It is time for another dividend income report. These reports are a staple of this blog and one of the most important posts I make on a monthly basis. I’m actually looking forward to writing this report. That’s because I recently increased my monthly contributions as indicated in my Debt Payoff & Conscious Spending Plan post. While I expect the monthly dividends earned will be small in this report, I am looking forward to an increase in the forward annual dividends amount. Let’s dive in to see how much dividends I earned in June 2023.

Dividend Income

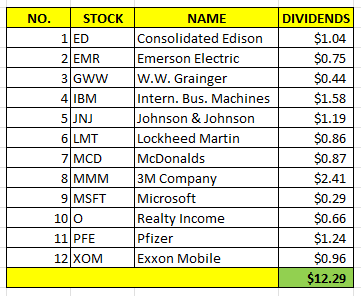

In June, I earned $12.29 in dividends broken down as follows:

Well, I am into double-digits, although barely. As anticipated, the actual amount of dividends is low. But, I anticipate that this will increase (at a faster pace) in the coming months.

Annual Income

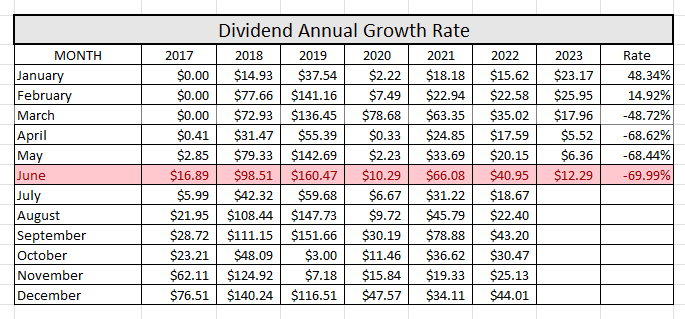

Here is a graphical representation of the dividends earned in June in relation to the dividends earned in previous years:

Here is the raw data:

As you can see, I earned 69.99% LESS dividends this year compared to last year. Of course, the reason for that is that I had to liquidate my stocks to fund the earnest deposit needed for my condo. The good news is that I hate seeing my account balance this low and my goal is to get it over $10k soon.

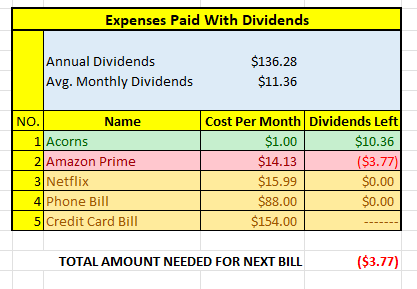

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $136.28. A month ago, my forward annual dividends was $116.31. This represents a 17.17% increase from the previous month. This double-digit increase is mainly due to my increased contribution to my dividend portfolio. More importantly, I fully expect the trend to continue in the next few months.

What Expenses Would Dividends Cover?

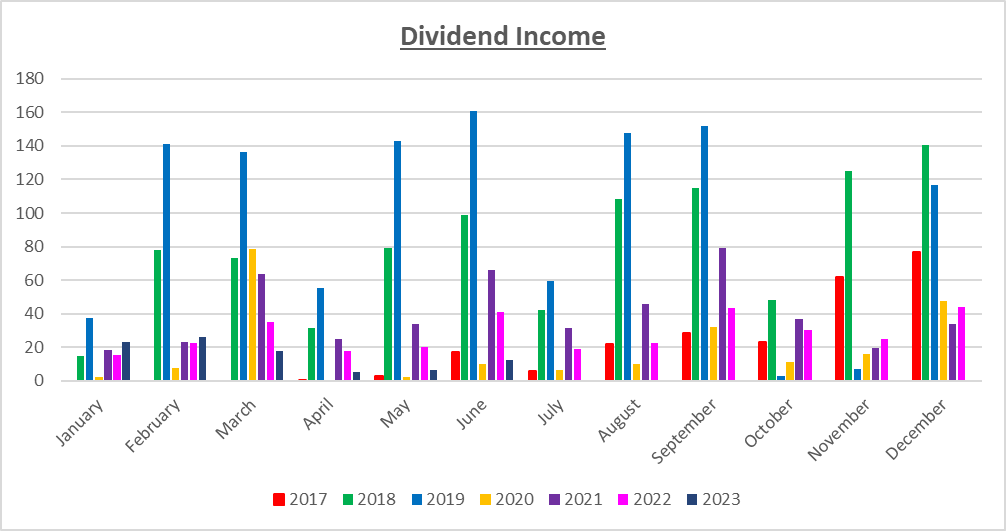

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$136.28 per year is $11.36 dividends per month, on average. At present, I earn enough in dividends to cover Acorns. I’ll take it.

The following is a list of expenses I am targeting:

The good news is that I should be able to cover Amazon Prime in a month or two. Also, I’ll mention that the cost per month for my credit card bill is more than $154. Since I’m far away from covering that amount with dividends, I won’t worry about updating this figure every month. Quite frankly, by the time I reach the point where I can payoff my credit card bill with my dividends, I will likely already have a zero credit card balance. As you may be aware, I track my credit card debt payoff on a monthly basis on this blog.

Final Thoughts

The first half of the year is gone! It was really expensive! I developed some expensive bad habits (namely bingo) that I hope to rectify the second part of the year.

More recently, I’ve been incurring a lot of costs traveling. I recently got back from overseas, and I’m planning another overseas trip, this time to the Caribbean. But, I can say with confidence that getting rid of my credit card debt and rebuilding my dividend portfolio are top priorities of mine. So stay tune to see how well I make good on my financial goals.

What did you think of this post? Let me know your thoughts by commenting below.