Welcome to the May 2020 Dividend Income Report.

The first five months of the year are behind us. And what a year it has been. I don’t know about you, but I’m ready for 2020 to be over – or at least take a turn for the better. There’s a deadly global pandemic going on and now deadly protests around the United States. These are trying times indeed and I hope everyone is doing their best to keep healthy and remain safe.

Despite all the bad news going on in the world, I can count on dividend income rolling in on a monthly basis. These dividends are used to buy more shares of stocks which generate even more dividends. And the snowball repeats itself on a monthly. So, let’s see how much dividends I earned in May 2020.

Dividend Income

In May 2020, I earned $2.23 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | AABV | Abbvie | $0.48 |

| 2 | AAPL | Apple | $0.24 |

| 3 | HRL | Hormel Foods | $0.12 |

| 4 | O | Realty Income | $0.19 |

| 5 | PG | Proctor & Gamble | $0.27 |

| 6 | SBUX | Starbucks | $0.39 |

| 7 | T | AT&T | $0.54 |

| $2.23 |

There you have it. 7 companies paid me dividends that amounted to total dividends earned of $2.23. It’s a small number, but it all adds up. That $2.23 will be added back to my portfolio and the amount of dividends I earn will exponentially grow over time. Consistency, discipline and time are the keys to success.

Annual Income

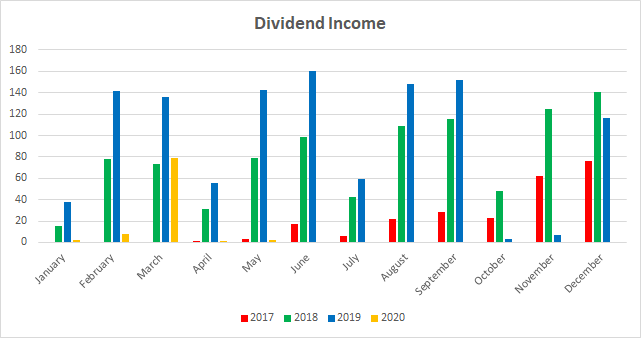

Here is a graphical representation of the dividends earned in May in relation to the dividends earned in previous years.

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | -94.09% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | -94.69% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | -42.34% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | -99.40% |

| May | $2.85 | $79.33 | $142.69 | $2.23 | -98.44% |

| June | $16.89 | $98.51 | $160.47 | ||

| July | $5.99 | $42.32 | $59.68 | ||

| August | $21.95 | $108.44 | $147.73 | ||

| September | $28.72 | $111.15 | $151.66 | ||

| October | $23.21 | $48.09 | $3.00 | ||

| November | $62.11 | $124.92 | $7.18 | ||

| December | $76.51 | $140.24 | $116.51 |

As you can see, in May, I earned 98.44% LESS dividends than I did in 2019. Although not the best, it is still a slight improvement in terms of percentage from my April 2020 Dividend Income Report. I think that’s just an indication that my portfolio is slowly getting back towards positive territory.

Forward Annual Dividends

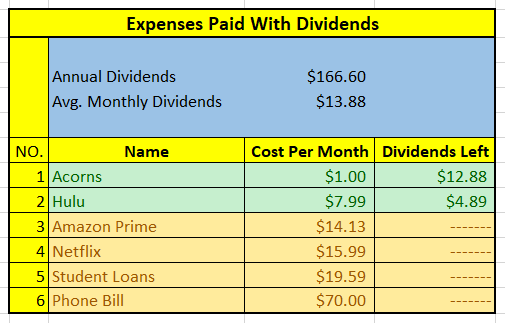

At the time of this writing, my forward annual dividends is $166.60. In my last dividend income report, I indicated that my forward annual dividends was $47.63. That’s a WHOPPING 250% increase from the previous month. SWEET!!! I was able to put more in my account than usual. For example, I found a $1000 check while cleaning my room. I probable should have saved that money for closing costs (see below) but oh well.

I don’t anticipate such a stellar growth rate in June or July. That’s because I still need to close on the condo and buy furniture (see below). So, I won’t be able to add much more than the minimum investment in those months.

What Expenses Would Dividends Cover?

I recently started visualizing what expenses my annual dividend income could pay for. This is a new section that I hope to start reporting on every month. It helps to keep me motivated.

$166.60 per year is $13.88 per month. At present, I pay $1 per month to use Acorns. Also, my Hulu Plus bill is $6.41 per month. I earn enough in dividends to cover both Acorns and Hulu Plus. The next bill I am targeting is Amazon Prime. That amount is $14.13 per month. The immediate goal will be to see if I can generate enough dividends to cover all three bills for the year.

I’m hoping I can do that by the end of 2020. Using the debt snowball method, I will list of my bills from smallest to largest. I will keep track of them here. This is what I’ve come up with so far:

I listed only the top 6 expenses because I fully expect that my expenses will massively change in a couple of months. At that time, I will identify more fixed expenses. It’s going to take me some time to fully pay my Amazon Prime bill with my dividend income. So no rush. I’ll also be working on how I can make the table more automatic with formulas and the like. So stay tuned.

Adopt A Stock Project

The adopted stock for May was Exxon Mobile (XOM). The project is still a working progress. I had intended to adopt the stock from the 15th of the month to the 14th of the next month. So, that would mean that I would adopt XOM from May 15 through June 14th. But, I now will start identifying the stock to be adopted on the first of every month – even if I won’t be able to buy an extra share until the 15th. So, the stock will be evaluated for adoption on the first of every month.

Once a stock is adopted, I’ve committed to purchasing at least one additional share of that stock. It’s going to be difficult to do some months, like in June and July, but it’s a commitment I intend to keep. I’ll re-evaluate the project at the end of the year.

In May, I was able to buy 12.4706 additional shares of XOM at a $40.65 share price totaling $506.93. XOM is now overweighted in my portfolio.

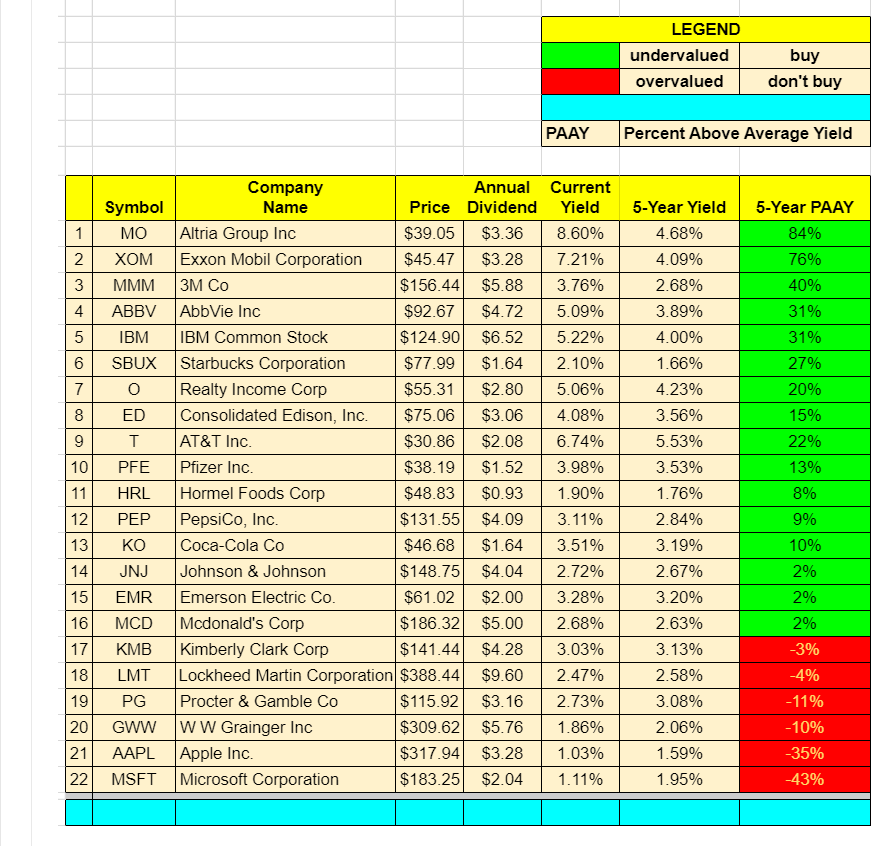

In June, the adopted stock of the month is Altria Group (MO). See the valuation below:

Remember, the higher the PAAY, the more undervalued the stock may be. The lower the PAAY, the more overvalued it may be.

See the Adopt A Stock Project page for additional information. Rules are subject to change. And I always welcome your inputs.

Condo News

June will be a very important month. There is a possibility that I could finally close on the condo. The building is set to be finally finished around June 15, 2020. So closing might be towards the end of June or more likely early July.

I am bracing for some potentially bad news, as well as potentially good news, in terms of how much I need to bring to closing. Depending on the bank and the closing cost, I could be short up to about $5000 or have significantly way more than I need for closing with a much better interest rate.

If I come up short, depending on the amount, I might simply withdraw the funds from my Roth IRA without penalty with the goal of rolling it over within 60 days. Rolling it over means putting the money back into my Roth IRA account. I won’t do anything until I know for sure what closing costs are going to be. But, I also won’t know that until I figure out which bank I will be using for closing.

Finally, I recently spent $3000 to buy a couch for the condo. Don’t ask why I spent so much. It was a queen-size sleeper sofa sectional and a love seat all in one. It takes about 6 weeks to make and so it was better to order that now, so that once I close on the condo, it can have suitable furniture in the unit as soon as possible. I had to pay cash for the couch because banks don’t like it when you take on new debt while trying to get a mortgage. All remaining furniture will likely be financed after I close on the unit. But, again, that depend on which bank I end up using.

Conclusion

I hope this dividend income report brought you a tad bit of joy or even inspiration in a world filled with bad news. The total amount of dividends wasn’t a lot, but these are the very first few steps I am taking towards rebuilding my portfolio.

The dividend growth investing road to financial freedom is long and hard, but I truly believe that in the end, it will be worth it.

How was May for you? Did you reach any milestones or break any records? Any ideas on how to improve on the Adopt A Stock Project? What did you think of this post? Let me know by commenting below.

Nice metrix you developed here 5y avg. dividend yield vs. Current yield. This migh end up buying past srocks that market see bad in the future.

Maybe but the thing is that all these stocks are already in my portfolio and I plan on keep purchasing shares of these stocks every month. So even if my metrics are off, I’m not doing anything more than I ordinarily would do otherwise. That’s how I look at it.

But I’m hoping my metrics are not off and that I am buying more shares of these stocks while they are undervalued.

Hmm good point. Pick a stock list and then prioritise. Yes some stocs get some event from time to time. PG was beat down some time ago, also JNJ and some otner great stocks that are way up high today.

It looks like my valuation chart analysis agrees with your assessment on PG and JNJ

That’s a nice month Dividend Portfolio. Reading this report brought me a lot of joy. It was exciting to see your dividend income grow 250% compared to last month. Its time to rebuild and see this thing take off. Best of luck closing your Condo!

Bert

Dividend Diplomats recently posted…Dividend Increases – Expected in June 2020 -(Hopefully)

Thanks Bert. I’m going to need it, with respect to the condo. Really looking forward to the portfolio growing more this year.

Slow and steady wins the race DP. I’m always happy reading your positive posts and being happy with these amounts knowing where you can from.

Keep it up!

Thanks a lot. I keep thinking about dividend income almost every day. I want to be financially independent like yesterday but I know it’s going to take years of patience and discipline. I appreciate the continued support.

Pingback: Dividend Income from YOU the Bloggers - May 2020

Pingback: Dividend Income from YOU the Bloggers – May 2020 | ResourceShark Blog

Pingback: Dividend Income Report - June 2020 - Dividend Portfolio

Pingback: Dividend Income Report - July 2020 - Dividend Portfolio