Another month has gone by and we are getting closer to the end of the year. I for one can’t wait. It’s been an expensive year. But, regardless of what’s going on, I can count on my dividends coming in. The dividends I earn gets reinvested in my portfolio. Those dividends are used to buy more shares, which in-turn increase the size of the dividends. This repeated process allows me to experience exponential growth and compound interest. So, Dividend Growth Investing is one of my favorite investment strategy to earn passive income. But, you probably already knew that. So, without further adieu, let’s see how much dividends I earned in September 2023.

Dividend Income

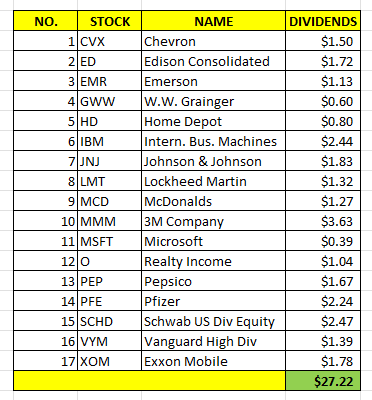

In September, I earned $27.22 in dividends broken down as follows:

Not bad. That $27.22 was reinvested back into the portfolio and I fully expect that the next quarter, I’ll be reporting an even higher amount in dividends.

Annual Income

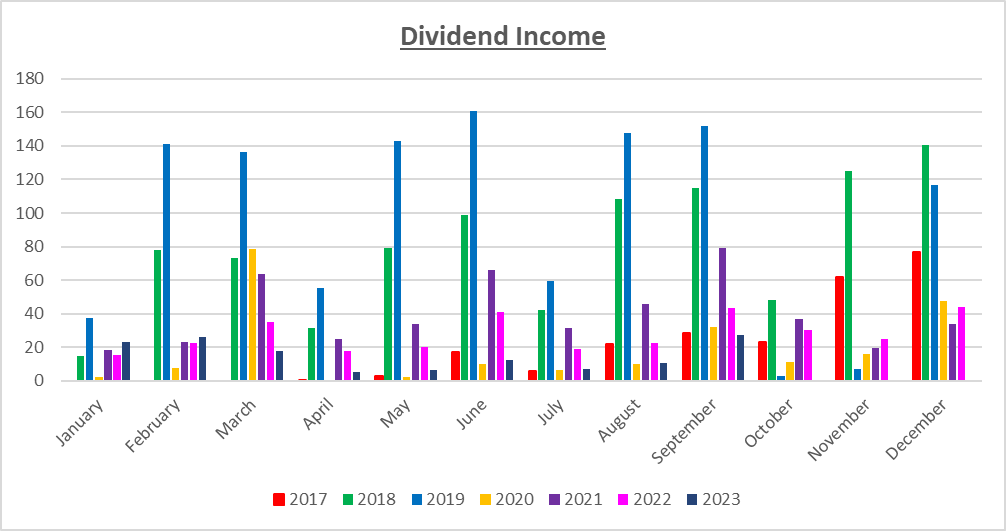

Here is a graphical representation of the dividends earned in September in relation to the dividends earned in previous years:

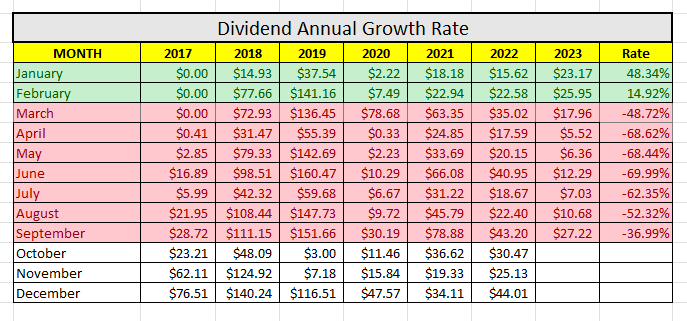

Here is the raw data:

As you can see, I earned 36.9% LESS dividends this year compared to last year. It may take a few more months, but I anticipate being in positive territory soon – hopefully by the start of the new year! Notably, the percentage of loss keeps going down. I am very encouraged!

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $257.55. A month ago, my forward annual dividends was $224.44. This represents a 14.75% increase from the previous month. This double-digit increase is mainly due to my increased contribution to my dividend portfolio. More importantly, I fully expect the trend to continue in the next few months.

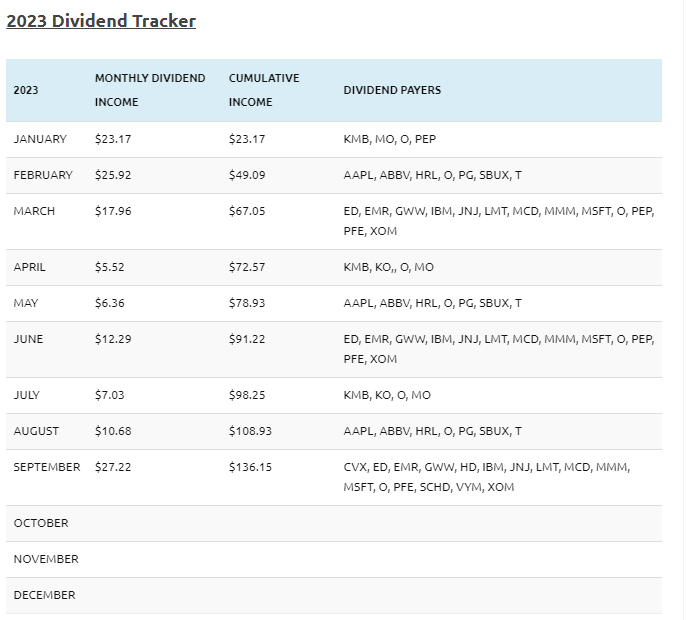

Finally, the Dividend Tracker, has been updated. As you can see from the tracker below, I’ve made $136.15 in dividends since the beginning of the year.

What Expenses Would Dividends Cover?

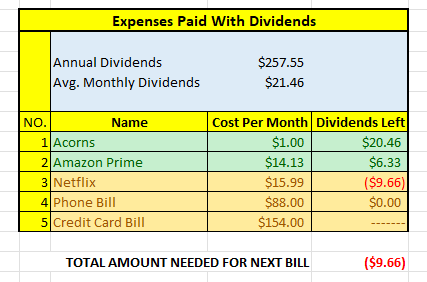

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$257.55 per year is $21.46 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Amazon Prime. I’ll take it. Next on the list is Netflix!!!

The following is a list of expenses I am targeting:

I’ll mention that the cost per month for my credit card bill is more than $154 (currently about $300). Since I’m far away from covering that amount with dividends, I won’t worry about updating this figure every month. Quite frankly, by the time I reach the point where I can payoff my credit card bill with my dividends, I will likely already have a zero credit card balance. As you may be aware, I track my credit card debt payoff on a monthly basis on this blog.

Final Thoughts

This was a good report. I earned dividends from 15 companies and 2 ETFs. Although the amount is small right now, I fully expect that it will be larger in the future. All it takes is patience, discipline and consistency.

In other news, I still don’t have a job. In fairness, I also haven’t been looking for one. But, starting today, I plan on being very frugal with my spending. Of course, I am aware that life is what happens when you make plans. For example, I have a trip to Barcelona in a few days and I’m not sure I’ll be frugal when I travel, but we will see.

Regardless of what’s happening in my life, I know that my dividends are working for me in the background. Here’s hoping that I will be able to finish the year strong.

How was September for you? Did you break any records?

What did you think of this post?

Let me know your thoughts by commenting below.

It’s been a long time, but I’m glad to see you’re still investing and reaping in the dividends. It’s a testament to the power of long-term investing and the benefits of quality dividend stocks. Keep up the good work, and may your portfolio continue to grow and provide a reliable stream of income in the years ahead!

Thanks a lot Dividend Geek. It’s good to hear from you. I hope you’re doing well and I wish you nothing but the best of luck. I also whole heartedly agree with your comment and I plan on investing for as long as possible.

nice port.

LIke you, Im lower yr over yr but that should change soon enough

keep it up!

cheers

Thanks a lot! That’s the plan – to keep going!