Wow. What a busy month! I barely had time to write a post. I usually publish this report at the beginning of every month, but I was unable to do so. However, as the saying goes, better late than never. As we enter the last quarter of the year, it’s important to stay the course. Let’s hope we can finish strong and report record dividend income for the year! Now, it’s time to see how much dividend income I earned in September.

Dividend Income

In September, I received a total of $151.66 in dividend income broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | EMR | Emerson | $18.10 |

| 2 | GWW | W.W. Grainger | $10.33 |

| 3 | JNJ | Johnson & Johnson | $33.47 |

| 4 | MCD | McDonalds | $0.68 |

| 5 | MMM | 3M Company | $18.95 |

| 6 | O | Realty Income | $0.35 |

| 7 | PFE | Pfizer | $19.08 |

| 8 | XOM | Exxon Mobile | $50.70 |

| $151.66 |

As you can see my dividend income this past month wasn’t too bad. It’s certainly not the powerhouse I’m used to. But, the sad thing is that my portfolio will get worse before it gets better as there’s a possibility that I might still have to sell more shares. That decision won’t be made until closer to the end of the year. Stay tuned.

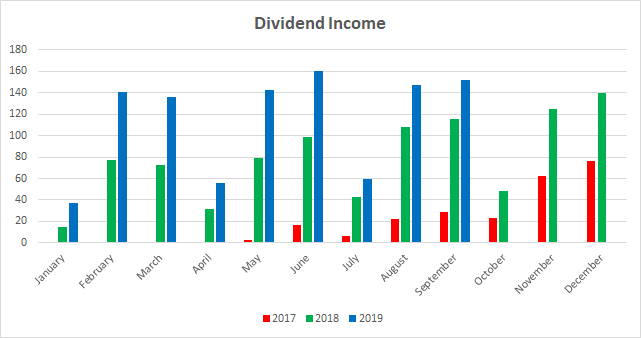

Annual Income

Here is a graph of the annual income. Although the graph may look the same as previous graphs, below is just a copy and paste from excel. That’s just way easier than the plugin I was using before (which seems to have stopped working).

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | Rate |

| January | $0.00 | $14.93 | $37.54 | 151.44% |

| February | $0.00 | $77.66 | $141.16 | 81.77% |

| March | $0.00 | $72.93 | $136.45 | 87.10% |

| April | $0.41 | $31.47 | $55.39 | 76.01% |

| May | $2.85 | $79.33 | $142.69 | 79.87% |

| June | $16.89 | $98.51 | $160.47 | 62.90% |

| July | $5.99 | $42.32 | $59.68 | 41.02% |

| August | $21.95 | $108.44 | $147.73 | 36.23% |

| September | $28.72 | $111.15 | $151.66 | 36.45% |

| October | $23.21 | $48.09 | ||

| November | $62.11 | $124.92 | ||

| December | $76.51 | $140.24 |

As you can see, I earned a 36.45% increase in dividend income compared to last year. The rise in dividends is a combination of my contributions as well as the organic growth in dividends in the portfolio.

Finally, the Dividend Tracker has been updated.

Forward Annual Dividend

At the time of this writing, my forward annual dividends is $489.95. A month ago, my forward annual dividends was $469.19. This represents a 4% increase from the previous month.

Conclusion

Right now, I’m very cash poor. I’m just trying to maintain my portfolio. The possibilities are high that I may need to withdraw from my portfolio. As you know, I recently purchased a condo so it’s going to take some time for my portfolio to rebuild. But, in the words of Confucious, “it does not matter how fast you go as long as you don’t stop.”

I’ll be instituting a new financial plan after I close on the condo. I may do so through an LLC but I’m not sure. In the meantime, my dividends will be working for me in the background.

If things go well, I hope to rebuild my portfolio at a faster rate, starting around 2021, but only time will tell if that’s possible.

Thanks as always for your continued support. If you have any comments, let me know.

nice port

great growth rate and I enjoy the quote. Pulling out cash for other assets is fine if you keep moving forward.

keep it up

cheers!

Passivecanadianincome recently posted…Passive Income – September 2019

Thanks ROB. It’s cool because even though I sold stocks, I still experienced a growth rate compared to last year!

Great YOY growth! Nice payout from JNJ too! I agree with that quote; don’t stop, keep moving forward! 🙂

My Dividend Dynasty recently posted…September 2019 Dividend Income

Thanks MDD. I’m glad you like the quote. When I wrote it I was tempted to restart the Quote of the month series.

Solid portfolio of companies paying you. 6 out of 8 names paid me in Sept. as well. Nice to be in such good company. You continue to show growth and progress. Here’s to a strong 4th quarter for us all.

DivHut recently posted…Dividend Income Update September 2019

Thanks DH. It’s amazing how quickly the end of the year is approaching.

Looking good, DP. XOM and JNJ delivered some nice amounts. I happen to own both as well.

It doesn’t appear that you sold any part of your dividend portfolio to fund the condo purchase at this point. How soon do expect to see the biggest impact of your sales show up in your dividend totals?

Hopefully, you don’t have to sell off more of your dividend portfolio for the condo, but if you do, perhaps it won’t impact your overall passive income totals too much, just shift it from dividend income to rental income.

Take care.

Engineering Dividends recently posted…Monthly Dividend Income (Sept. 2019)

Hey ED. I actually did sell a huge junk of my portfolio to fund the condo purchase. Also, I anticipate another massive withdrawal. It’s gonna take sometime to rebuild, but I’m determined to do so. Thanks as always for the support.

Great job with some solid companies paying you this month! Congrats on the awesome growth rate Dividend Portfolio.

Keep it up-

Divcome

Thanks Divcome. Hopefully I can keep it going.

I don’t see the effects of the selling yet in your report. Hopefully the dividend income shifts to rental cash flow and your overall passive income stays in tact. Good luck!

Passive Cash recently posted…Passive Income Summary – September 2019

Thanks PC. The earliest I will start bringing in rental income is March 2020. So, I have a ways to go. I’m hoping the overall income stays the same or get better. I’ll definitely be posting more about that.

Nice YOY growth portfolio. Keep looking ahead and keep your focus forward right now. Those are some awesome names in your dividend portfolio, that’s for darn sure.

Bert

Thanks Bert. I hope to keep all these companies going forward.