Just like that, the first month of the New Year is gone. In any given month, there’s a lot that goes on in life. But, regardless of the ups and downs, I can count on my dividends working for me in the background. In fact, my investments are so automatic, that I barely even think about them until it’s time to post my dividend income report. Talk about set it and forget it. I set my automatic investment amount. Then, every single month, a portion of my income gets invested into my dividend portfolio. A long and consistent approach is the name of the game when it comes to dividend growth investing and that’s what I do. So, without further adieu, let’s see how much dividends I earned in February 2024.

Dividend Income

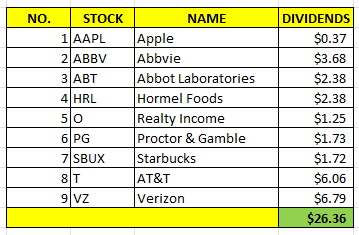

In February, I earned $26.36 in income broken down as follows:

That’s a small amount. But, my portfolio is small. Dividend Growth Investing is a long-term strategy and that $26.36 was re-invested back into my portfolio. Hopefully, towards the end of the year, I will be able to increase my monthly contribution to my portfolio but all in good time.

Annual Income

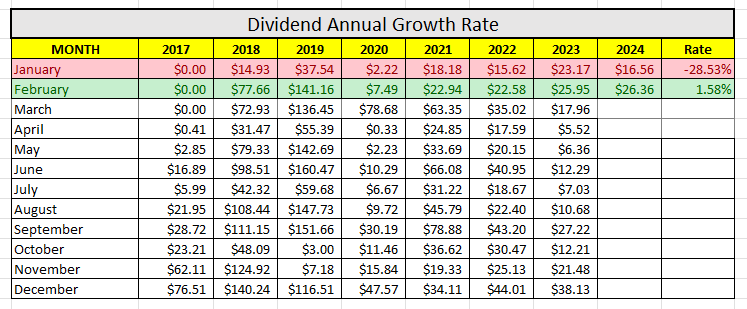

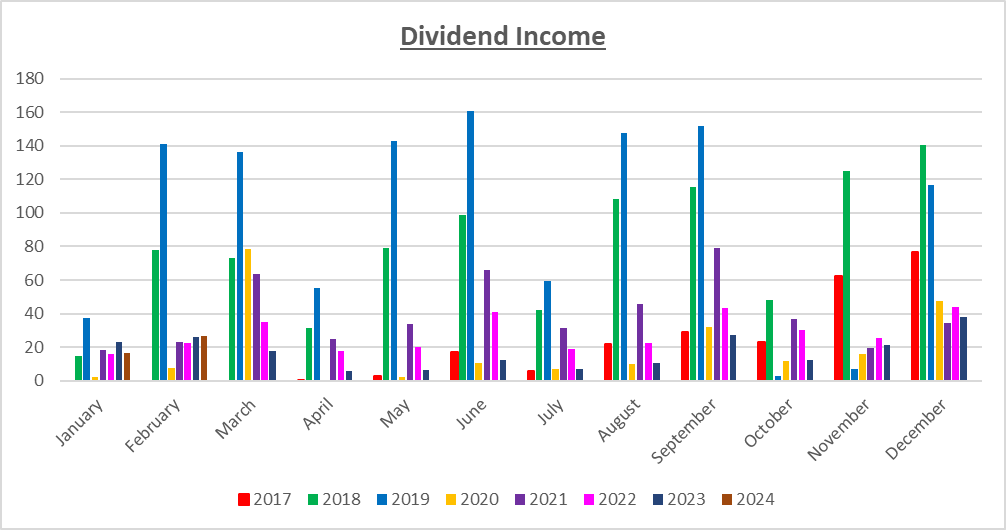

Here is the raw data:

As you can see, I earned 1.58% MORE dividends this year compared to last year (and frankly, since 2020). I’m glad I’m in positive territory again and hope the trend continues, but I am confident, that in the long run, it will.

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $352.62. A month ago, my forward annual dividends was $336.92. This represents a 4.66% increase from the previous month. This small increase is mainly due to my reduced contribution to my dividend portfolio. Unfortunately, given my negative cashflow situation and my current lack of adequate income, I think the growth rate will be this low over the course of the next three months.

Finally, the Dividend Tracker, has been updated. As you can see from the tracker below, I’ve made $42.92 in dividends since the beginning of the year.

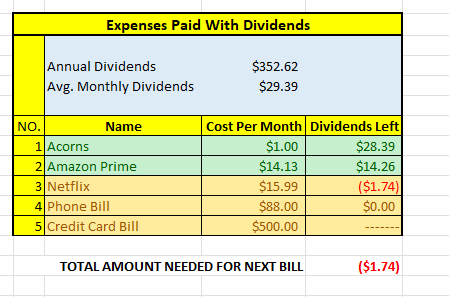

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$352.62 per year is $29.39 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Amazon Prime. I’ll take it. Next on the list is Netflix and we are so close!!!

Final Thoughts

I am excited to see what 2024 has to offer. My dividends will be small for the first half of the year and maybe even be small all year round. But that’s ok. It’s a marathon and not a sprint.

I feel much better about my financial situation. Over the next couple of months, my financial stress will be lessened and hopefully, it will be smooth sailing from here.

As indicated in my most recent debt payoff report, my credit card balance is still very high. That will be my focus this year. My goal is to put a dent into my $20k credit card balance. I’ll still be maintaining my current level of contributions to my dividend portfolio. But, I may not be able to increase it significantly until after I payoff my credit card debt.

In the meantime, my dividends will be chugging along. As it has already been stated, it’s a marathon and not a sprint.

How was February for you?

What did you think of this post?

Let me know your thoughts by commenting below.