Wow. The first year of the New Year is already over. Now it’s time for the dividend income report. January is off to an interesting start. So far, it’s been an expensive month. Moreover, I don’t anticipate my financial situation getting better until about March or April of this year. In the meantime, I am what they call “house rich and cash poor.” It’s not a great situation to be in. But, despite all my financial woes, my dividends are there working for me in the background. They are working hard for me even when I don’t feel like working. My dividend stocks produce dividends whether I go to my job or not. They even produce dividends while I sleep. It doesn’t get much better than that. So, without further adieu, let’s see how much dividends I earned in January.

Dividend Income

In January, I earned $15.62 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | KMB | Kimberly Clark | $3.36 |

| 2 | MO | Altria Group | $7.97 |

| 3 | O | Realty Income | $1.51 |

| 4 | PEP | Pepsico | $2.78 |

| $15.62 |

It’s not much but that’s $15.62 that I didn’t have before. Also, that’s money that I got without having to go to my job. As I rebuild my portfolio, the amount of dividends I get increase over time. I wouldn’t have it any other way.

Annual Income

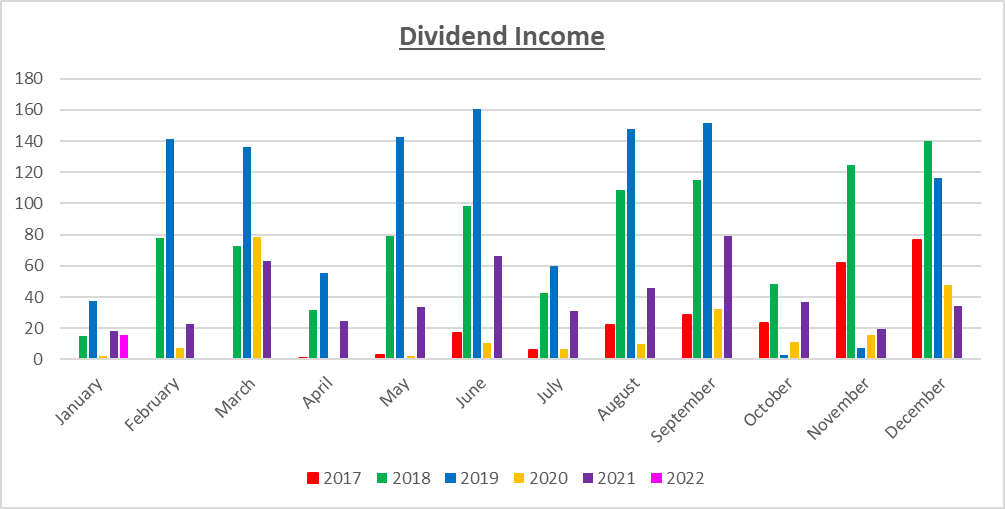

Here is a graphical representation of the dividends earned in January in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | $18.18 | $15.62 | -14.08% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | $22.94 | ||

| March | $0.00 | $72.93 | $136.45 | $78.68 | $63.35 | ||

| April | $0.41 | $31.47 | $55.39 | $0.33 | $24.85 | ||

| May | $2.85 | $79.33 | $142.69 | $2.23 | $33.69 | ||

| June | $16.89 | $98.51 | $160.47 | $10.29 | $66.08 | ||

| July | $5.99 | $42.32 | $59.68 | $6.67 | $31.22 | ||

| August | $21.95 | $108.44 | $147.73 | $9.72 | $45.79 | ||

| September | $28.72 | $111.15 | $151.66 | $30.19 | $78.88 | ||

| October | $23.21 | $48.09 | $3.00 | $11.46 | $36.62 | ||

| November | $62.11 | $124.92 | $7.18 | $15.84 | $19.33 | ||

| December | $76.51 | $140.24 | $116.51 | $47.57 | $34.11 |

So close! However, I made 14% LESS in dividends this January than I did last January. Clearly my portfolio did not move in the direction I would have hoped. But, with consistency and dedication, I fully expect January 2023 to exceed the income generated in January 2022.

Forward Annual Dividends

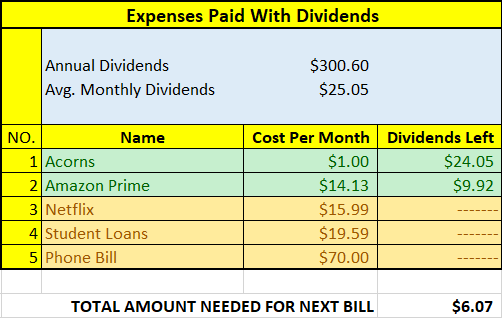

At the time of this writing, the forward annual dividends is $300.60! A month ago, my forward annual dividends was $289.77. This represents a 3.74% growth from the previous month. I’ll take it. Right now, I am focused on my new project entitled Driving For Dividends. That helps to bring hundreds of dollars into my portfolio on a monthly basis. I just started the project in December 2021 and I plan on continuing with it throughout 2022. I am 100% certain that in 2022 I will prioritize my portfolio like never before!!!

I must say that crossing over the $300 threshold is a bit exciting. I’m going to be writing about achieving this milestone in a future post, but I am waiting for my portfolio to cross $10,000 which it is poised to do shortly.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$300.60 per year is $25.05 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Amazon Prime. I cancelled my Hulu Plus subscription. I hadn’t used it in months. The next bill I am targeting is Netflix. The total amount needed until I can pay the next bill is $6.07 in dividends. I hope to cover this bill during the first half of 2022.

The following is a list of expenses I am targeting:

Conclusion

2022 has turned out to be a challenging year so far. I’m experiencing a sad case of Murphy’s Law right now. I’m all about transparency and so I will update the community soon. But for now, I am content that my dividends are constantly working for me in the background during good times and bad.

I am excited by the fact that the portfolio again crossed the $300 per year threshold! It’s important to celebrate the mini-milestones along the way. The path to financial freedom via dividend growth investing is a slow one. But ultimately, I think it will all be worth it.

How was January for you? Did you break any records or achieve any milestones? Let me know your thoughts by commenting below.

Hitting the big reset button on your dividend growth investing and getting back on that horse is a good thing. Hopefully you found time last month to play with your Christmas toys :). You know the old saying all work and no play…

Hey SD Growth, I did find time to enjoy my Christmas toys BUT I’m already using them less. It’s proof that I need to spend money more wisely. Having a big reset has been challenging but no pain no gain right?

Thanks for the comment and as always for the support.

Nice crossing new thresholds DP! Every little bit helps. Hang in there and keep marching forward! 🙂

My Dividend Dynasty recently posted…January 2022 Dividend Income Plus Health Update

It is exciting crossing the threshold. I can’t wait until I pass 5-digits again! Thanks for the encouragement.

Pingback: Driving For Dividends - January 2022 - Week 4 - Dividend Portfolio