Hello from Barcelona, Spain! I’m currently visiting Spain for the first time and I love it so far. There is so much to do and so little time to do it. Oh well. Even though I am on vacation, I still have to write about my ability to payoff my debt. I missed producing a report in August. But, as the saying goes, it’s better late than never. Spoiler Alert: I don’t expect this to be a good report. For starters, my debt has increased since July and that’s before I took this trip where I am putting all my day-to-day expenses on my credit card. Ouch! My credit score has also declined. It is what it is. Despite my ever so increasing debt, I still have not given up. I am still committed to reducing and eliminating my debt as soon as possible. Whether I succeed or fail, I will be fully transparent. So, without further adieu, let’s see how much debt I was able to payoff in September 2023.

Debt Payoff Progress

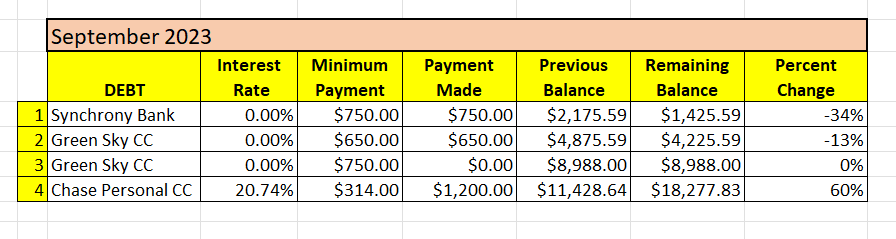

In September, I made the following debt payments:

Wow. A bit of explanation is in order. First, you will notice two Green Sky CC. Long-story short, I had to replace a new HVAC in my most recent unit. Part of me feel that the company just recommended a new HVAC (like the did my old unit) to take advantage of my naivete. But I’d rather be on the safe side. Of course, I don’t expect to incur such expenses next year.

Secondly, you’ll notice a SIGNIFICANT increase on my Chase Personal CC. That’s because one of my other properties (not talked about on this site) needed a new fence. That’s going to be about $3,300. I just added $4000 to the balance because I haven’t spent it yet. So, next months report should show a more accurate balance for my credit card.

The struggle is real as they say.

Final Thoughts

Despite the overall increase in debt, there is some good news. That’s because the $8,988 debt that I incurred is at a 0% interest rate per year. Technically, the minimum payment is far less than the $750, but I plan on making equal payments so that I pay this off in a year.

The increase in credit card debt is a bit substantial. A new fence for my property was an unexpected expense. Unfortunately, I haven’t taken the good advice that is to fund a separate maintenance account for each property. I will undoubtedly do that in the future, but right now I need to concentrate on getting out of debt.

I didn’t get into this debt overnight and I’m not going to get out of it overnight. In fact, my financial situation is a bit worse now because I don’t have a job and therefore I don’t have that active income coming in. Although I get some money from a pension, and have other income sources from my real estate, (at least in theory. I say that because I am currently experiencing negative cashflow), the total funds are not nearly enough to cover all my bills. So, I am not in a position to dump a massive amount of money on my debt.

Of course, if I am able to have a job, then that will be icing on the cake. But for now, i will focus as much as i can on that massive credit card debt.

What did you think of this post?

Let me know your thoughts by commenting below.