Another month has gone by and now it’s time for my dividend income report. Dividend investing is a slow and long-term strategy. The benefits of compounding growth really shines towards the latter end of the strategy. Until then, it’s a grind. A lot can happen during the long-term. For example, recently, I posted on the fact that I owe $6000 in taxes. In order to come out with the full amount, I decided to withdraw about $2000 from my dividend portfolio. Now, the jury is still out on whether I can scrape together the $6000 without having to withdraw anything from my dividend portfolio. Regardless, I will let you know. But. despite the potential setback, I am still committed to this strategy. So, without further adieu, let’s see how much dividends I was able to earn in March.

Dividend Income

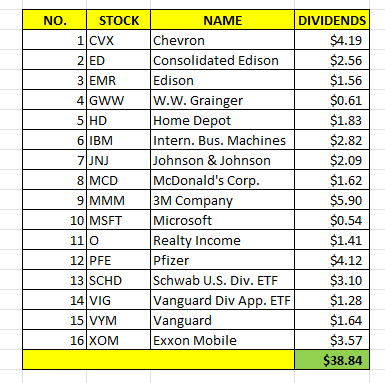

In March, I earned $38.84 in income broken down as follows:

I almost hit $40 in dividends for the month. The dividends right now are small, but that $38.84 will be re-invested back into my portfolio so that I can experience compounding growth.

Unfortunately, I have other financial priorities right now than increasing the minimum contribution to my dividend portfolio. For starters, I owe $6000 in taxes. During that post, I indicated that I may have to sell about $2000 of my stocks from my dividend portfolio. I will write about this in a future post shortly, but I don’t think I will have to do that anymore. This would be a huge psychological boost because I was worried about selling stocks.

Additionally, I owe approximately $20k in credit debt. This will be the priority going forward because my credit card interest on this debt is super high.

Finally, I also want to save for the slow months. I’m already behind saving because I had to come up with the $6000 for taxes. But, if I have a good year in my vacation rentals, I might be able to both pay down on my credit card debt and save what I need to for the slow season.

The bottom line is that I think I’ll at least maintain the current minimum contribution to my dividend portfolio for now.

Annual Income

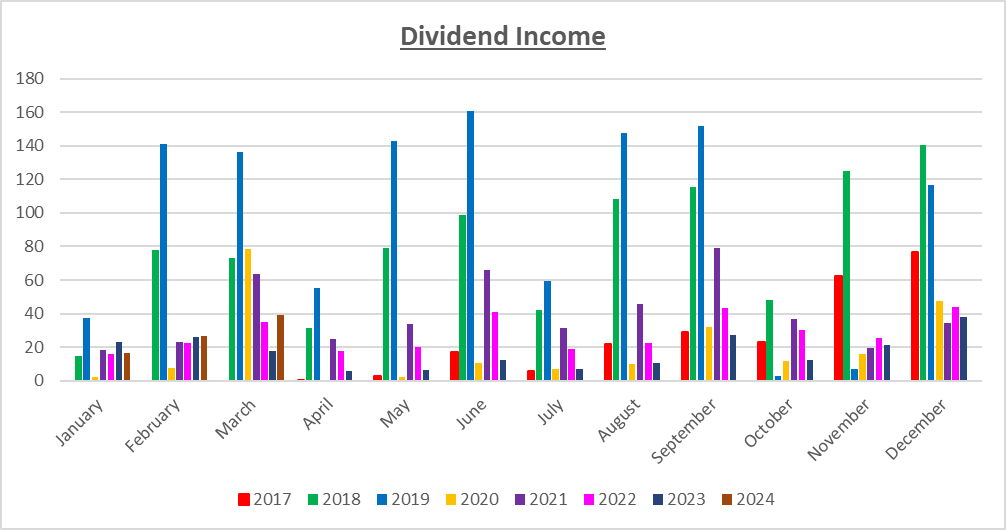

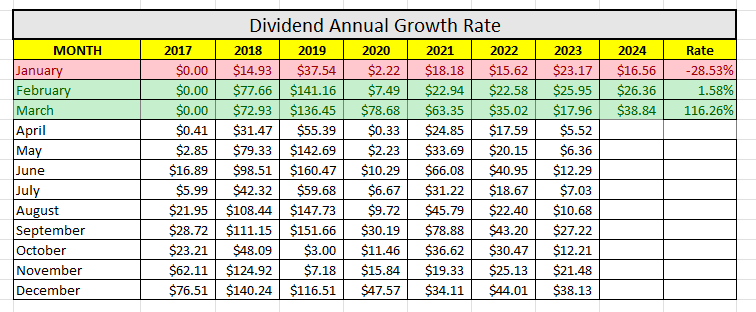

Here is the raw data:

As you can see, I earned 116.26% MORE dividends this year compared to last year (and frankly, since 2022). I’m glad I’m in positive territory again and hope the trend continues, but I am confident, that in the long run, it will.

This is a very encouraging report. The numbers are small now, and quite frankly, I have no where else to go but up. The threat of me having to sell $2000 of stocks in my portfolio has been eliminated. Looking ahead, I don’t see another reason to sell. Of course, life is what happens when you make plans, but I’m hoping it’s smooth sailing from here.

Forward Annual Dividends

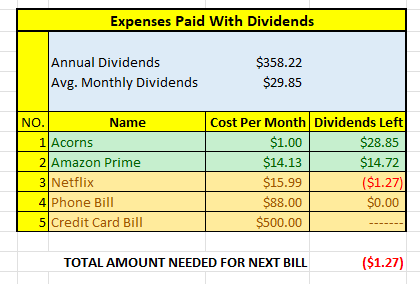

At the time of this writing, the forward annual dividends is $358.22. A month ago, my forward annual dividends was $352.62. This represents a 1.59% increase from the previous month. This small increase is mainly due to my reduced contribution to my dividend portfolio. Unfortunately, as explained above, I may have to maintain my current level of contributions for now.

Finally, the Dividend Tracker, has been updated. As you can see from the tracker below, I’ve made $98.32 in dividends since the beginning of the year.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$358.22 per year is $29.85 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Amazon Prime. I’ll take it. Next on the list is Netflix and we are so close!!!

Final Thoughts

This was a good report. Although the actual dividend income was low, I am in positive territory from year-to-year.

Additionally, I feel less financially stressed these days. That’s mostly because we have entered the busy season and my vacation rentals will hopefully be able to pay for themselves. Still, I am mindful of the fact that I have high credit card and I still need to save for the slow season. But, where there’s a will there’s a way.

How was March for you?

What did you think of this post?

Let me know your thoughts by commenting below.