Just like that, we are in the last month of 2019. The year seemed to go by quickly, and so much has happened already. Normally, I try to get the Dividend Income monthly updates out at the beginning of the month, but I had a busy time at work recently. But as the saying goes, better late than never.

November was an expensive month, thanks in large part to Black Friday. I bought a new gaming laptop and a very expensive adjustable dumbbell set with the stand. There was no deal with the dumbbell but I wanted to start working out from home. I’ve made significant lifestyle improvements since my recent health scare and so far so good. More on that in future posts. But I’m sure that’s not why you’re here. Without further adieu, let’s see how much dividend income I’ve earned in November 2019.

Dividend Income

in November, I received a total of $7.18 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | AAPL | Apple | $0.44 |

| 2 | ABBV | Abbvie | $1.70 |

| 3 | GIS | General Mills | $1.17 |

| 4 | HRL | Hormel Foods | $0.63 |

| 5 | O | Realty Income | $0.35 |

| 6 | PG | Proctor & Gamble | $0.64 |

| 7 | SBUX | Starbucks | $0.47 |

| 8 | T | AT&T | $1.78 |

| $7.18 |

Well, as you know, I’m pretty much starting over. So, my immediate goal is to break the $10 mark in dividends earned for the month. As the saying goes, the journey of a thousand miles begins with a single step.

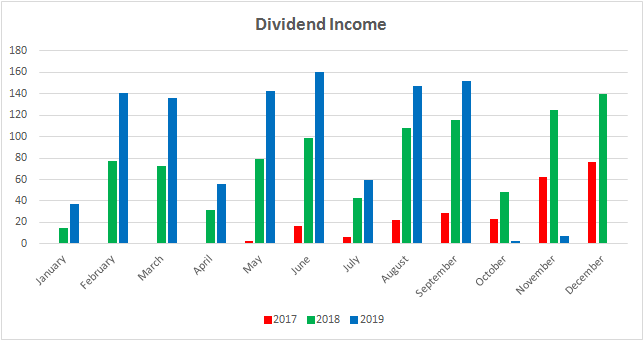

Annual Income

Here is a graphical representation of the dividends earned this month in relation to the dividends earned in previous years.

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | Rate |

| January | $0.00 | $14.93 | $37.54 | 151.44% |

| February | $0.00 | $77.66 | $141.16 | 81.77% |

| March | $0.00 | $72.93 | $136.45 | 87.10% |

| April | $0.41 | $31.47 | $55.39 | 76.01% |

| May | $2.85 | $79.33 | $142.69 | 79.87% |

| June | $16.89 | $98.51 | $160.47 | 62.90% |

| July | $5.99 | $42.32 | $59.68 | 41.02% |

| August | $21.95 | $108.44 | $147.73 | 36.23% |

| September | $28.72 | $111.15 | $151.66 | 36.45% |

| October | $23.21 | $48.09 | $3.00 | -93.76% |

| November | $62.11 | $124.92 | $7.18 | -94.25% |

| December | $76.51 | $140.24 |

As you can see, I earned a NEGATIVE 94.25% in dividends compared to last year November. That is, I earned less money this year than I did last year. That’s because I sold my stocks. Still, I’m not giving up. Although it will take some time, one of my short term goals will be to earn enough dividends that exceed my 2018 results, starting with breaking the $10 threshold.

Finally, the Dividend Tracker has been updated.

Forward Annual Dividends

At the time of this writing, my forward annual dividends is $501.79. A month ago, my forward annual dividends was $497.50. This represents a 1% increase from the previous month. I do expect another decrease to the forward annual dividend figure to help with closing costs of my new beach condo.

Conclusion

2019 has been a wild year. There is so much to update the dividend community on. Definitely stay tuned for future posts. I will give an update on my health and my wealth (or lack there of). I’m ready to tackle 2020.

Although it may not seem like it, given the low amount of dividends earned in November, I am laying a strong foundation to build a better financial future. Either that, or everything will come crashing down and I’ll have to declare bankruptcy. Ha! All kidding aside, I am very hopeful.

Every year I do a post that recaps my yearly progress. I also do a new financial plan for the new year. You will see that my new financial plan is unlike anything I’ve posted before!

I hope November was profitable for you all and that you had a good Thanksgiving, for those who celebrate that holiday. Let me know how it was or what thoughts you have on this post by commenting below.

It’s a new year and a new start. You are starting off anew very well, with a nice bunch of companies paying you and a sweet new laptop and dumbbell set. That is what I call a great way to start anew (plus the awesome condo)! You set yourself up for a great 2020! Good job! 🙂

My Dividend Dynasty recently posted…November 2019 Dividend Income

You’re right MDD. It’s all about setting myself up right for 2020. I’ve made some BIG decisions in 2019, and even now, I’m learning about new strategies and approaches to my financial life. I’m eager to share them with the community. But patience is a virtue – haha.

All in all I think you’re still looking solid. You made a move to improve your lifestyle which is always a plus in my book. I’m possibly/probably going to be making a change myself. While it will be a big drop to our monthly investment capital it’ll be a huge increase to a happy life.

JC recently posted…Dividend Increase | Becton, Dickinson & Company (BDX)

Definitely good luck on any changes you pursue JC. It can be scary at times, but sometimes its definitely worth it. Looking forward to hearing about all about it – and it’s all about having a happy life at the end of the day.

Hopefully, it’s just one step backward in order to take two steps forward, DP. Sounds like you have a master plan for 2020 and I’m excited to hear about it.

You still have a diverse group of stocks paying you despite the payout reduction… certainly something to build on.

Thanks to that new gaming laptop, you ought to be able to whip out all sorts of future posts in no time. 😀

Engineering Dividends recently posted…Monthly Dividend Income (Nov. 2019)

OMG you have no idea how difficult it was on my old laptop. In a day or so I’m going to take that piece of crap to best buy, wipe the data, and maybe get $50 for it. I also have a desktop that I still use to help me with writing posts. I’m just rarely home and my cell phone is no ideal for blogging. I’m not sure I’ll be dragging my gaming laptop with me around when I travel. We will see.

Might be painful right now but once that rental cash flow kicks in…you’ll be glad you did it.

Passive Cash recently posted…Passive Income Summary – November 2019

Thanks PC. I really hope so. Looking forward to providing updates on the good, the bad, and the ugly.

Looks like you are taking the right steps now to get back on track. Keep it up.

I think so BHL…thanks.

Pingback: November Dividend Income from YOU the Bloggers! - Dividend Diplomats

same here DD. It’s all very exciting and I’m a little impatient but slow and steady wins the race.

Hi! Since I have been following your blog for a long time, I would like to ask your opinion about my results so far! You can find the translator application in the sidebar for translation. Thank you in advance for your answer!

https://osztalekcsaszar.blogspot.com/2019/12/unnepi-hirlevel-es-eves-osszefoglalo.html

As I mentioned on your site, I like the diversification of your portfolio. We share some companies together. Looks like great minds think alike. Good luck.