Recently, I posted the Calypso Memories Vacation Rental Report. Now it’s time for Emerald’s Corner. So far, the year-to-date loss on Emerald’s Corner has been significantly less than Calypso Memories. But a loss is a loss. Additionally, there is not much room in the calendar to earn additional revenue. In fact, I had to make a $5000 capital contribution to my account so that I can pay the mortgage and HOA fee. I posted on the negative cashflow I’ve been experiencing and the capital contribution is a reflection of that status. The bad news is that I anticipate having to make such a capital contribution over the next 6 months. Woe is me! But we have to take things one month at a time. So, without further adieu, let’s see how Emerald’s Corner faired in September 2023.

Vacation Rental Profit/Loss

Let’s see whether I made a profit or incurred a loss in September 2023 at Emerald’s Corner.

A. Vacation Rental Income

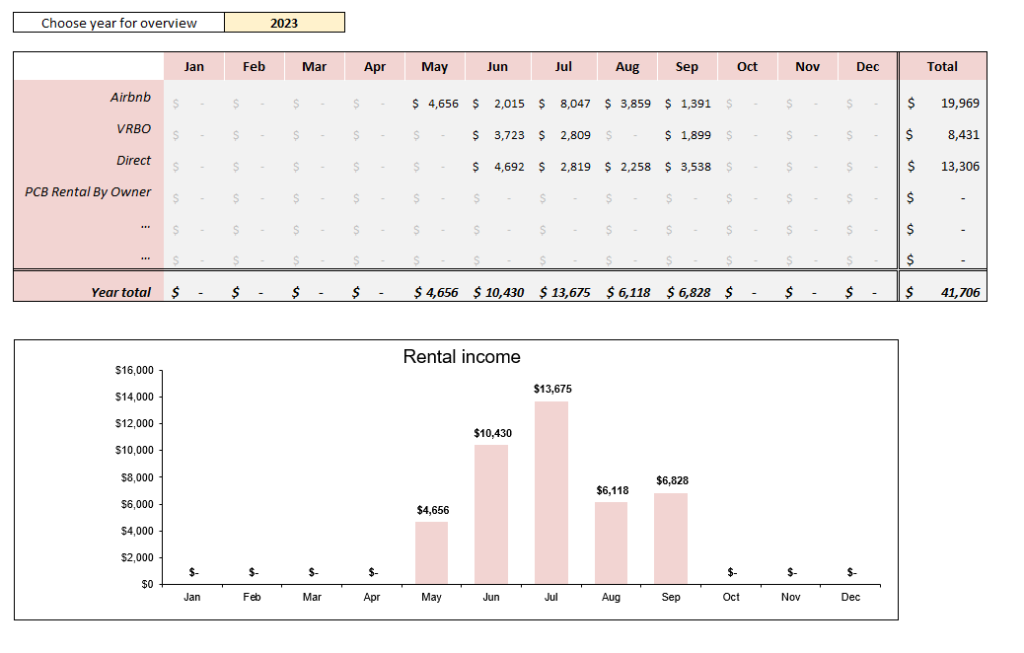

During the month of September, I earned $6828 in income broken down as follows:

This is a fair amount of income. But, I am not hopefully that I will turn a profit. Just my mortgage and HOA alone is about $6000. That doesn’t include many of the other expenses I typically incur in a month. It is what it is.

B. Vacation Rental Expenses

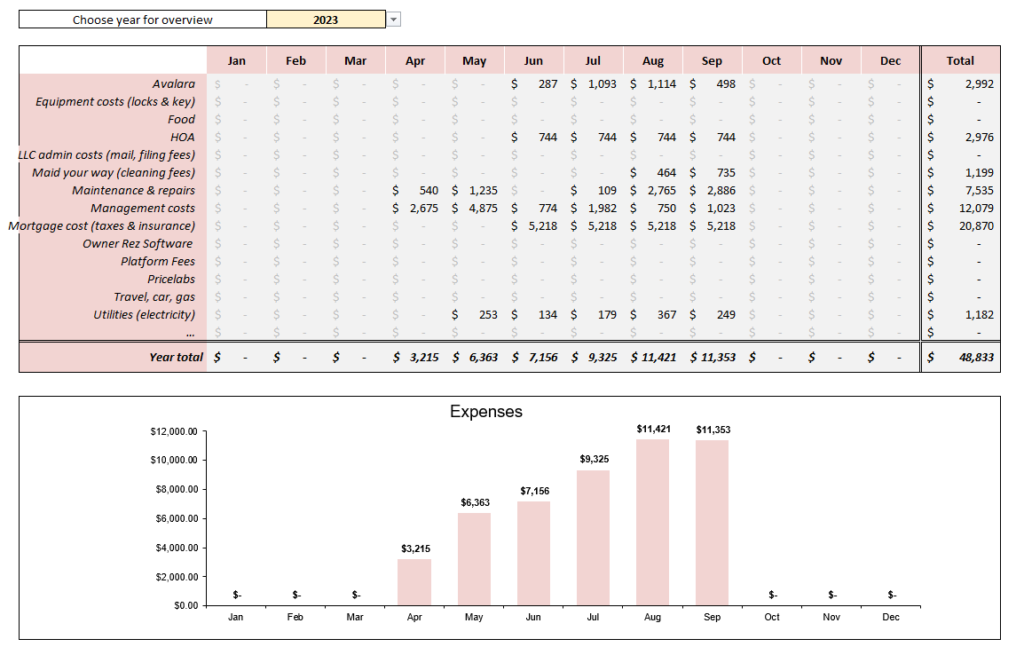

During the month of September, I incurred $11353 in expenses broken down as follows:

It seems that my typical expenses for the month is around $11,000. Ouch.

The good news is that this is the result of high maintenance cost of about $3000. I had to fix the AC system and that cost me over $2500. The point being is that I don’t anticipate such high maintenance cost in the future.

A lot of my maintenance cost has to deal with preventative maintenance. My thought process is that I’ll spend some money now so that I don’t have to spend a large amount of money later. I am hoping that plan works out but we shall see.

C. Profit/Loss Statement

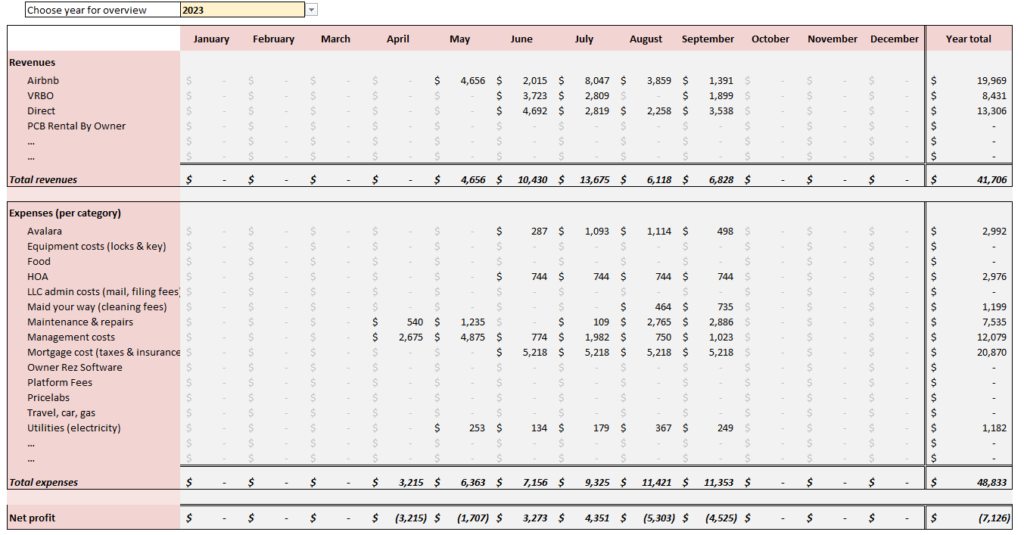

Based on the fact that my expenses exceeded my income, my loss for September was $4525. This is a significant loss.

As shown below, my year-to-date loss has increased to $7126.

For what it’s worth, last month’s year-to-date loss was $2601.

As mentioned, the struggle is real. Now you see why I had to make about a $5000 capital contribution to keep the boat afloat.

The good news is that I should have lower maintenance expenses in the future. Additionally, I have a furniture debt that I am paying $750 a month on. The current remaining balance as of today’s date is $1425.59. So, this bill will be paid off in exactly two months.

Starting in December, I will no longer have to pay this $750 per month. If my maintenance expenses remain low, then my monthly expenses should be around $8000. It is still going to be tough to make a profit over the next six months, but after that, I am hoping there is light at the end of the tunnel.

Annual Income and Expenses

This is my first year owning Emerald’s Corner. So, I don’t have any income or expenses to compare it to. This section will make a lot more sense come September 2024.

A. Annual Income

Here is the raw data:

Hopefully, the revenue will continue to be strong over the next several months, at least where it dents the amount of capital contributions I have to make to stay afloat.

B. Annual Expenses

Here is the raw data:

Again, this section will make a lot of sense in 2024 when I am able to make an annual comparison.

Final Thoughts

I am going to be in a world of financial hurt over the next six months. My expenses are super high and my income will not be high enough to cover those expenses. Not only that but the Airbnb bust is real and I’m feeling it.

For what it’s worth, this is my first year owning this property. One can typically expect higher expenses during the first year. I am hopeful that next year will be dramatic turn of events once we get to the busy season.

I also plan on raising my prices about 10% starting in January, but we will see. In any case, I am thankful I am in a position to weather the financial storm over the next six months. Due to the large amount of capital contributions I am expecting to make, I will probably have to live on beans and rice over the next six months, but I think it will all be worth it in the long run. If not, I can alway sell.

Wish me luck.

What did you think of this post? Let me know your thoughts by commenting below.

Thank you for openning up and sharing the real life data. Rental properties arent for faint hearted. Later on you can passify yourself that the property price will go up and that you are paing off the mortgage, meaning this is increase in your capital. This is not visible now, but as the years go by it should get better.

Typically what is missing in the cals is your time – how much time do you spend by doing all that? Do you pay yourself enough? Can you manage multiple properties, work the day time job and live your life?

Financial Independence recently posted…September 2023 update ($790,707 -$37,778 or -%4.6)

Thanks for the comment FI. To answer your question, you’re correct. I don’t address the time it takes me to manage multiple properties or the extent to which I pay myself. To answer your questions, it really doesn’t take me that much time. Maybe 2-5 hours per month. It might be a little more since I tend to look at my calendar several times a week, but that only takes a couple of minutes.

I do sometimes spend time on the phone with maintenance or sometimes answering questions from a guest but those are few and far between. Much of the inquiries I get that I manually respond to takes about 30 seconds to do and even when I have to manually process someone’s parking pass, that also takes about 30 seconds.

I estimate 2-5 hours per month based on things that I HAVE to do. But I’m sure I spend more time per month on my vacation rental because I WANT to not necessarily because I have to.

In terms of paying myself, I don’t! One condo is in the name of my LLC and that’s a single-member LLC and so it’s a disregarded entity for tax purposes. The other condo is in my name. But, as a practical matter, I don’t pay myself anything. I’m satisfied if the condos can pay for themselves. Right now, the one-bedroom is paying for itself (even though it’s operating at a loss this year). But the 2-bedroom condo is not paying for itself, and so I have to put more capital into that account each month just to pay the basic bills. It would be nice one day to be able to withdraw money from the condo to pay bills or enjoy life, but right now I haven’t really been able to do that. Truth be told, I use both condos relatively frequently myself, so I get benefit from that standpoint.

So for example, last month, I hosted a few friends while I was there. This month I will be going to the 2-bedroom condo with my mom and next month, I will be going to the 1-bedroom condo also with my mom. It’s hard to put a value on that.

But again, thanks for the comment.