OMG, what a difference a month make! I had not one but TWO gigantic surprise expenses and they were not good. I knew November was going to be rough, but I didn’t realize it was going to be that rough. Sufficed to say I’ve come down from cloud 9 and am now back to Earth. So, without further adieu, let’s jump in to see how November was for my vacation rental.

Vacation Rental Profit/Loss

In November, I expected my calendar was going to be mostly empty and reality did not disappoint. My goal in every month is to at least try to break even. I failed miserably. Let’s see how.

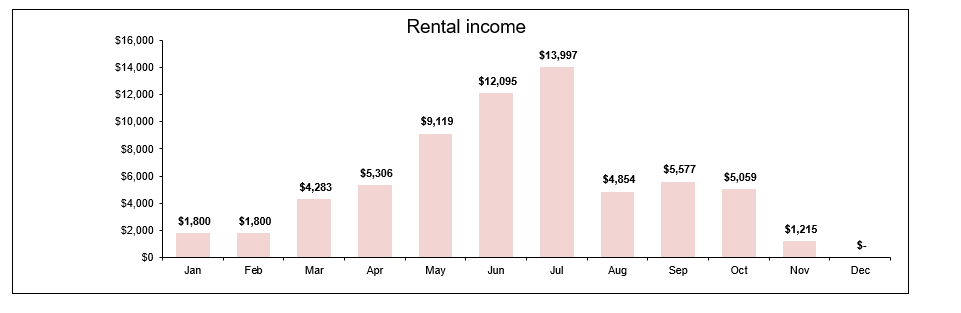

A. Vacation Rental Income

During the month of November, I earned $1215 in income broken down as follows:

I literally only had one booking in November for 3 days. So, in terms of income, November was pretty light. However, I would take one booking over zero bookings any day. It’s the slow season and I purposely chose not to take on any snowbirds this year because I wanted to see how the condo would do without snowbirds. Now that I know, I will likely take on snowbirds next year.

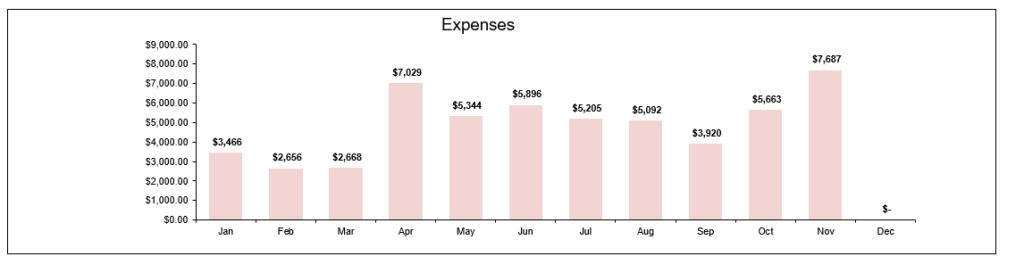

B. Vacation Rental Expenses

During the month of October, I incurred $7687 in expenses as shown below?

As you can see, my expenses were elevated in November. As indicated earlier, I had TWO big surprise expenses in the expense column. The first is that of my insurance. I didn’t realize that when I was paying my mortgage every month, my mortgage payment did NOT include any amount for insurance. So, I had to pay the insurance myself. Ouch.

The cost of the insurance for the year was $941.94. It’s possible that I was told this during closing or throughout the process but somehow it didn’t register. So, I had to pay the insurance for the next year to prevent my insurance from lapsing.

The next surprise expense was my taxes. You heard that right, my monthly mortgage payment did NOT include my taxes. So, my tax bill for the year became due. That amount was $4222.48. I could cry but I won’t. Thankfully, I had liquid cash to pay for it all at once. But the result is that my profit for the year is SUBSTANTIALLY reduced. It’s also possible that I won’t break a profit for the year, but we will see.

Lesson learned!

C. Profit/Loss Statement

So, as you can see, I incurred a loss of $6472 for the month.

The overall profit year-to-date is $10,479. That would be great if that was the profit for the year. However, I fully expect that number to go way down because my December calendar also has one booking, and the expenses, though normal, will eat into the profit margin.

So, given my expected expenses in December, I will have very little profit for the year. I will also likely start January and February at a substantial deficit before approaching the busy season again.

At the end of the year, I will do an evaluation as to whether purchasing the condo was worth it. So, stay tuned.

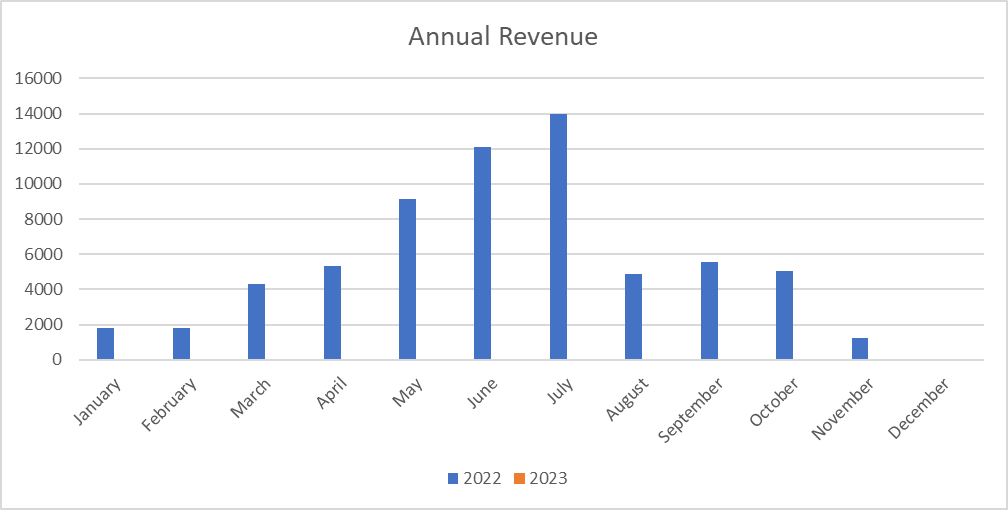

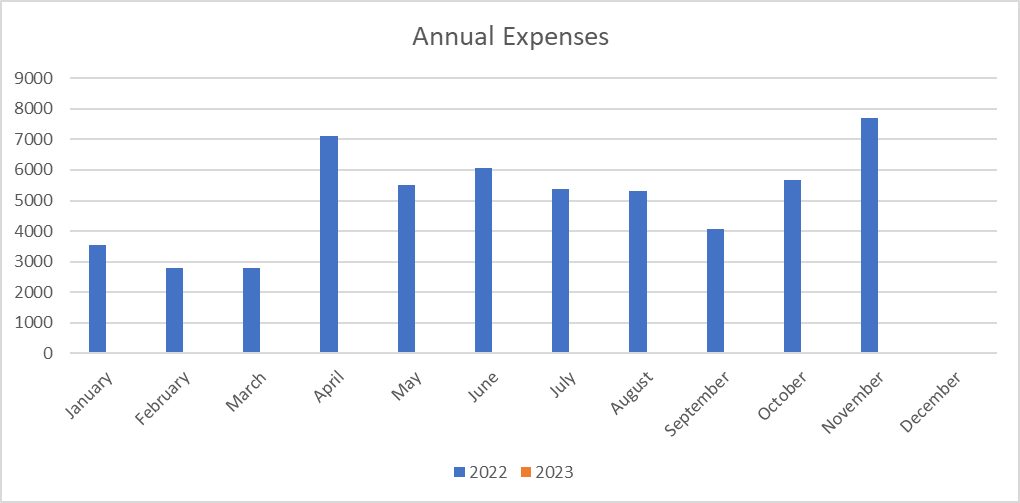

Annual Income and Expenses

As this is my first year investing in a vacation rental, I don’t have any annual income to compare it to. However, for purposes of this section, here is a graphical representation of the revenues earned in November 2022 in relation to the revenues earned in previous years:

Here is a graphical representation of the expenses incurred in November 2022 in relation to the expenses incurred in previous years:

As you can see, the charts are exactly the same (except in style) as indicated above. This annual comparison section will make a lot more sense come 2023 when I am able to make a comparison. I will be able to see a trend not just from month-to-month, but also from year-to-year.

Final Thoughts

Although my income in November was to be expected, the expenses were not. I didn’t realize that the monthly mortgage payment I was making did NOT include taxes or insurance. I’m used to this being escrowed in all my previous mortgages, but it wasn’t this time. It was recently explained to me that most commercial loans are like that. Oh well, you live and learn.

Now that I know this, I will be more ready next year to tackle this expense. Knowing that I will have a huge expense in November will help me with limiting the expenses I make throughout the year. A failure to plan is a plan to fail and I’m not going to do that for 2023.

Although I had unexpected expenses in November, I fully anticipate that I will be able to end the year with a profit – although a lot smaller than previously anticipated.

I’m just hoping that there are no unexpected expenses in December. Even better, I hope I have unexpected income!

What did you think of this post? Let me know your thoughts by commenting below.