Another month has gone by. And right now, there is so much uncertainty and sadness in the world. The Ukraine and Russia war is difficult to watch and I imagine it’s more difficult to live through. I pray for a peaceful resolution to the crises. In addition to the uncertainty overseas, there’s also uncertainty here at home. With the possibility of rising interest rates, more severe inflation, and more volatility in the market, it’s understandable why there is so much fear in the market. But, despite the uncertainties, I can still count of my dividend income working for me in the background.

For me, last month was tough. I barely had enough money to pay my mortgage. For all practical purposes, I was house rich and cash poor. But, March is a new month and I am working towards building up a cushion for my expenses, establishing a healthy emergency fund, and prioritize paying down my credit card debt. It kind of all seems so trivial now given what’s going on in Ukraine. Still, let’s dive in to see how much dividend income I’ve heard in February 2022.

Dividend Income

In February, I earned $22.58 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | T | AT&T | $9.32 |

| 2 | AAPL | Apple | $0.63 |

| 3 | ABBV | Abbvie | $5.07 |

| 4 | HRL | Hormel Foods | $1.97 |

| 5 | PG | Proctor & Gamble | $1.98 |

| 6 | O | Realty Income | $1.70 |

| 7 | SBUX | Starbucks | $1.91 |

| $22.58 |

$22.58 is not a bad amount. I know it’s small but every dividend counts. Recently, I just restarted the minimum contribution to my dividend portfolio. I fully anticipate that over time, I will be able to get closer to triple digits. It’s going to be a long journey, but the journey of a thousand miles begins with a single step – or at least a single dividend. In my case, I just took $22.58 steps towards that journey.

Annual Income

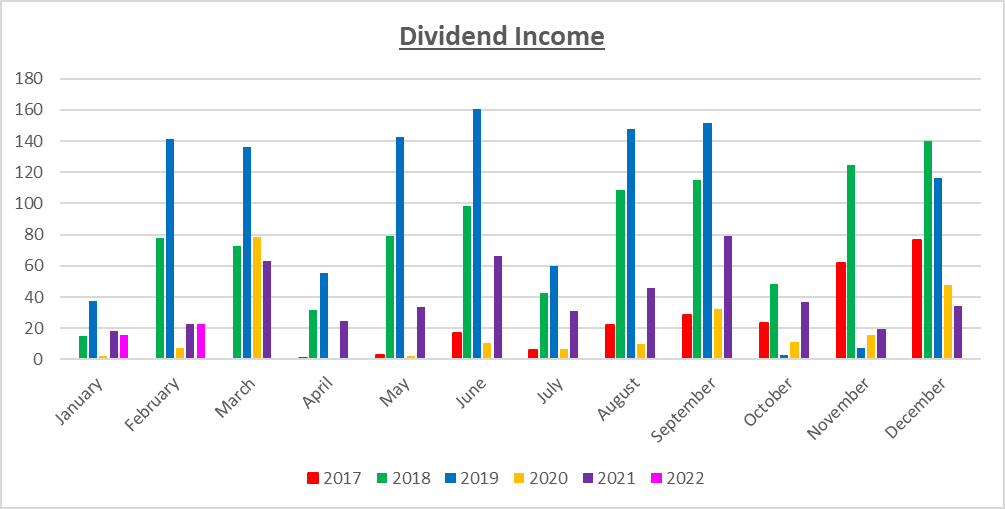

Here is a graphical representation of the dividends earned in February in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | $18.18 | $15.62 | -14.08% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | $22.94 | $22.58 | -1.57% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | $63.35 | ||

| April | $0.41 | $31.47 | $55.39 | $0.33 | $24.85 | ||

| May | $2.85 | $79.33 | $142.69 | $2.23 | $33.69 | ||

| June | $16.89 | $98.51 | $160.47 | $10.29 | $66.08 | ||

| July | $5.99 | $42.32 | $59.68 | $6.67 | $31.22 | ||

| August | $21.95 | $108.44 | $147.73 | $9.72 | $45.79 | ||

| September | $28.72 | $111.15 | $151.66 | $30.19 | $78.88 | ||

| October | $23.21 | $48.09 | $3.00 | $11.46 | $36.62 | ||

| November | $62.11 | $124.92 | $7.18 | $15.84 | $19.33 | ||

| December | $76.51 | $140.24 | $116.51 | $47.57 | $34.11 |

So close! However, I made nearly 2% LESS in dividends this February than I did in February last year. Clearly my portfolio did not move in the direction I would have hoped. But, with consistency and dedication, I fully expect February 2023 to exceed the income generated in February 2022.

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $311.63! A month ago, my forward annual dividends was $300.60. This represents a 3.67% growth from the previous month. I’ll take it. Right now, I am focused on my new project entitled Driving For Dividends. That helps to bring hundreds of dollars into my portfolio on a monthly basis. I also just restarted my contributions to my dividend portfolio. So, I’m confident that in 2022, I will be prioritizing my portfolio like never before.

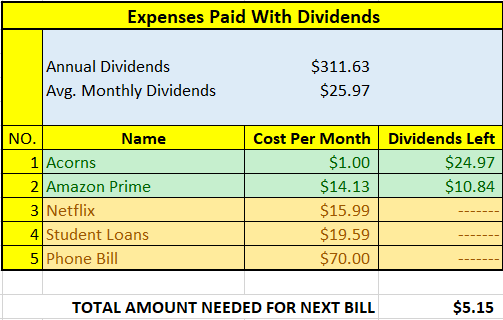

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$311.63 per year is $25.97 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Amazon Prime. I cancelled my Hulu Plus subscription. I hadn’t used it in months. The next bill I am targeting is Netflix. The total amount needed until I can pay the next bill is $5.15 in dividends. I hope to cover this bill during the first half of 2022.

The following is a list of expenses I am targeting:

Conclusion

I feel like I’m in a transition phase. Currently, my cash flow is low, but I feel like the next few months is going to change that in a positive way. My portfolio is small, but I am encouraged at the rate at which I am rebuilding it. Additionally, I am mindful that notwithstanding my personal financial situation, there is a lot of fear and uncertainty in the world right now.

Dividend growth investing is a slow but worthwhile strategy. It’s one that I intend to pursue for years to come.

Finally, I try not to comment on politics here, as this is a personal finance blog. However, I do hope there is a peaceful resolution to the Ukrainian crises soon.

What are your thoughts about this post? Let me know your thoughts by commenting below.

Nice month with great payers! Great to hear your restarting the contributions. Your dividend income is going to snowball in no time! 🙂

My Dividend Dynasty recently posted…February 2022 Dividend Income

Thanks MDD. Don’t jinx it!

Keep at it. As you pointed out your dividends can still cover some minimal monthly expenses. That’s awesome. Know that in the future you’ll be covering a lot more expenses. Seems like every stock that paid you in Feb. also paid me. Nice to see that we share many common names. I’ll be posting my results soon for Feb. You know DGI is a marathon. Don’t stop.

DivHut recently posted…Recent Stock Purchase February 2022

Thanks DivHut. I’m looking forward to your post in February. Welcome back.

Glad to see you back contributing to your portfolio and getting it moving in the right direction again. With consistent investing you’ll get those dividends built back up.

JC recently posted…Nike: Still Expensive, But Getting Better $NKE

I’m looking forward to it JC. It will be slow at first but hoping to increase it over time.

Thanks for the comment.

Pingback: $10,000 Milestone Reached - Dividend Portfolio

Pingback: Dividend Income from YOU the Bloggers – February 2022