened in 2022. Still, I am very confident in my ability to fulfill my promise to rebuild as soon as possible.

Annual Income

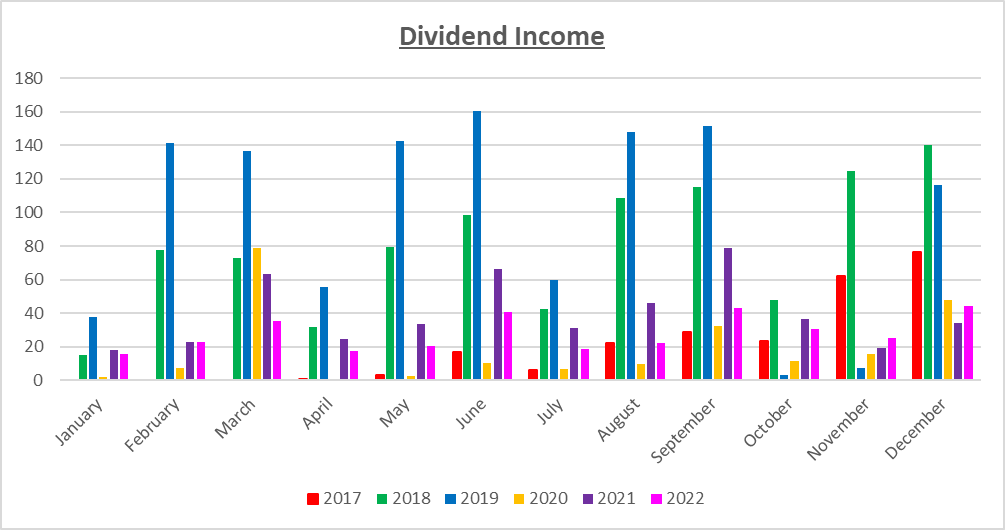

Here is a graphical representation of the dividends earned in December in relation to dividends earned in previous years:

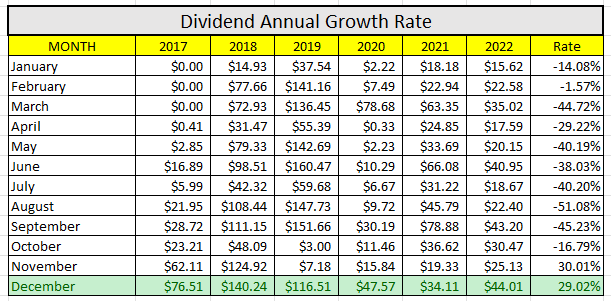

Here is the raw data:

As you can see, I continue to be in positive territory when compared to last year. I’ve earned 29.02% MORE dividends this year than I did in 2021. However, I am still down from where I was in 2017 and a far cry from where I was in 2019. It feels good to be in positive territory again and I will continue to work hard to rebuild my portfolio.

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $403.04. A month ago, my forward annual dividends was $397.64. This represents a small1.36% growth from the previous month. It could be better and I know that there this is much work to do – but I’ll take it.

Crossing the $400 mark was an unofficial goal of mine and I am glad I was able to meet that metric for the year.

Finally, the Dividend Tracker has been updated.

What Expenses Would Dividends Cover?

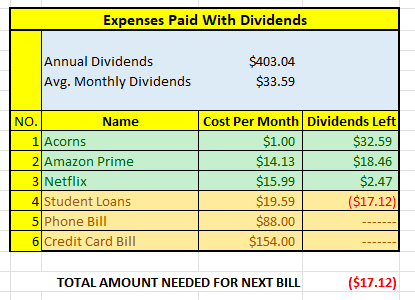

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$403.04 per year is $33.59 dividends per month, on average. At present, I earn enough in dividends to cover Acorns, Amazon Prime and Netflix.

The following is a list of expenses I am targeting:

Technically, the next bill I am targeting is my student loans. The current balance on my student loans is approximately $5,000. I am grateful that I was able to pay down my student loans to that amount. It has taken me YEARS and the original balance was over $100,000.

Currently, the minimum payment on my student loans is $0.00 because I am in deferment until June 2023. The previous payment was $19.59, which is what I am tracking here. I am anticipating that my student loan balance will be either forgiven or cancelled and I won’t have to worry about it anymore. In fact, I did confirm that I was on a list whose student loans was approved to be forgiven. It’s just a matter of time. I was told 90 days as the worst case scenario. Once my remaining student loans have been forgiven, I will report it on this blog and update this section accordingly.

Finally, I will need to reassess my expenses in 2023. For starters, I will likely be moving to live with mom for a bit. I anticipate that a lot of my expenses will be reduced once I rent out the house I am living in. My utilities, internet and lawn care add up to over $500 a month!!! I won’t have any of those once I mov in with my mom. Honestly, I can’t wait to move.

I anticipate that I will have enough money to fund my current lifestyle for the rest of my life. I won’t be rich, but I also won’t starve. So wish me luck.

Final Thoughts

I have very big and expensive plans for 2023. Regardless of my financial goals, I hope to live life to the fullest. Everyday is a blessing to me and I want to ensure I enjoy it to the best of my ability.

With regards to my dividend portfolio, 2022 ended on a great note. My portfolio is back in positive territory as compared to 2021. Moreover, I have plans to increase my contributions in 2023. Despite the ups and downs in my personal life (more downs right now), I can always count on earning dividend income on a monthly and quarterly basis.

How was 2022 for you? Did you finish strong? Break any milestones?

What did you think of this post?

Let me know your thoughts by commenting below.

It looks like you are getting back on track. Increasing your contributions will make a big difference on your dividend portfolio. I look forward to reading about how things play out next on your journey!

Jason from MoreDividends recently posted…Recent Buy – WestRock ( $WRK )

Thanks Jason. I’m hoping my plans for 2023 come to fruition. Happy New Year!

All things considered that looks like a solid month. The personal/health issues plus purchasing that condo really put a dent in the portfolio but you saw an opportunity that was potentially more lucrative. I was really happy with 2022’s performance as we continued to save and invest and the dividends kept climbing. We officially crossed the $10k and $11k marks for forward dividends during the year and even snuck in over the $11.2k level on 12/31. I wasn’t targeting any buys on 12/30 but we were just too close so I went ahead and did it. We’re kind of in the same boat right now with our portfolio where we might take a big chunk out for a different opportunity and while it would hurt in the short term I believe it has the potential to be much more rewarding over the long term. We’re looking at possibly pulling out around 1/2 of our portfolio, not including taxes, but it has the potential to possibly pay that back within 2 years.

JC recently posted…Dividend Update – December 2022 #Dividend

That sounds awesome JC. Congrats on crossing over the 10k mark in forward annual dividends. I hear you with respect to having to potentially withdraw from the portfolio. Proper consideration of Opportunity cost is key and ultimately, an investor has to make the best decision they can under the circumstances. If you have to withdraw, good luck – I hope it works out. Thanks as always for the support.