Welcome to another debt payoff report. The goal is to make progress on my debt reduction plan at least twice per month, even though I may post once a month. To quote Dave Ramsey, “You can wander into debt, but you can’t wander out.” Even though I won’t be as gazelle intense as Dave preaches, I still plan on taking an aggressive approach to paying off my debt. I have several financial goals that I am working on at the same time, but paying off my debt is a top priority. So, without further adieu, let’s see how much debt I was able to payoff so far in June.

Debt Payoff Progress

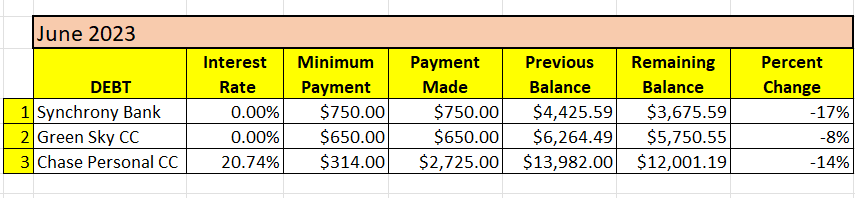

In June, I made the the following debt payments:

A word about the remaining balance. It’s not straight math. Not only are there interest charges factored in, but I do use my credit card on a very small scale. These purchases include paying with my Starbucks app, which is tied to my credit card. I may switch this to a debt card, which would probably result in me going to Starbucks less, but we shall see.

But I no longer make large purchases on my credit card (or at least I try not to). My credit card is out of my wallet so I don’t even carry it around with me anymore.

Finally, I will note that you no longer see my Best Buy credit card payments because I paid that off last month. More importantly, I closed my Best Buy credit card. I opened it up a couple of months ago and there was absolutely no good reason for me to have done that. Closing the account will have a negligible short term impact on my credit score. I intend to do the same thing with the Synchrony card when its paid off in six months, and the Green Sky credit card in a year.

Final Thoughts

Of the above referenced debts, the main one I am concerned about is the personal credit card, which has the highest interest rate and the highest account balance. That’s also the only account I am paying from my personal funds.

The other accounts are paid by my business accounts and so I don’t feel it as much. Although I hope to make a profit with my vacation rentals, I’ll be happy to break even. So long as I don’t have to support the operation of the property with my personal funds, I will call that a win in my book.

Paying off my Chase credit card is a top priority of mine. No promises, but I hope to be under the $10,000 in the next month or two!

Wish me luck.

What did you think of this post? Let me know your thoughts by commenting below.