Welcome to my first debt payoff report. If you’re paying attention, you’ll notice that I already produce dividend income reports, vacation rental reports and now I’ve added a debt payoff report. I’ll continue to produce this report until I get out of credit card debt. I honestly can’t wait. Some people are ok with debt and to some extent I am one of those people. But only for good debt, such as mortgages. Bad debt such as credit card debt are ones that generally should be avoided. I certainly don’t play the credit card game where I payoff my credit card every month and use the credit card points for travel and other benefits. To me, it’s too easy to get stuck with debt if you slip up or hit a rough financial patch. So, I will try to get out of credit card debt as soon as possible AND stay out of credit card debt for as long as possible. Let’s dive in to see how my progress is going.

Debt Payoff Progress

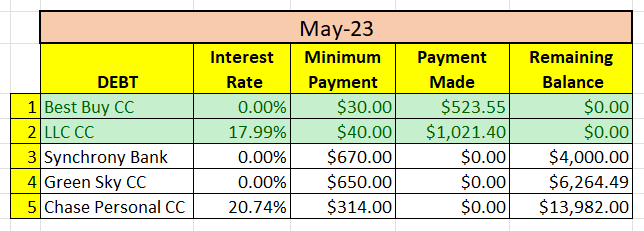

In May, I made the following debt payments.

As mentioned in my Debt Reduction Plan, the best buy credit card was my lowest debt and the easiest one to get rid of. So, I decided to get rid of this asap. In fact, I also stated that before I tacked my debt, I wanted to ensure that I had my mortgage payment of $6000 for June, and at least $1000 in each savings account that I have per bank. I was able to accomplish this goal, except for one bank. So, I have 3 separate bank accounts (technically 4, but the 4th one is used as an emergency account/saving for a down payment account), and manage to have $2000 ready to use as a starter emergency fund (separate and apart from my real emergency fund in my 4th bank account).

Over the next month or two, I will be able to fund $1000 in my third bank account in accordance with my debt reduction plan.

You will also see that I paid off my business credit card. I used my business account to do that. I had the funds to do so and I am not anticipating any extraordinary expenses over the next several months. So I decided to just write a check.

Final Thoughts

It’s not fun being in dept. Recession is on the horizon, and there is a possibility that interest rates will be raised, such that the cost of my debt may also increase. But, the good news is that I have a plan to weather the storm. More importantly, I fully intend to stick to that plan.

I realize that life is what happens when you make plans. In fact, just yesterday, I had to pay about $800 to fix an AC leak at the new condo. But, sticking to my plan is much better than leaving my head in the sand.

Stay tuned for future reports to see how I am able to tackle the remaining debt.

What did you think of this post? Let me know your thoughts by commenting below.