It’s hard to tell what day it is anymore. With COVID-19 and my State’s quarantine, the days just run together. But, despite the fact that there is a global pandemic going on, to achieve financial freedom, I know that my dividends are hard at work in the background. As you know, I’m in the process of rebuilding my dividend portfolio. It really bothered me that I had to sell so early, but it was a good process to go through. Now, I am making sure that any money invested will be money I don’t touch for at least another 13 years when I hopefully will retire. That amount of time won’t make me rich, but I hope to be in a position where my dividend income is truly supporting my ability to achieve financial freedom. Now, with that said, let’s see how much dividends I earned in April 2020.

Dividend Income

In April, I received a total of $0.33 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | CSCO | Cisco Systems Inc. | $0.23 |

| 2 | KO | Coca Cola | $0.04 |

| 3 | O | Realty Income | $0.06 |

| $0.33 |

Wow. I think that’s the lowest dividends I’ve ever earned since I started tracking my dividends. But, that’s what starting over from scratch means. The good news is that it will only get better.

In April, I reached my unannounced goal of having a minimum of $1000 balance in my account. I’m shooting for $2000 by the end of May. I may not achieve $3000 in June because that is when I plan on closing on the condo – assuming the deal doesn’t somehow falls through. I’ve already lost a bank that had previously approved a loan, but because of the coronavirus, they backed out. So, I am still in the process of trying to get approval. I’ll keep you updated.

But, I am very excited about the prospects of rebuilding my dividend portfolio. Financial freedom is worth it, and as the saying goes, the journey of a thousand miles must begin with a single step. Well, I’ve taken my first step in rebuilding my portfolio.

Annual Income

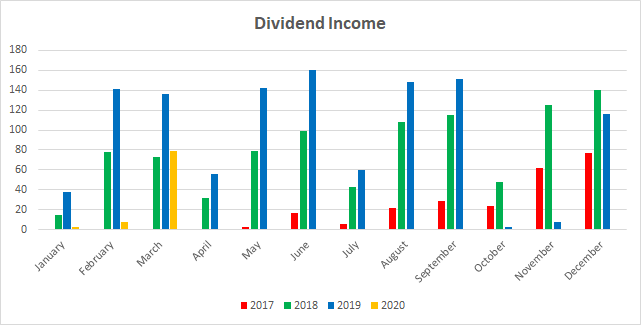

Here is a graphical representation of the dividends earned in April in relation to the dividends earned in previous years. I’m sure it’s there, but it’s just not visible to the human eye.

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | -94.09% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | -94.69% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | -42.34% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | -99.40% |

| May | $2.85 | $79.33 | $142.69 | ||

| June | $16.89 | $98.51 | $160.47 | ||

| July | $5.99 | $42.32 | $59.68 | ||

| August | $21.95 | $108.44 | $147.73 | ||

| September | $28.72 | $111.15 | $151.66 | ||

| October | $23.21 | $48.09 | $3.00 | ||

| November | $62.11 | $124.92 | $7.18 | ||

| December | $76.51 | $140.24 | $116.51 |

As you can see, the end of the quarter is usually my slowest month receiving dividends. In any case, I earned a whopping NEGATIVE 99.4 percent less dividends this April as compared to last year. The good news is that as I rebuild my portfolio to achieve financial freedom, the percentage increase on an annual basis is going to be EPIC.

Finally, the Dividend Tracker has been updated accordingly.

Forward Annual Dividends

At the time of this writing, my forward annual dividends is $47.63. In my last dividend income report, I indicated that my forward annual dividend income was a whopping $19.66. So, this is a 142% INCREASE from the previous month’s report of my forward annual dividends. Financial freedom – here I come.

Conclusion

April was indeed a slow month for dividends. I’m not even sure what I could buy with $0.33. But, over time, it will get better.

I’ve committed to contributing a minimum of $500 to my portfolio every month. However, in May, I’m hoping to bring my portfolio balance from $1000 to $2000. It’s already sitting at $1200.

Financial freedom is a worthy goal. There are many paths to get there, and this blog has chosen the path of dividend growth investing. Wish me luck, but hopefully with enough time, discipline and consistent investing, I won’t need it.

What did you think of this post? Let me know your thoughts by commenting below.

You are right, DP… a year from now your YoY growth will be epic. I look forward to seeing that.

Since you are basically starting with a clean slate, are you approaching the portfolio re-build any differently than when you started before? For instance, might you be favoring certain sectors or company types this time around? Or perhaps have a certain set of minimum standards for a company making it into your portfolio? Not sure if you’ve covered that already, but if not, I’d love to hear about it.

Sorry to hear about the delay in condo closing, but it’s no surprise given the financial state of affairs in the midst of COVID-19. Here’s hoping your new approval comes through and you can start lining up some rental income over the summer.

Engineering Dividends recently posted…Portfolio Thoughts (Apr. 2020)

Thanks ED. I haven’t covered those topics yet, but happy to do so – so stay tuned for future posts. I’m really hoping I can close on the condo and be done with the process, but as the saying goes, patience is a virtue.

Look long term rather than short term. Sorry to hear about the delay in condo closing. It’s hard in the midst of COVID-19.

Haven’t tallied our April dividend income but I think we’re around $2,400 range for April.

Tawcan recently posted…Travelling the world with 4 kids

That’s just awesome Tawcan. It will be a while before I can post such numbers! Thanks for stopping by and stay safe!

Step by step, this portfolio is going to rebuild and come back stronger. Let’s go DP!!

Bert

Oh just wait and see!

Always great to see your positive outlook on everything, keep going strong DP! And as ED said, your growth next year will be stellar!

Stay safe and am slo looking forward to seeing you expand your portfolio!

Mr. Robot recently posted…April 2020 Dividend Report

Awesome, thanks Mr. Robot. It’s tough to be positive these days, but I’m trying.

Hello ,

I’m a german so my english is not the best …. this is one of the first comments on a website outside from Germany ….. I am also a Dividend investor and wish you all the best … great blog … I come back …

Thanks a lot for the inspiration

Yours sincerelly

Uwe

You’re welcome here anytime Uwe. Thanks for stopping by. I’m looking forward to you returning to the blog.

Pingback: April Dividend Income from YOU the Bloggers! - Dividend Diplomats

Pingback: Dividend Income Report - May 2020 - Dividend Portfolio