I have some exciting news! I made my first extra mortgage payment ever. Having debated numerous times whether I should Pay Off My Mortgage Early Or Invest, I decided that the best thing for me to do was to take a balanced approached. So, consistent with my 2019 Financial P

For your reference, the total mortgage balance is about $181,000 with a 3.5% interest rate. Knowing that every dollar counts, the question becomes this: how much extra should I pay on the mortgage? Let’s dive in to see what I did.

THE AMOUNT

Automation

I love automation. If I can automate my payments, then I don’t have to think about it. Currently, my mortgage payment with taxes and insurance is about $1156 per month. Previously, it was $1231 or about $75 more. However, given the new year and, perhaps because of a reduction in taxes, the payments got reduced to $1156. Honestly, I don’t know why the payments got reduced, but I’m not complaining.

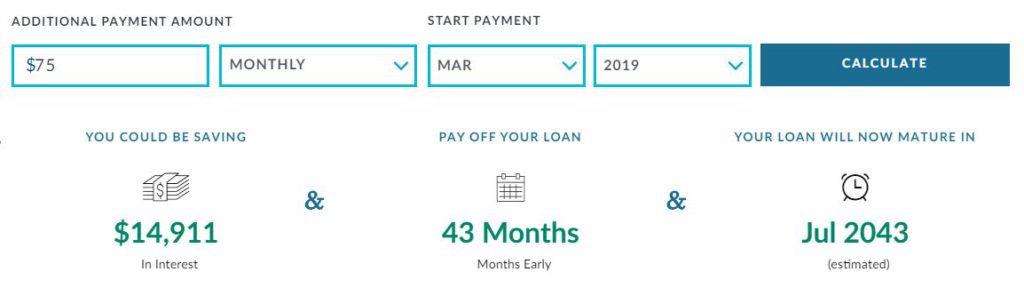

I’ve decided to maintain the $1231 figure so that I could pay an extra $75 per month on my mortgage. According to my mortgage lender’s amortization calculator, that would save me $14,911 in interest and allow me to pay off my mortgage about 3.5 years earlier. See full details below:

That’s not too bad at all.

The problem with my lender’s automated tool is that I can have only ONE automated payment schedule at a time. So, since I get paid twice a month, any extra payment that I want to send would have to be manual. That’s very annoying. I will inquire into bill pay

Based on my paycheck, I don’t make enough to pay all the extra payments in one automatic payment to cover the entire month.

Manual Payment

Unlike the ONE automatic payment, there does not seem to be a limit on the number of manual payments I can make. I’ve chosen to make an additional $500 per month on my mortgage manually. As mentioned, I will try to explore how I can make this automatic. But, according to the calculator, if I just make $500 extra on my mortgage, I would save $54,076 in interest payments and pay off the mortgage about 13.5 years early. See the info below:

That’s just great. Just by doing an extra $500 a month, I can pay off the mortgage 14 years from now.

But what if I combine both the automated and manual mortgage payment?

Combination

A combination of the $75 automated payment and the $500 manual payment brings me to $575 monthly payment. If I pay that amount extra per month, then I save $57,598 in interest payments and pay off the mortgage 14.5 years early. In other words, I could pay off my mortgage in 13 years! See below for more details:

I’ve already made the first payment in February 2019. I initially paid that $75 extra automatically, and then subsequently sent the $500 manual payment via my mortgage lender’s app. It was easy making that manual one-time payment, but I don’t want to have to do that every month. But I’m just glad that the mechanics of making my payment (even if manual) is not too complicated.

CONCLUSION

I have decided to pay off my mortgage early. Since I bought my house about 3 years ago, paying it off in 13 years will allow me to catch up and pay the mortgage as if I had gotten a 15-year term. I fully intend on making even more payments than the $575 which is a minimum threshold for me.

I have many other bills that are due the same time that the $75 extra is taken out, but I suspect that towards the end of the year, when I get another raise, I will be able to increase the automatic payments. In addition, I plan on increasing the $500 manual payments as well. I want to get to the point where I can pay off the mortgage in about 10 years. This would require an additional $300 more per month. I could do it, but I would really be sacrificing the amount I use to invest.

That being said, I will continue to contribute to my Dividend Portfolio, even though the contributions in 2019 will be nowhere near where they were in 2018. That’s in accordance with my financial plan and my ultimate goal of buying another house.

What did you think of this post? Let me know your thoughts by commenting below.

Congratulations my friend! Great to see you also take a balanced approach.

Funny thing, a few days ago we also made an extra payment on our mortgage!

Mr. Robot recently posted…January 2019 dividend report

That’s cool Mr. Robot. Btw, I plan on putting a count-down graph or something on my blog. I just got to figure out where.

Good job on finding an approach that works to pay off your mortgage early! This is something I have though about in the past. Is it better to pay off the mortgage early or to maximize investments dividend stocks? Which would be better? I guess it depends on a variety of factors.

Ultimately, I bought an co-op apartment without needing to take out a mortgage, but every now and then I still run out scenarios like if I were to buy a house with a mortgage what would be best. Glad to see you found an approach that will save you a nice chunk of money in interest payments and you can still contribute to your portfolio! Keep up the good work DP! 🙂

My Dividend Dynasty recently posted…Building Up that Emergency Fund

Thanks a lot MDD. Now that I’ve started to pay off the mortgage early, all I can think about is how faster I can go. Only time will tell.

That’s a fantastic approach. I too like to pay off a little extra towards the home loan. So far from just keeping extra cash in that account (I can take out any time) I have saved the equivalent to 5 years and 3 months in interest. I am happy with that!

Buy, Hold Long recently posted…Why Investing In Australia Is A Great Idea

That’s awesome BHL. No complicated strategies. Just paying extra on the principal, works.

Great work DP! We took a similar approach where we have continued to pay the same amount as when we originally obtained our mortgage. Since then our interest rate went down quite a bit due to refinancing, although increases in property taxes have taken some of the extra payment away.

Look forward to seeing how quickly you can pay it off!

Thanks DD. I know I just got started, but if I maintain the same payments, I will pay off the mortgage in 13 years, which is about 15 years from when I bought it. Eventually, I might pay it off quicker than that, but not in any super hurry to do so.