What a month it has been. It’s amazing how unpredictable life can be. One minute, you are on cloud 9 and the other, it’s like the world is on your shoulders! I don’t know, but I for one am happy July is over. Wish me luck. By the time I write the monthly report for August 2021, if I’m smiling, then I’ll be one of the happiest persons on earth. If not, probably one of the saddest. So, yea, without going into specifics, please wish me luck. Anyway, you came here to see how much dividend income I earned in the month of July.

Each month, I track the dividends for several reasons. For starters, it’s fun! I truly enjoy tracking my dividends and seeing my portfolio balance rise on a monthly basis. But, additionally, it’s important to take stock (no pun intended) of where I am and where I’ve been. Doing an annual comparison gives me an indication of how close I am to achieving my goals of financial independence. So, without further adieu, let’s see what progress I made in July 2021.

Dividend Income

In July, I earned $31.22 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | KMB | Kimberly Clark | $7.29 |

| 2 | KO | Coca Cola | $6.36 |

| 3 | MO | Altria Group | $14.61 |

| 4 | O | Realty Income | $2.96 |

| $31.22 |

Not bad. That’s $31.22 that I didn’t have before. Moreover, that amount of money will go back into my dividend portfolio through dividend reinvesting. That way, I experience the power of compounding. With a small portfolio, the compounding effect is small, but over time, it grows exponentially. I can’t wait.

Annual Income

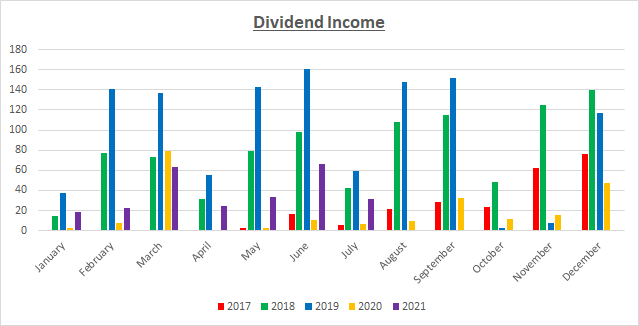

Here is a graphical representation of the dividends earned in July in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | 2021 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | $18.18 | 718.92% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | $22.94 | 206.28% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | $63.35 | -19.48% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | $24.85 | 7430.30% |

| May | $2.85 | $79.33 | $142.69 | $2.23 | $33.69 | 1410.76% |

| June | $16.89 | $98.51 | $160.47 | $10.29 | $66.08 | 542.18% |

| July | $5.99 | $42.32 | $59.68 | $6.67 | $31.22 | 368.07% |

| August | $21.95 | $108.44 | $147.73 | $9.72 | ||

| September | $28.72 | $111.15 | $151.66 | $30.19 | ||

| October | $23.21 | $48.09 | $3.00 | $11.46 | ||

| November | $62.11 | $124.92 | $7.18 | $15.84 | ||

| December | $76.51 | $140.24 | $116.51 | $47.57 |

368.07% is a healthy increase from 2019! It seems apparent that I’ve moved consistently into positive territory. I am rebuilding my portfolio quite nicely although admittedly quite slowly. Still, I am no where close to what my portfolio was in 2019. But every little bit counts, and I will continue to rebuild one dividend at a time. It’s only a matter of time before the dividends earned in July will exceed that of 2019!

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $617.48. A month ago, my forward annual dividends was $574.18. This represents an 8% increase from the previous month. I’ll take it.

I anticipate a slower growth rate for the next couple of months, as I try to figure out how to deal with increased expenses. Although it’s cool buying a house to live in, it’s also more expensive. Not only do I have the mortgage, but I have utilities and yard maintenance. So, as the saying goes, the struggle is real.

In addition, I plan on making another effort to buy a beach condo. More on this in future posts! In order to do this, I will be liquidating some of my retirement accounts. I’m trying my best not to liquidate my Dividend Portfolio again. Stay tuned!

Finally, the dividend tracker has been updated.

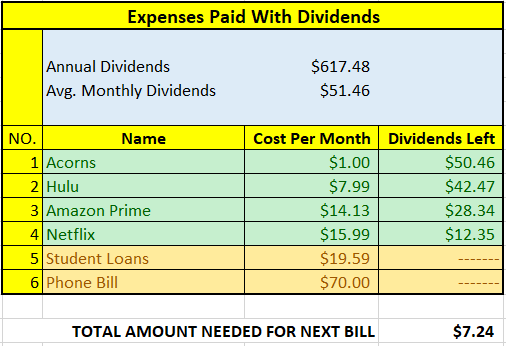

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$617.48 per year is $51.46 dividends per month, on average. At present, I earn enough in dividends to cover Acorns, Hulu Plus, Amazon Prime and Netflix. The next bill I am targeting is my student loans. That amount is $19.59 per month. The total amount needed until I can pay the next bill is $7.24 in dividends. I should be able to cover this bill by the end of the year.

The following is a list of expenses I am targeting:

Conclusion

Dividend growth investing is a long-term strategy. The first month of the quarter is not usually my strongest, but I think my portfolio is now consistently producing a positive annual growth rate from the previous year. My plan is simple. I dollar cost average my way into my portfolio on a monthly basis, regardless of what the stock market is doing. In doing so, I continue to purchase shares that continue to pay me an ever increasing amount of dividends. The process is very slow at first. But the speed of compounding increases as the months and years go by.

How was July for you? Did you break any records? Let me know your thoughts by commenting below.

Congrats on your progress. I’ve started my dividend portfolio around the same time as you and it’s a never ending learning process which I enjoy. Keep throwing those coins into the coffee can. – Mike

Thanks a lot for stopping by MG. Throwing coins in the coffee can – never heard that before but I like it!

No new records for me but a nice growth rate and results. As usual we share KMB and O!

Awesome Mr. Robot. Not every month will produce records, but small wins and gains are just as important. Thanks as always for stopping by.

Nice month DP! Great job clocking in another triple digit YOY growth! 🙂 I am also glad July finished. It was more of a hectic month for me and I am looking forward to a calmer August (I hope). Yeah, I agree with you, life is an unpredictable roller coaster ride… I wish you the best of luck!

My Dividend Dynasty recently posted…July 2021 Dividend Income

Thanks for the well wishes MDD and glad the month is over for both of our sakes. Definitely hoping for a calmer August as well.