In the investment world, there are several brokerage firms to choose from. Each has their pros and cons and provide value to their customers. Today, I provide an in-depth look at M1 Finance and will discuss many of its key features. I hope this M1 Finance review will help you decide if M1 Finance is for you. Full disclosure, the links to M1 Finance are referral links. However, my goal in providing this M1 Finance review is to give my honest opinion about the service. The fact that E-Trade acquired Capital One Investing prompted me to try to find a brokerage that meets my needs. M1 Finance does that for me.

In the investment world, there are several brokerage firms to choose from. Each has their pros and cons and provide value to their customers. Today, I provide an in-depth look at M1 Finance and will discuss many of its key features. I hope this M1 Finance review will help you decide if M1 Finance is for you. Full disclosure, the links to M1 Finance are referral links. However, my goal in providing this M1 Finance review is to give my honest opinion about the service. The fact that E-Trade acquired Capital One Investing prompted me to try to find a brokerage that meets my needs. M1 Finance does that for me.

Although much of the information below comes from M1 Finance, I also document my experience using this platform, including my experience transferring money from Capital One Investing to M1 Finance. I hope you had your coffee because this is going to be a longer post. I will discuss both the good and the bad with M1 Finance. Here is my M1 Finance review.

If you find this review helpful, sign-up with M1 Finance and we both get $10, or at least leave a comment in the comment section below.

WHY CHOOSE M1 FINANCE?

As previously mentioned, there are a number of brokerage firms. For example, you have Charles Schwab, E-trade, TD Ameritrade and many other traditional brokerages. In addition, you have several Robo-Advisors such as Betterment and Wealthfront and other up and coming brokerages such as Robinhood. In short, there’s no shortage of options for an average investor looking to invest money. So, why choose M1 Finance?

M1 Finance offers many benefits to a long-term investor. In this M1 Finance review, I will discuss several of the highlights. But for a complete understanding of everything that the platform has to offer, I encourage you to check out M1 Finance.

However, for me, the following are the key benefits to M1 Finance:

- Portfolio Pies

- Automatic Investing

- Investment Speed

- Fractional Shares

- Dividend Reinvesting

- Dynamic Rebalancing

- Tax Efficiency

- Customer Service

- Low Minimum Starting Balance

- It’s Free

I’ll discuss the key benefits below. But, in addition to these benefits, it’s easy to sign up. And, for the most part, M1 Finance is easy to use. You’ll see why I say for the most part later. The platform has both a web version and a mobile app. I’ve never had a problem logging in or with the functionality of the platform.

As you can tell from this blog, I am a DGI investor. So, it’s important to have a brokerage that caters to the small investor. Thankfully, M1 Finance does that and that’s why I’ve chosen them to be the home of my Dividend Portfolio. For more information on the strategy, here are my Top 5 Reasons To Invest In Dividend Growth Investing.

THE KEY BENEFITS OF M1 FINANCE – PROs

Let’s take a deeper look at some of the key benefits to M1 Finance.

1. Portfolio Pies

I have to admit that I wasn’t initially a fan of the pie structure. But, it’s starting to grow on me. Think of your portfolio as a pie (or pizza). A pie has several slices. The slices of your portfolio can be made up of stocks or ETFs. According to M1 Finance, they offer 6000+ exchange-listed securities. With M1 Finance, you can have as many slices in your pie as you see fit to achieve your desired level of diversification.

So, for example, with M1 Finance, I have my Dividend Portfolio inside of a pie I named my Dividend Freedom Fund. You can name your pie whatever you want. Each stock I have inside of M1 Finance is part of my Dividend Freedom Fund. Now, that fund is concentrated on the DGI strategy.

Imagine though if I wanted to have another portfolio devoted to stock appreciation? With M1 Finance, you can have as many portfolios as you like each made up of different slices as you see fit. The fact that you can totally customize your portfolio is one of the benefits of M1 Finance.

Imagine though if I wanted to have another portfolio devoted to stock appreciation? With M1 Finance, you can have as many portfolios as you like each made up of different slices as you see fit. The fact that you can totally customize your portfolio is one of the benefits of M1 Finance.

In addition to pies you create, M1 Finance has what it calls Expert Pies. These are professionally designed pies to achieve a particular goal. As indicated on the platform, some of the goals that these Expert Pies target include:

- Income Earners – “Choose a portfolio focused on dividends and income returns.”

- Hedge Fund Followers – “Mimic the investment strategies of some of the most successful investors and reputable hedge funds.”

- Responsible Investing – “Sound financial options for the socially responsible investor.”

- Plan For Retirement – “Invest for your target retirement date in a portfolio that adjust to your goals as you age.”

- And More

Whether you choose to use an Expert Pie or create your own, M1 Finance offers you the flexibility and customizability to make it happen.

2. Automatic Investing

Dollar Cost Averaging is a viable strategy for the small investor. The idea is to buy an investment with a fixed dollar amount on a regular schedule. So, let’s say that I want to buy Apple stock and can afford to invest $100 per month. By purchasing Apple stock at $100 each month, I would be practicing dollar cost averaging.

Now, to make the strategy even more powerful is to put it on autopilot. That way, I don’t have to physically go to my checking account every month and transfer $100 to my brokerage. By making it automatic, the investment remains consistent and works like clockwork. It also makes things passive and allows me to focus on other things.

M1 Finance allows for automatic investing. That $100 automatically gets taken from my checking account, deposited into M1 Finance and then used to purchase Apple stock. All I had to do was set the amount I want to be transferred and the frequency with which it happens. I do this once, but the action repeats itself as long as I want.

I use Apple in this example to emphasize that I can purchase individual stocks automatically. Many brokerages allow investors to automatically invest in index funds or mutual funds, but NOT in individual stocks. Capital One Investing used to do it, but they stopped their Sharebuilder plan now that they are being acquired by E-Trade. Robinhood is a good platform, especially because it’s free. But while you can buy individual stocks with Robinhood, you can’t do so automatically. You can with M1 Finance.

As you can see, I take the lazy approach to investing. And M1 Finance allows me to be as lazy as possible by allowing me to automatically invest in individual stocks.

3. Investment Speed

3. Investment Speed

As a long-term investor, I am not too concerned about the volatility of the market today. Like everyone else, I would like to invest at the best price, but timing the market has never been one of my strongest attributes.

When I was with Capital One Investing, one of the more annoying things was having to wait for my money to be invested. Because I was on the Advantage Plan, I could only invest once a month at a cost of $12 monthly for it to make sense. But, because I got paid twice a month, I would send money after each paycheck to Capital One Investing.

So let’s say I wanted to invest $600 a month into my Dividend Portfolio. Because I don’t have the $600 one time, I would send $300 from my mid-month paycheck, and then $300 for my paycheck at the end of the month. Then once my account in Capital One Investing reached $600, Capital One Investing would then use that money to purchase my stocks in a predetermined amount. I would have to wait a whole month before my money gets deposited. Not the end of the world, given my long-term horizon, but quite annoying nonetheless.

With M1 Finance, the money takes about 24 hours (2-3 days tops) to move from my checking account to M1 Finance. Then, once it gets to M1 Finance, the money gets automatically invested the next trading day. My money is no longer sitting idle in my brokerage account. It’s hard at work in the stock market.

Because I’m not a trader, the speed at which my funds get invested is negligible in the long run. But, if given the choice between having the money invested almost immediately versus waiting a month, I’ll take immediate any day.

4. Fractional Shares

This is a key benefit to M1 Finance. There don’t seem to be too many brokerages that allow you to buy fractional shares of individual stocks. That’s not to say you can’t have fractional shares at these brokerages. When you are paid dividends, that may result in the fractional ownership of stocks. However, in order for you to purchase the stock, you have to do so in whole shares and not fractional shares.

At the time of this writing, Google is trading at about $1155 per share. If I wanted to invest in Google using another brokerage, I would likely have to come up with the whole $1155 before I could invest in Google. Not a very accommodating system for the small investor.

However, with M1 Finance, I can invest $100 into Google one time or on a recurring basis. If I had about $577.50 to invest, I could purchase 0.5 shares of Google. I can do that with virtually any stock. The ability to purchase fractional shares of a stock is the best friend of a small investor.

5. Dividend Reinvesting

This is a familiar feature that is present in almost all brokerages. Dividends received are automatically reinvested free of charge. The same applies to M1 Finance.

However, M1 Finance does things a little bit differently. Usually, when a stock pays dividends, those dividends are reinvested into that same stock. This creates a Psuedo-DRIP. What makes M1 Finance different is that dividends aren’t necessarily reinvested into the same stock, but more so back into the overall portfolio.

Firstly, there is a $10 minimum threshold to meet before dividends are reinvested. Now, remember that your pie has slices. The investor sets a target allocation for each slice. More on this in the dynamic rebalancing section. But dividends get reinvested back into the portfolio according to the asset target you’ve selected.

This is either good or bad depending on your objective goals. If you want to get a true DRIP-like feeling, then it might be difficult to achieve that with M1 Finance. You’re still getting the dividends automatically reinvested, it’s just a matter of where the reinvestment goes. Because of the benefits of dynamic rebalancing, I’m counting this as a positive.

6. Dynamic Rebalancing

6. Dynamic Rebalancing

This is certainly a defining characteristic that sets M1 Finance apart. The firm practices what it calls dynamic rebalancing.

We all know that it’s important to balance your portfolios from time to time. Let’s say I have a portfolio consisting of two stocks: Kimberly Clark (KMB) and Realty Income (O). I want 50% of my funds in KMB and 50% in O. Well, as the stock market rises or falls, KMB might be weighted at 60% of my portfolio and O at 40%.

If I were to rebalance my portfolio the usual way, I would sell 10% of my shares in KMB and use the proceeds to buy O so I can get my portfolio close to the 50% mark that I originally wanted. This would incur a tax liability if the rebalancing occurred in a taxable account.

With dynamic rebalancing, M1 Finance automatically diverts new money I contribute to the portfolio (including the reinvestment of dividends) until I am back to the allocation I originally set. This includes how M1 Finance prioritizes sale of slices from its pie as well. Brilliant!

To make things simple, I simply equalize the stocks in my Dividend Freedom Fund. There is a button for that. So, that means that as I invest, the platform will focus more on the stocks that are underweight and less on the ones that are overweighted.

There is a concern that the platform is only investing in the losers. But I tend to look at it differently. If the goal is to buy low and sell high, by continually purchasing the stocks that are underweighted, in effect, I am buying low. Probably a lousy analogy but it works for me.

M1 Finance does allow you to manually rebalance the portfolio in a traditional sense, with all the tax implications that naturally follow.

7. Tax Efficiency

This M1 Finance review would not be complete without a discussion of taxes.

The first thing I’ll point out is that M1 Finance is a partner with Turbo Tax. This was very important to me because I do my own taxes. Turbo Tax makes taxes simple because I am able to import tax data into Turbo Tax from my brokerages. I remember when I had to manually do my taxes because Computershare was not a partner with Turbo Tax. It’s one of the reasons why I left Computershare back in the day. M1 Finance could have all the best features in the world, but I would not be with them if they weren’t a partner with Turbo Tax. Visit Turbo Tax Partner List to see a list of the current partners. As indicated by the support center, M1 Finance uses the Apex Clearing Corporation to allow data to be imported. For more information, visit the M1 Finance Support Center’s answer to this question.

When an investor requests to sell a security, M1 Finance uses what it calls its tax minimization strategy. That is, the platform prioritizes the sale of securities in the following order:

- “Losses that offset future gains”

- “Lots that result in long-term gains”

- “Lots that result in short-term gains”

Importantly, M1 Finance does not do Tax Loss Harvesting. This is the strategy of selling investments at a loss and reapplying the proceeds back into the market to offset what is paid in taxes on both gains and income. I don’t utilize this strategy, but if you do, it’s important to note that it is not offered at M1 Finance.

8. Customer Service

8. Customer Service

There are two aspects to M1 Finance’s customer service that I wish to highlight. The first is that I’ve never had a long wait trying to call the customer service number. I called M1 Finance before and after I became a customer. Each time, a representative was quick to answer the phone. Each time, the representative was knowledgeable and helpful. I felt like a valued customer.

The second is how smooth the transition has been from Capital One Investing to M1 Finance. M1 Finance is on a mission to transform the way you invest. Because of the relative newness of M1 Finance, I wanted to give it a try before I jumped right in. I created a portfolio with just two stocks (MCD and KMB). I contributed $200 per month evenly split between the two stocks. Indeed, I earned my first dividends with McDonalds as I indicated in my Dividend Income Report for June. Because I was pleased with the service, and because the Sharebuilder plan I was fond of was going away, I decided to transfer funds from Capital One Investing to M1 Finance. That required help from the customer service department.

I contacted customer service and got pretty good directions. Specifically, I was supposed to send an email to their transfer department with instructions as to how much of my account I wanted to be transferred, and my latest account statement. I sent the email as directed and received a response 11 minutes later. The representative was helpful throughout the process.

Once the transfer was complete, I did have a follow-up question, and I notice it took a bit longer to receive a response. But when I called customer service, they were helpful as usual. Having helpful customer service is always a plus.

9. Low Minimum Starting Balance

Want to open an account with Vanguard? Most funds have a minimum starting balance of $3000. You could do what I did and start with their STAR fund, which is a balanced fund, but that has a minimum of $1000. Sometimes, high minimums needed to open an account deter small investors from beginning investing.

The lowest minimum you can have is $0. That’s perhaps one reason why companies like Robinhood are succeeding. The minimum to open a Robinhood account is zero, zilch, nada.

However, M1 Finance is not zero, but it’s also not too bad. The minimum to open an M1 Finance account is $100. Although it’s not zero, I think it’s low enough where it will not deter small investors from beginning to invest. This is for a taxable account. The minimum to open a retirement account is $500.

Once the account has been opened, investments can be of any amount. For more information, visit their FAQ.

10. It’s Free

10. It’s Free

I saved the best for last. One of the best things about M1 Finance is that it’s free. There are no commissions to buy or sell shares of stock. This is HUGE! Let’s see why.

When I was with Capital One Investing, I was paying $12 per month just so I could invest into 12 stocks at the effective cost of $1 per stock. That comes out to $144 per year. Now, I know that’s expensive, but being able to automatically invest in individual stocks on a monthly basis was very important to me – and still is.

Capital One Investing is being acquired by E-Trade. Looking at E-Trade’s fee structure, at the time of this writing, E-Trade charges $6.95 PER TRADE! To invest the same way with E-Trade, I would have to spend $83.40 per month or $1000.40 per year just in fees. The most I was investing with Capital One was $600 per month. It just doesn’t make financial sense to pay that much in fees.

Robinhood is also free. But, unlike M1 Finance, there’s no automatic investing of my funds. I would have to manually place trades every month and I didn’t want to have to do that. I’m lazy, remember. With M1 Finance, I get all the benefits of the Sharebuilder plan, and more, without any of the cost. For a more detailed look, visit the company’s self-serving blog post entitled M1 Finance: The Best Sharebuilder Alternative.

THE KEY DRAWBACKS TO M1 FINANCE – CONS

THE KEY DRAWBACKS TO M1 FINANCE – CONS

No brokerage is perfect. This M1 Finance review would not be complete if I also didn’t highlight some things I don’t like about the company. Much as how there is no investment strategy that is suitable for everyone, neither is there one brokerage firm that suits everyone’s needs. Let’s take a look at some reasons to avoid investing with M1 Finance.

The following are the key drawbacks to M1 Finance:

- Name Recognition

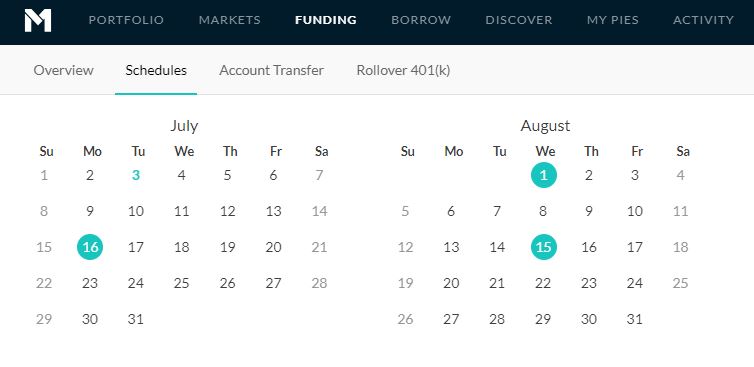

- Investment Schedule

- Sustainability

- Limited Alternative Assets

- Dividend Tracking

I’ll discuss each drawback below.

1. Name Recognition

Ok, this really isn’t a con as it is a rant. What is up with that name? I understand the “finance” part of the name, but I’m still not sure about the “M1” part.

I mean, Robinhood makes sense. It reminds me of the character who lived in Sherwood Forest and stole from the rich to give to the poor. I get it. But M1 Finance? Really?

That being said, If at the inception you had asked me what I thought of the name of Apple, or Google or even Yahoo, I would think those are lousy names too. But because of name branding, etc, I can’t imagine those companies by any other name. I guess it’s just going to take some time to get used to the name, M1 Finance. At least it’s somewhat original.

But, it points to a larger problem, which is name recognition. M1 Finance doesn’t have it, at least not yet. Again, they are fairly new to the investment brokerage space and so that’s understandable. Hopefully, they will get to the point where they are as recognizable as Vanguard or even TD Ameritrade.

2. Investment Schedule

M1 Finance makes its trades one-time in the morning every trading day! That’s it. Want to take advantage of the intraday movement of stock prices, M1 Finance is NOT for you! It does not cater to traders. Rather, the platform is squarely focused on long-term investors.

Robinhood would be better for trading, but there are also powerhouses like TD Ameritrade that will have all the bells and whistles that you might want.

M1 Finance is perfect for the lazy, Do-It-Yourself investor who just wants to set up automatic recurring investments into individual stocks based on a set dollar amount. Chances are, for most other investors, it’s not necessarily the most ideal platform.

3. Sustainability

3. Sustainability

One concern is whether M1 Finance is sustainable. It’s worth mentioning that M1 Finance wasn’t always free. It used to charge 0.25% on accounts between $1000 to $100,000. But in December 2017, M1 Finance changed its fee structure to now being completely free. That’s great, but how does M1 Finance make money and is M1 Finance sustainable?

I don’t need to bring up Loyal3 do I?

- So, how does M1 Finance make money? In a year-end 2017 webinar, M1 Finance CEO Brian Barnes explains that the way M1 Finance makes money is similar to how a bank makes money on your free checking account. The bank is able to lend and make money from the interest it charges. Similarly, M1 Finance is able to lend money with the cash and securities on the platform and earn interest on those loans. They also make money from transacting with various exchanges, which helps offset the cost of trading. Additionally, customers can now borrow money from M1 Finance using their portfolio as collateral, and M1 Finance earns money from the interest it charges. Visit M1 Finance Year-End Review Webinar to listen to it yourself.

- Is M1 Finance sustainable? I hope so. Given how M1 Finance makes money, it seems sustainable. But, admittedly, I’m no expert. One of the things that help me sleep well at night is that the funds in the account are protected by the Securities Investor Protection Corporation (SIPC). According to their website, “SIPC protects against the loss of cash and securities – such as stocks and bonds – held by a customer at a financially-troubled SIPC-member brokerage firm.” M1 Finance is on the SIPC member’s list, and so the funds in my account are covered up to $500k. So, even if M1 Finance were to shut down, I wouldn’t lose my funds.

4. Limited Alternative Assets

4. Limited Alternative Assets

M1 Finance is great if you’re looking to invest in stocks or ETFs. But, if you’re interested in gold, Forex, cryptocurrencies or other alternative asset classes, you’re going to have to look elsewhere.

For the longest while, I’ve been interested in stock options. The idea of renting out my shares with the covered call strategy seems appealing. As much as how I like M1 Finance, I’m just not able to use that platform for that purpose. I also don’t think there are any plans to incorporate these options into the platform anytime soon.

The company is great at what it does, but it certainly doesn’t do everything.

5. Dividend Tracking

I saved the worst drawback for last. As a DGI blogger, I track my dividends on a monthly basis and report the number on this blog. Blogging makes what is otherwise a boring and passive strategy fun. It’s very important that I be able to figure out how much dividends I’m getting for each stock.

Disappointingly, it’s not the most intuitive feature to find on M1 Finance. There is a great screen that shows me my holdings and how many shares each holding has. But, I couldn’t find a similar screen for dividends. It seems like I have to go into each stock to figure out if I earned any dividends.

This brings me to another point. While M1 Finance is relatively easy to use, it does take some time to get used to it. It might be just their approach to investing, but it is by no means my favorite user interface. I hope the user interface for dividend recording improves. Right now, it seems it’s going to be a bit labor intensive to click into each stock to figure out the dividends. Not a big deal since I currently only have 18 stocks in my portfolio. But, imagine if I had 50 and wanted to track the dividends every month.

I called customer service to see if there’s a better way to figure it out. They said I could look at my statements, but that’s less than ideal. They did say they are working on a solution to improve dividend tracking, which was music to my ears. But the fact that I had to call customer service for that reason should give you an indication of how unintuitive the platform is with this issue.

M1 FINANCE REVIEW – CONCLUSION

In this M1 Finance review, the goal was to give you an honest feedback of my experience with the platform. In my honest opinion, M1 Finance is ideal for a lazy investor with a long-term horizon looking for a way to automatically invest in a portfolio of his/her choosing. However, M1 Finance is not ideal for a trader. There are many pros and several cons to using M1 Finance. After all, there is no one broker to meet all investors’ needs.

I hope this M1 Finance review was helpful to you. If it was, please leave a comment below. If you think you want to give M1 Finance a try, sign up under my link so that we can both get $10. Regardless of your decision, my main goal in this M1 Finance review was to provide my feedback with the platform. M1 Finance has met my investment needs. I hope it meets yours. But if it doesn’t, I hope you find a suitable alternative that does.

What do you think of this review? Let me know your thoughts by commenting below.

I think this review is very comprehensive and balanced DP. I would guess you put a lot of time into writing it. I’m not looking for a new broker, but anyone who is should find a lot of value in this post. Tom

Tom @ Dividends Diversify recently posted…Consider Your Possibilities

Thanks Tom and value is what I was going for. It did take a while to write, but it helps that I’m on vacation. I figure that a lot of people are in the same boat as me with having their Capital One Investing account being acquired by E-Trade. In any case, I hope this review is helpful to anyone who might be considering M1 Finance as an option. Thanks as always for the comment.

Does MI offer IRAs or Roths? Otherwise your review was comprehensive though obviously written for search engines.

Hey RAnn, yes, M1 Finance does offer IRAs (traditional and/or Roth). I do notice that there weren’t many comprehensive reviews when I was looking at M1 Finance initially. So, the goal was to help others seeking that information with an honest feedback. As with any post on a blog, it does not matter how good it is if no one sees it. So, to an extent, all my posts are written so that it can be viewed by others online, including those who search for the information via a search engine. There are some posts though that I put more time and energy in, including this one. So, I try to make it for wide a consumption as possible, given the audience of folks who read this blog. Thanks for the comment.

Interesting review. Probably won’t help me as I am Australian, but I can tell you’ve put a lot of effort into this. Well done to you!

Buy, Hold Long recently posted…I Challenge You!

Thanks BHL. Yea, unfortunately, it’s only available in the USA at this point.

Very helpful review – thanks for sharing.

I’ve looked closely at M1 in the past, but this made me reconsider it again. I’m currently utilizing Robinhood, so I’ve already enjoyed the “free” trading aspect. What seems very appealing here are some of the other nice features you’ve highlighted. I’m also not looking to make intraday trades, etc., so the approach with M1 seems like it would work for our needs. – Mike

Mike at Balanced Dividends recently posted…Balanced Dividends Blogroll Spotlight #4: Guy on FIRE

Glad you found it useful Mike. I’m not saying they are perfect, but there’s much to love about them, especially for a DGI investor.

Appreciate the review and details provided on all of the pros and cons. While I am not personally looking for a new broker, I could see M1 being a potential option for my teenage son who wants to begin investing but doesn’t have a lot of money.

Do you know if they offer custodial accounts? As he isn’t 18 yet, he needs myself or my wife to open an account with him and I know some places don’t offer that option.

DivvyDad recently posted…Dividend Income Report :: June 2018

Hey DivvyDad. According to M1 Finance FAQ page, they do not support custodial accounts at the moment, but they “plan on supporting custodial accounts later in 2018.” It seems like it’s something will happen this year, but not right this second. Good luck. I think starting out that young is AWESOME!

Thanks for looking that up and sharing. It is great to see that custodial accounts are in their plans, so I will keep an eye on that and let my son know. In the meantime, I provided him access to an old Roth IRA account that I have and told him he can make all decisions with those funds as long as he presents me his rationale for making a buy or sell order before doing so.

My older son has little interest, however last year he took me up on my offer to match his contribution to an IRA and he chose to invest in VYM. So it’s a start, but he is more interested in spending his money on his car right now.

Just trying to instill the importance of starting as early as possible, so when they are my age working will be entirely optional.

DivvyDad recently posted…The Cost of Patience

That’s a great lesson to teach your kids. I wish my own parents taught me the same. Right now, my mom is in her 60s with about $10k in a retirement account. So, it’s not like she knew better, and by the time she figured out that she needed to save for retirement, it was too late.

I actually also considered owning VYM, and I might do that in the future. Not a bad option for someone who wants to get started in investing. Good luck to your sons with respect to their investments, and it was no trouble looking up that information for you — you’re welcome.

I love M1 finance. Now I manage my own index fund free of cost. Pls use my referral link if you like to try it too. https://mbsy.co/pm9C9

Glad you’re enjoying M1 Finance John.

Pingback: Abbvie Transfer Agent - Dividend Portfolio

Pingback: Why I No Longer DRIP With Conputershare - Dividend Portfolio

Pingback: Adopt A Stock Project Is Back - Dividend Portfolio

Pingback: M1 Finance Updated Review For 2020 - Top 5 Pros and Cons - Dividend Portfolio