Welcome to the first vacation rental report of the New Year. If you’re paying attention, you will notice that I have another beach condo under contract. So, I am going through the process of closing on that unit. Closing is set for April 1 and the unit won’t go online until sometime in May. The point being is that this vacation rental report for January will look a lot like previous reports. However, once I start generating income from my new property, this report will be a bit longer. That’s because I will be reporting on two properties and not just one. Whether I make money, break even, or lose money, I promise to be transparent throughout the process. But that’s for later. Today, let’s dive in to discuss the vacation rental report for January 2023.

Vacation Rental Profit/Loss

In January, I expected my calendar was going to be mostly empty and reality did not disappoint. My goal in every month is to at least try to break even. Once again, I failed miserably. Let’s see how.

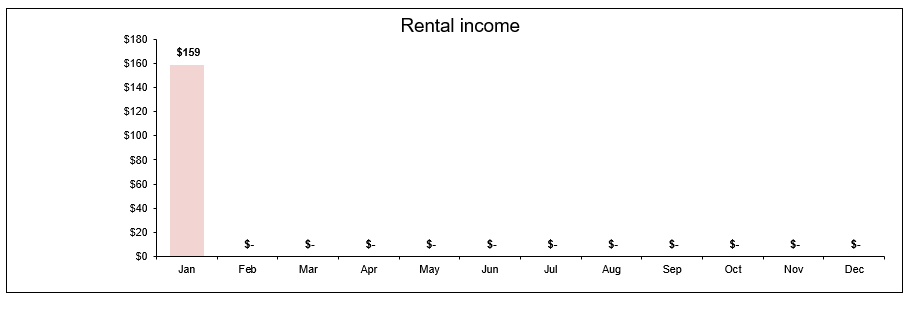

During the month of January, I earned a whopping $159 in income broken down as follows:

Wow, that’s low. At first, I wanted to see what it was like owning the condo without snowbirds. I had gotten several snowbird requests but turned them down. When I saw that November and December were really slow, such that it was difficult to even break even, I decided that snowbirds were a good idea. But, by then, it was probably too late, and I didn’t have any snowbirds for January.

In addition, as you will see later, I wanted to make some improvements to the unit. So, several dates in January were blocked off so that I could make those improvements.

So, where did the $159 come from? Well, I was able to get snowbirds in February. However, they wanted to come a few days earlier towards the end of January, and stay a few days later during the first week of March. So, I broke down the amount by month, and the income from my snowbird in January is $159. It’s better than $0.

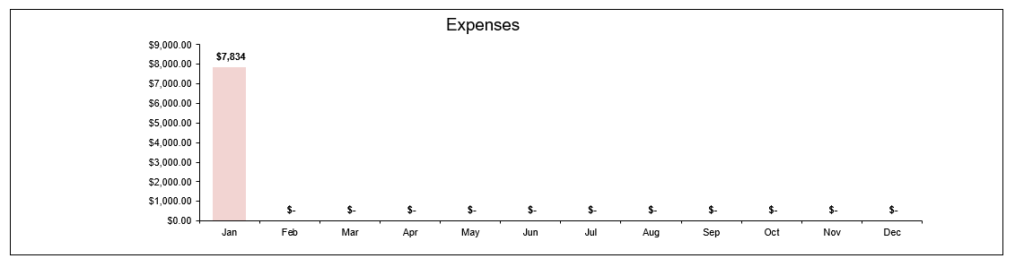

B. Vacation Rental Expenses

During the month of January, I incurred $7834 in expenses as shown below:

Wow, that’s a lot! As I mentioned earlier, I wanted to make some improvements. So, during January, I bought two new smart tvs, a new tv stand, and a dresser for the master bedroom. Of course, I had to pay my handyman as well for the installations. In addition to the above and my typical expenses in the month, (mortgage, admin fees, etc), the total came to $7834. Sufficed to say, I am cash poor at the moment, especially since I am trying to buy a super expensive condo!

However, I really like the improvements made and how the condo looks and feel. Although no one last year complained about the décor, I wasn’t happy with the fact that the furniture in the unit were the original furniture that came with the condo when it was built, over 15 years ago. I had previously updated the couch, and replaced the washer and dryer. The goal is to provide the best guest experience I can. Guests are paying a lot of money to stay in the unit and I want to ensure that they get what they pay for (and more if possible).

C. Profit/Loss Statement

Based on the low income and the high expenses for January, I incurred a loss of $7675 for the month! That means I am starting the year at a huge deficit! It’s going to be very difficult (but not impossible) to cash flow this year.

So far, the one change I’ve made is that I am now accepting snowbirds. In fact, I already have a snowbird who booked the condo in January of 2024. Additionally, my snowbirds in February have already expressed an interest in returning. They will be looking at the new unit to see if they like it better. Granted it will be more expensive, but it is also a great location and an incredible unit that shows well. If they don’t want it for whatever the reason, then they will likely book my first unit for February 2024.

But that’s all in the future. It’s encouraging, but doesn’t change the fact that I am starting the year at a massive loss. Hopefully, I will be able to change that around as the busy season comes along.

Finally, as the years go by, I anticipate having less expenses in the off-season. There are only so many furniture I can replace. My next improvement with this unit will be to replace the washer and dryer for a larger one, and replace the fridge. That should be it for a while, but those improvements will have to wait as I focus my attention on the beach condo that is under contract.

Annual Income and Expenses

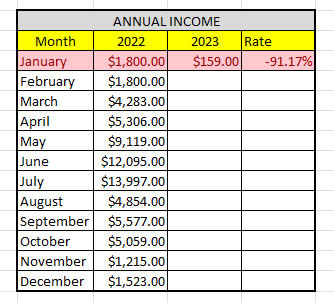

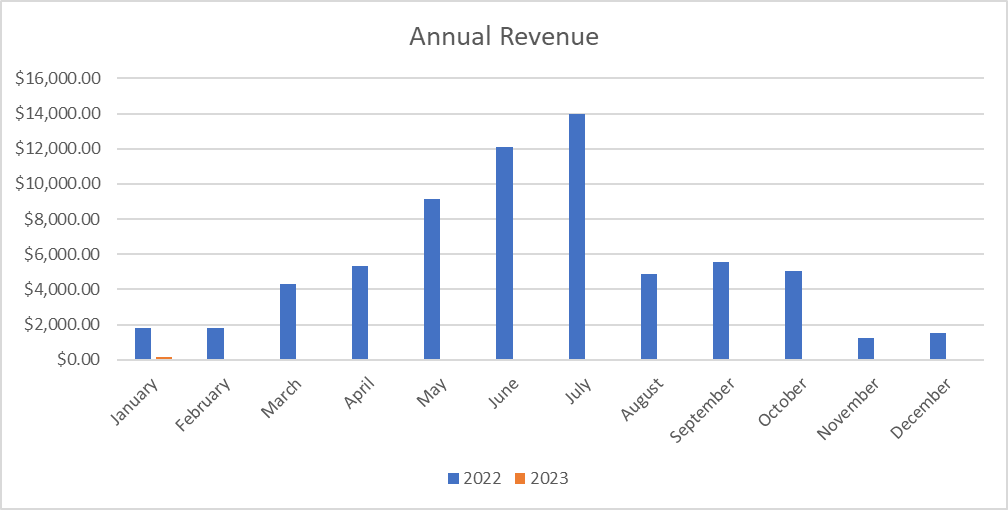

This is the first time I am able to make a comparison of annual income and expenses. 2022 was my first year with this vacation rental. So, let’s see how the revenues earned in January 2023 compared to those of January 2022.

A. Annual Income

Here is the raw data:

As you can see from the above graph, I incurred a 91.17% loss from January of last year. I explained the reasons for this above. Last year, I inherited snowbirds when I bought my 1-bedroom condo, and they were paying $1800 a month. I increased the price I wanted to charge them and they declined to stay at the unit again this year. They may come again next year (we’ve had conversations), but since the unit is already booked, they will either have to come during dates they don’t want (November and December), or try to stay at the beach condo that is under contract. I’m not optimistic they will return, but we will see. In any case, I hope to end the year in a profit, but it’s going to be tough.

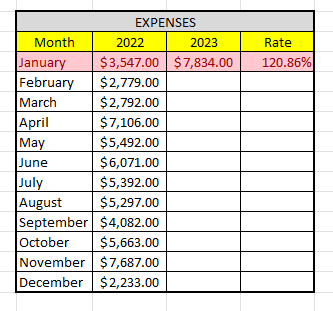

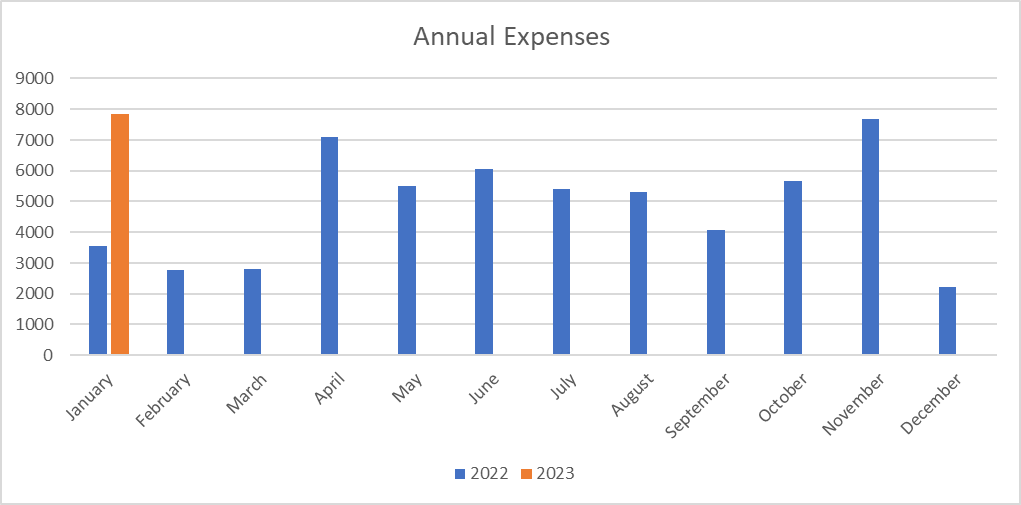

B. Annual Expenses

Here is a graphical representation of the expenses incurred in January 2023 as compared to January 2022:

Here is the raw data:

As you can see, I incurred 120.86% MORE expenses this year than I did in January of last year! That’s not ideal. But, as explained earlier, I made some improvements to the condo that I think is for the better. I hope to keep my expenses to a minimum in 2023, especially since I will be acquiring a new property.

In fact, I anticipate that I am going to be house rich and cash poor for a few months. I keep joking with my friends that I plan on declaring bankruptcy in about 2 years. Wish me luck.

Final Thoughts

I am beyond excited about the prospect of acquiring my dream condo. I was planning on living on my own and spending about $2000 a month in rent. Instead, I am going to live with my mom, and use that money to help supplement the new condo until it can sustain itself. So, even if it operates at a loss for a little while, I will still be ok with it. In fact, I just had a conversation with one of my sisters telling her that I would like to keep the condo in the family if anything were to happen to me. I intend on owning this new condo for the rest of my life.

With regard to my current unit, I am starting the year at a massive loss. But, I think they were for the better. In the coming months and years, I hope to keep my expenses low and my profits high. Only time will tell.

The U.S. may enter into a recession and usually, the hospitality industry suffers because people are less likely to spend a lot on vacation. So, I am prepared for the possibility that I may not make as much in 2023 as I did in 2022. The good news is that as I go through the ups and downs of these investments, I am learning the valuable lesson of what it means to run my own business.

I am excited and hopeful for the future, and that’s the point!

What do you think of this post? Let me know your thoughts by commenting below.