Welcome to my second debt payoff report for the year. Based on the amount of my debt, it looks like I’m going to be reporting on my status for a while. Credit card debt is a wealth killer, at least the credit card debt that I have. The interest is super high, almost criminal. But, it was my poor choices that got me into debt. So, now I have to deal with the consequences. There’s no use crying over spilt milk. All I can do now is make better choices going forward. To that extent, I’ve decided to prioritize paying down my debt. The fact that I owe $6000 in taxes doesn’t help things. But, I am taking things one month at a time. I might even get a low paying job to help with my financial situation, but we will see. For now, let’s see how much debt I was able to payoff.

Debt Payoff Progress

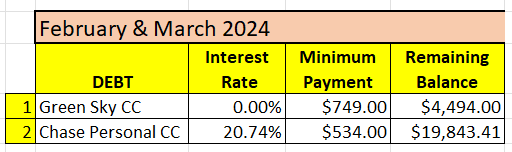

Here is the current status of my debts.

The Green Sky Credit Card is on track to be paid off this year. That will allow me to keep the promotional rate balance of 0.00% Otherwise, the interest rate would have been 25%.

The Chase Personal Credit Card is the bane of my existence. But, my goal is to keep chipping away at this balance. The interest payment alone is $335. So, I really want to bring this balance down. Thankfully, I decided against putting the $6000 I owe for taxes on this credit card. But, it’s going to be tough to both pay down on the credit card and save for the slow season. I am going to try and walk and chew gum at the same time.

Final Thoughts

It really helps that the busy season for the condos is upon us. That takes some of the financial stress off my plate for the next few months. But, I still don’t make enough to do everything I want, and so I have to prioritize.

While I would love to get rid of my credit card debt in a year, what’s more realistic is that I eliminate the debt in two years. So far, I’ve avoided using my credit card, so the balance should keep going down with every report. I do make more than the minimum payment. But, as the saying goes, life is what happens when you make plans.

Eliminating the credit card debt will give me the flexibility to deal with life’s upcoming surprises. We will see.

Finally, I titled this report for February & March. Going forward, I will report on my debt status in the current month as the post. I’ve simplified the report so that I am reporting on what my current debt status is, rather than what the debt status was in the previous month. I hope that makes sense.

What did you think of this post?

Let me know your thoughts by commenting below.