Just like that, 2 months of the year is already gone. Welcome to my February 2023 Dividend Income Report. As you will see in a moment, there have been a lot of developments since my last income report. All I can say is that I am excited for the future. It’s going to be financially strenuous, but that’s ok. A little bit of financial stress might be a healthy thing, but we will see. What you will also see is that my overall dividend portfolio value has substantially declined. I mentioned the rational in other posts, but I will again mention them here. So, without further adieu, let’s see how much dividend income I earned in February 2023.

Dividend Income

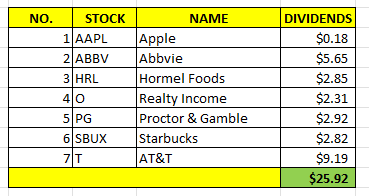

In February, I earned $25.92 in dividend income broken down as follows:

$25.92 is not terrible. I had to sell stocks so my results are going to be small for the foreseeable future. More on this later. But for now, that’s $25.92 that I was able to put back into my portfolio. Slow and steady wins the race.

Annual Income

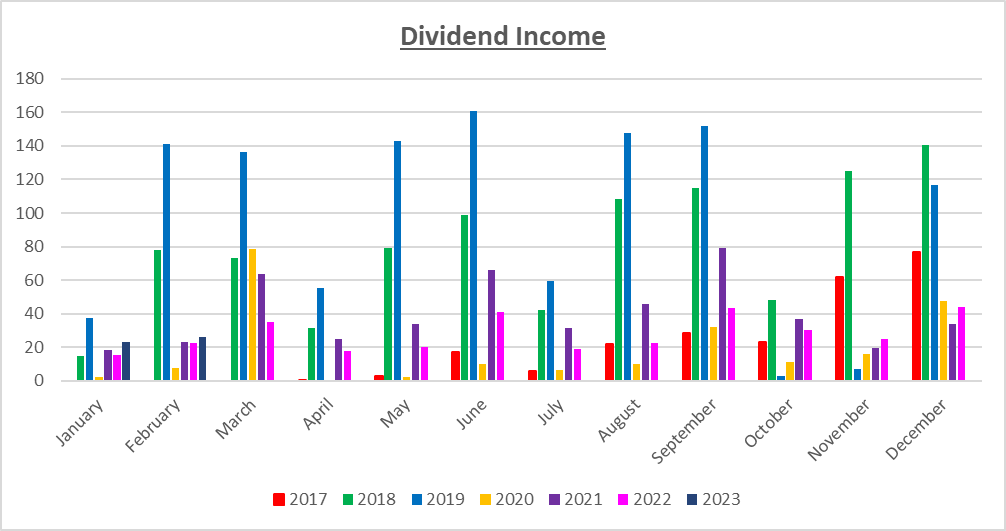

Here is a graphical representation of the dividends earned in February in relation to the dividends earned in previous years:

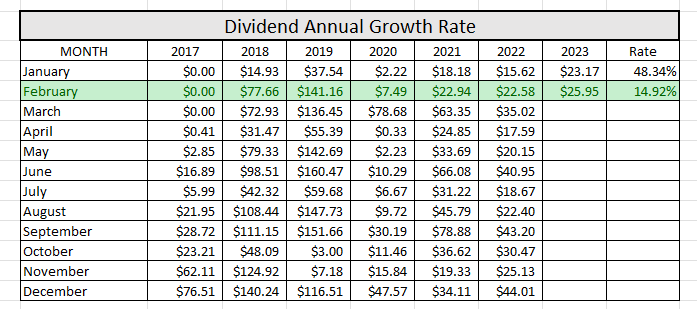

Here is the raw data:

Nice! I earned 14.92% MORE dividends in 2023 than I did in 2022. Additionally, the amount earned in 2023 exceeded that of 2021 and 2020. It’s such a shame I had to sell my stocks. Afterall, I was on track to exceeding my 2019 income. However, there were good reasons for me to sell. The current plan is to rebuild my portfolio as fast as possible AFTER the 2024 tax season. Wish me luck.

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $86.02! A month ago, my forward annual dividends was $400.35. This represents a 78.51% LOSS from the previous month. Wow, how the mighty have fallen. So let’s discuss what happened.

As I have mentioned elsewhere and in other posts, I had to sell some of my stocks. Long story short, I am in the process of purchasing my dream condo. It is a 2 bedroom 2 bathroom penthouse corner beach condo under contract. It is very expensive!!! I will post pictures after I close on the property in April.

More importantly, I had to liquidate some of my dividend portfolio in order to come up with the earnest money for this condo. I have also liquidated both my Roth IRA and my Roth 401K (both for the most part) to fund the down payment and closing costs. I am very excited about this purchase. However, the running joke amongst me and my friends is that I will likely have to declare bankruptcy in about 2 years given how expensive this condo is.

Because this is an investment loan, the interest rate is super high (even beyond the typical 6-7% that is currently being offered to those buyers seeking to purchase a primary residence). I hope to refinance in the future, if and when interest rates come back down. But, there’s no turning back now. I am basically just waiting for the closing date, which will be during the first week of April.

Finally, I do plan on rebuilding my portfolio but I also have to plan for the inevitable tax consequence in 2024 of liquidating my retirement accounts before I am the age of 59-and-a-half. Wish me good luck.

What Expenses Would Dividends Cover?

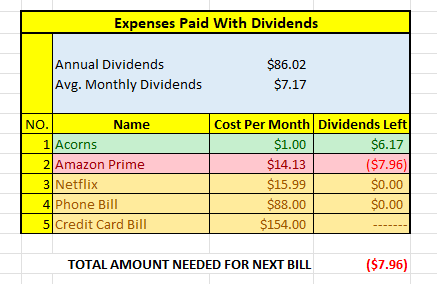

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$86.02 per year is $7.17 dividends per month, on average. At present, I earn enough in dividends to cover Acorns. I’ll take it.

The following is a list of expenses I am targeting:

I will need to reassess my expenses in 2023. For starters, I will be moving to live with mom for a bit (or permanently, I haven’t decided yet). I anticipate that a lot of my expenses will be reduced. I won’t have to pay rent while living with my mom. My property manager was able to find tenants for the house I used to live in. My utilities, internet and lawn care add up to over $500 a month!!! I won’t have any of those once I move in with my mom, although I may contribute this amount to help with her utility bills. That will happen in March! I can’t wait.

Final Thoughts

I wish I didn’t have to sell. But, life is what happens when you make plans. Money is a tool and it’s to be used as such. There are personal reasons why I chose to buy my dream condo now. I want to live life to the fullest everyday. I am under no illusions that purchasing the condo will put a strain on my finances. Quite frankly, had I not purchased the condo, I really wouldn’t have any financial stress.

But. the way I look at it is that this condo will be my primary vacation rental. My guests will help pay down the mortgage, and if I have to come out of pocket to help pay the bills, then so be it. I am budgeting about $2000 a month to help pay for the mortgage. Of course, there’s a fair (but not overwhelming) chance that this condo can pay for itself. Or, that the amount of needed to help cover the cost would be substantially less than $2000 that I am budgeting for. But, I am the kind of guy that hopes for the best but plans for the worst.

Time will tell whether this is a good financial investment or not. Regardless, it’s a good lifestyle investment for me right now. I am just happy that I am in a position to make this purchase. The sad part is, I am already thinking how I can go bigger with my next real estate purchase (without tapping into my dividend portfolio again)! Somebody stop me!!!

Finally, I could replenish my dividend portfolio this year. Based on my limited research, I don’t think I will be subjected to the early withdrawal penalties of taking money from my retirement accounts, but we will see. Regardless, I want to rebuild my portfolio fast, but I also want to ensure that my mortgage is being paid and that I set enough money aside for the tax bill that will come due next year. It’s going to be tough, but the mind is a powerful thing. I do not regret my decision one bit.

What did you think of this post? Let me know your thoughts by commenting below.