October was a negative month for the condo, but not by much. The really difficult months are going to be Nov – Feb. So, I’m am bracing for the storm. At the time of this writing, my calendar for those months are completely empty! So, I have no bookings whatsoever. But, my new mantra in life is not to sweat the small stuff. And though it will be financially painful, I’m not going to worry about it! In any case, I will talk about November next month. Quite Frankly, I incurred a HUGE unexpected expense that I will talk about in my next Vacation Rental Report update, so stay tuned. But for now, let’s see how much profit/loss I earned in October 2022.

Vacation Rental Profit/Loss

October resulted in a small loss. Although, I would have preferred to have made a profit, things could have been worse. Let’s dive in to see how much profit/loss I made for the month.

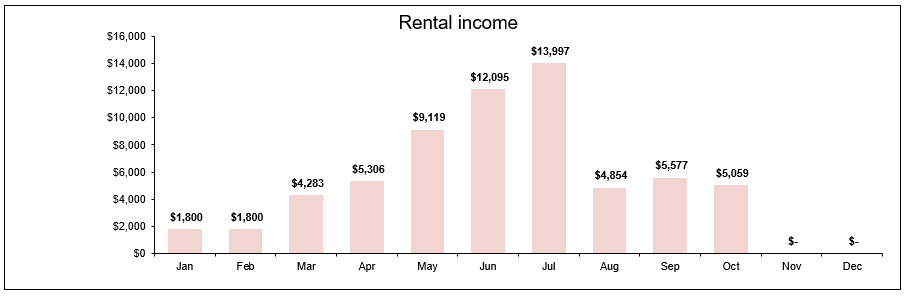

A. Vacation Rental Income

During the month of October, I earned $5059 in income broken down as follows:

As you can see, this income was less than September, but very much in line with the income I earned in April of this year. I suspect that once the remaining months are filled in, I will have a complete picture of what to expect over the course of a year. While past performance is no guarantee of future success, it will be a useful guide going forward for my planning purposes

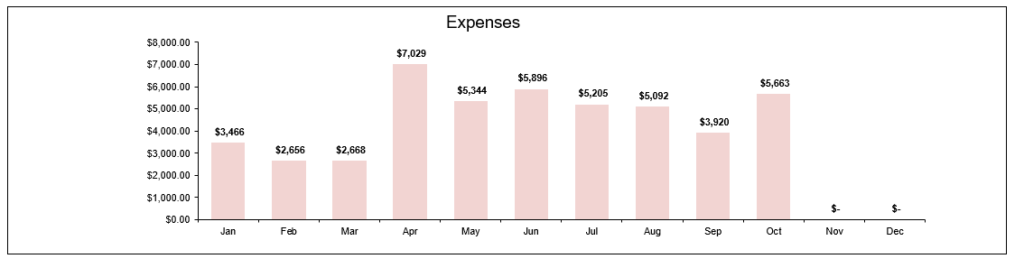

B. Vacation Rental Expenses

During the month of October, I incurred $5663 in expenses as shown below?

As you can see, my expenses slightly exceeded my income. It could have been much worse. So, I will take it! I pretty much broke even.

Part of the reason why my expenses were so high was because of insurance!!! I had to pay $941.94 to cover my insurance for the next year. What gives?

Typically, for all my other properties, when I pay my mortgage every month, that payment includes, principal, interest, taxes and insurance. The taxes and insurance are escrowed by the bank and paid on my behalf. However, for some reason, when I pay the mortgage on the condo, it only includes principal and interest! That came as quite a shock to me. I probably was told this, but somehow I wasn’t tracking this at all. I didn’t realize that I was responsible for paying my own property taxes and insurance.

So, it came as quite a shock when I received notice that my insurance expired. But, what’s done is done. I paid the bill and I’m good for another year. As you will see from next month’s report, I also have to pay my taxes as well. Let’s just say it’s a lot more than the cost of my insurance! It helps when I remember my mantra: Don’t sweat the small stuff.

C. Profit/Loss Statement

So, as you can see, I incurred a small loss of $604 for the month. This is much better than a huge loss, but a negative balance is a negative balance – no matter how much I spin it.

The overall profit for the year, at the time of this writing, is $16,952! I was trying to keep this above $15000, but given what I explained with the taxes, that’s going to be very unlikely to happen. So, all I am hoping for is just to have a profit at the end of the year – no matter how small it is.

I decided to reject snowbirds this year. I wanted to see what the condo can do without snowbirds. Right now, it looks like it’s going to be zero, but I may get a booking or two during the month of December – February. We shall see. Worst case scenario, I will use the condo myself. It’s nice having a place to go to so I can unwind. I just wish the beach was a bit warmer during the winter months, like it is in Miami.

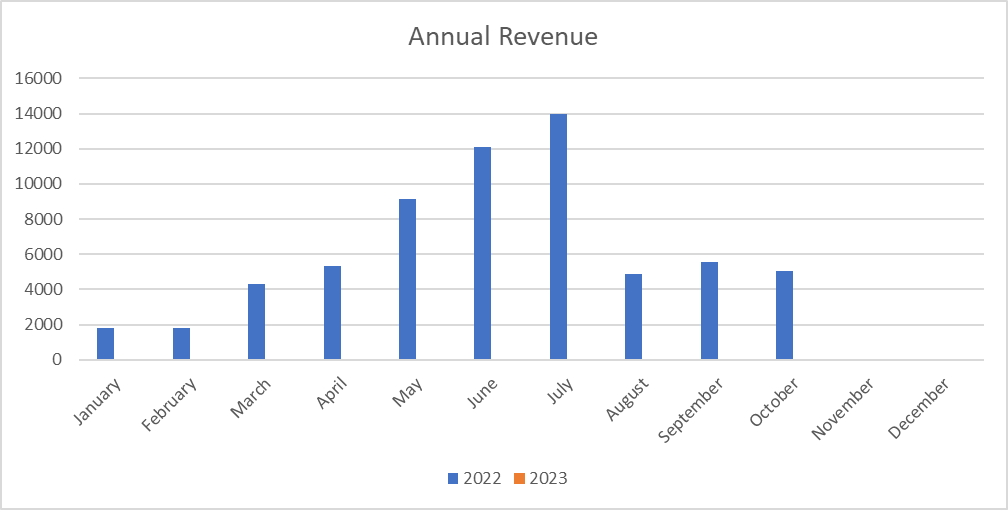

Annual Income and Expenses

As this is my first year investing in a vacation rental, I don’t have any annual income to compare it to. However, for purposes of this section, here is a graphical representation of the revenues earned in October 2022 in relation to the revenues earned in previous years:

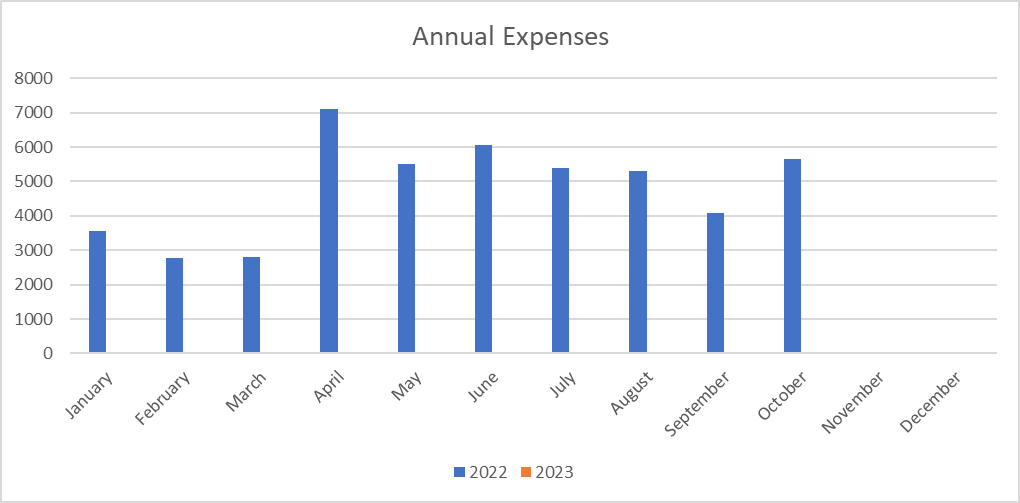

Here is a graphical representation of the expenses incurred in October 2022 in relation to the expenses incurred in previous years:

As you can see, the charts are exactly the same (except in style) as indicated above. This annual comparison section will make a lot more sense come 2023 when I am able to make a comparison. I will be able to see a trend not just from month-to-month, but also from year-to-year.

Final Thoughts

The vacation rental market is definitely slowing down – at least for me. The temperature has started to cool and less people tend to go to the beach during winter than they do during other times of the year.

I was hoping to at least break-even over the course of the next 4 months, but I doubt that’s going to happen. I think what is more likely is that the condo will have to cover the costs itself, without any additional income. So, whatever profits I have will likely be used to cover those months. So, hopefully when all is said and done, I will make a little profit.

Next year, if my life spares, I might have a better profit/loss statement. That’s because I probably won’t have as many expenses as I did this year, and I may entertain snowbirds for the winter months. But until then, I am taking things one month of a time.

What did you think of this post?

Let me know your thoughts by commenting below.