Welcome to my first debt payoff report of the year. As noted in previous reports, the first few months of the year are going to be tough. My income will be limited and my debts payments are high. But, as I am writing this at the end of February, I can see light at the end of the tunnel. I have just about another month of pain to go. After that, I can start making significant progress in my personal finances. Some of that progress includes me paying down my debt. Other part of that progress includes me saving for next year to prepare for the slow season, when I will have little-to-no income. But, let’s not get ahead of ourselves. Without further adieu, let’s see how much debt I was able to payoff in January.

Debt Payoff Progress

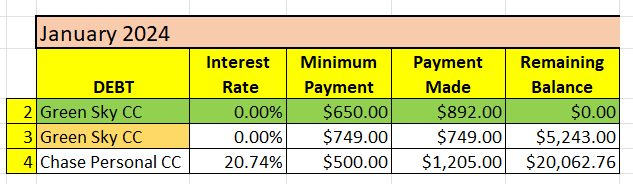

Here is the current status of my debts.

Now, as you can see, there are 3 debts shown. First the good news.

The first Green Sky credit card has been paid off. As I was writing this, there was going to be a $292 balance, but I decided to just pay it off now and be done with it!!! That means that I won’t have to keep paying that $650 per month. The payment was high so I could utilize the benefit of the promotional 0% interest rate. This cost was for a HVAC system that I decided to pay over time and now have it’s paid it off in less than a year.

Importantly, this debt is associated with Calypso Memories. Now that the debt is gone, it will be a little easier for Calypso Memories to start paying for itself, which I am hoping it will do. Time will tell, but I am encouraged.

Now, let’s get to the bad news. I’ve barely made a dent into my Chase Personal credit card. I need to get to a stable place where the condos are paying for themselves before I can start tackling my credit card. I anticipate this will happen starting in April (but perhaps as early as March). So stay tuned.

Final Thoughts

It’s hard to tell with these posts, but I am really feeling less financial stress as the weeks and months go by. During this current slow season, I didn’t really have any extra in reserves. So, I had to pay for everything out-of-pocket. Now, the goal is to save money on a monthly basis over the course of the year to cover next year’s slow season!

As you can see, I paid off one more bill in its entirety. That just mean I have two more bills to focus on. Granted the balances are high, and the interest rate on my chase personal credit card is no joke. But, I’ve already stopped using my credit card and I anticipate I will start making a dent into this balance very soon.

What did you think of this post?

Let me know your thoughts by commenting below.