Can you believe it? We are already in September. Happy Labor Day everyone. Only 4 more months to go before the end of the year. I for one can’t wait until the year is over. This year has been crazy for me. Despite all the downs that have occurred recently (and there have been a few), I am trying to keep my spirits up. There are a lot of blessings in my life and a lot of things to be thankful for. Things could be much worse. One of the things I can count on is my dividends working for me in the background. Rain or shine, good times or bad, my stock portfolio continues to pay me passive income in dividends. Those dividends not only increase my savings, but they get reinvested in my portfolio allowing me to experience compounding growth – albeit at a slow pace. Overtime, the growth rate will become exponential. Until then, I continue to track my progress and hope to one day realize the benefits of financial freedom. So, without further adieu, let’s see how much dividends I earned in August 2022.

Dividend Income

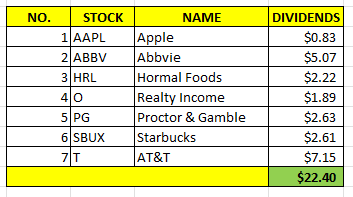

In August, I earned $22.40 in dividends broken down as follows:

Slow and steady wins the race. That near $23 was added back into the dividend portfolio to buy more shares. Over time, I will benefit from compounding growth and if I’m doing it right, also ever increasing dividends. Moreover, beginning 2023, or late 2022, I anticipate slightly increasing my minimum contributions to my dividend portfolio. So, this amount will get bigger and bigger as my dividend snowball gets larger and larger.

In previous posts, included my July 2022 Dividend Income Report, I indicated that I will be drastically increasing my minimum contributions. However, for the reasons identified towards the end of this report, I am modifying that stance. So, I will still increase contributions, but I don’t anticipate it will be drastic. Any drastic increase would likely come around July or August 2023.

Annual Income

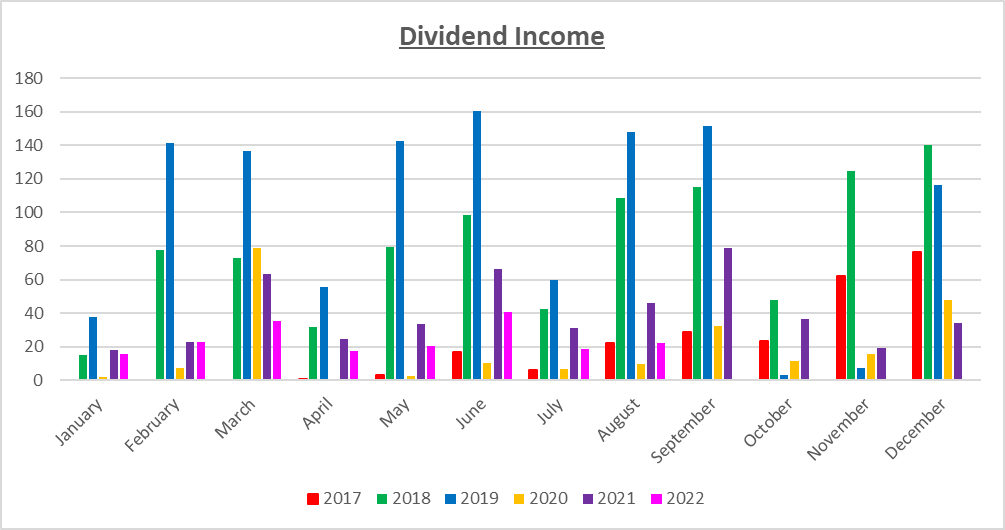

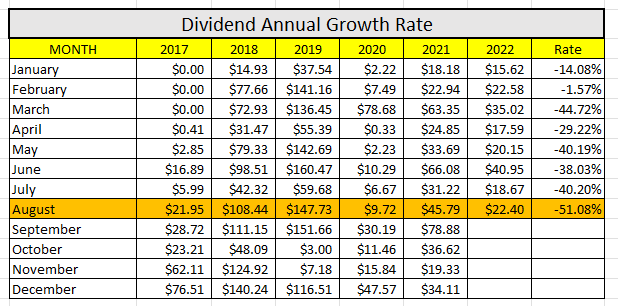

Here is a graphical representation of the dividends earned in August in relation to dividends earned in previous years:

Here is the raw data:

I made 51.08% LESS in dividends this August than I did in August of last year. It could be worse. Clearly my dividend portfolio did not move in the direction I would have hoped. But, with consistency and dedication, I fully expect August 2023 to be well on its way to exceed the income generated in August 2022.

Forward Annual Dividends

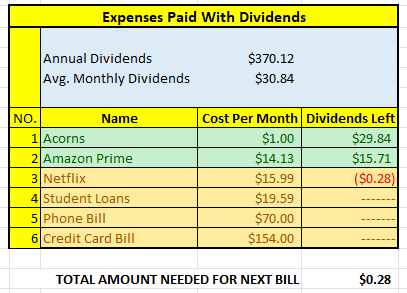

At the time of this writing, the forward annual dividends is $370.12. A month ago, my forward annual dividends was $357.32. This represents a healthy 3.58% growth from the previous month. Still, I know that there this is much work to do.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$370.12 per year is $30.84 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Amazon Prime. I cancelled my Hulu Plus subscriptions, but I renewed my Acorns subscription. The next bill I am targeting is Netflix. The total amount needed until I can pay the next bill is $0.28 in dividends. I hope to cover this bill in September.

The following is a list of expenses I am targeting:

14-Month Savings Goal

This is a brand new project I am starting. When I initially drafted this post, I explained this project fully, but then I realized it was too long and deserved its own post.

So, sufficed to say, I plan on saving towards the down payment on a beach condo (or house) and I will be tracking my progress here on a monthly basis.

My savings amount and strategy are specific and will be outlined in a later post on the subject. But, as referenced above, because of this savings goal, I won’t be drastically increasing the minimum contributions to my dividend portfolio in January 2023.

Conclusion

As I take a break from work during this Labor Day weekend, it gives me a moment to reflect on life and reflect on my goals. I am determined to finish the year strong and to work on saving more money and spending less.

My dividend portfolio is an important part of my overall retirement planning strategy and I am also determined to see this strategy through. We have four months left in the year and that’s plenty of time to make sound financial decisions that our future selves will be thankful for.

So, how was August for you?

Let me know your thoughts by commenting below.

Considering the amount of passive/semi-passive income that you’ve added with the condo I think you’re still doing just fine. Out of curiosity is the down payment for another rental or for personal? I’m sure you’ll be covering that later though if you want to keep the suspense. I’m glad you’re going to be able to start increasing your investment contributions though. That will definitely help build up your portfolio.

JC recently posted…Investment Review – EOG Resources

Thanks JC. The down payment would be for another beach condo. However, I may be decide to move next year and so, if I do, I may want to do what I did last year, which is buy a personal residence to live in, and then a beach condo.

I agree that it’s good to increase the contributions on the dividend portfolio. I’m doing what I can, but if I drive for Uber and Lyft more, that may help some (but not that much due in part to high gas prices). I’ve also been flirting with the idea of getting a second job, but I don’t know anything as flexible as doing rideshare.

Thanks for the comment.

Every little bit counts. Your very close to covering the Netflix bill with dividends. Keep it up! 🙂

My Dividend Dynasty recently posted…August 2022 Dividend Income

Thanks. I can’t get to be able to cover Netflix. After that, it’s going to take some time before I can cover the next bill, but I’ll eventually get there.

hey Port

Nice man, nothing wrong with buying real estate – especially beach side. I always wish we were or had something by the water.

slowly but surely the income grows. keep it up

passivecanadianincome recently posted…July 2022 Passive Income – An Outstanding Month!

Thanks Rob. I can’t wait for the income to grow, but I know it’s going to take time and patience.

Every bit counts. As long as you continue to reinvest and contribute what you can your divvys will grow. Personally, I have zero video watching subscriptions. No Hulu, Netflix, Prime, Disney, nothing. I don;t miss anything at all. I do have a Roku and there is plenty to watch for free. Everyone does their own thing but for me I’m happy not having those monthly bills. Happy to share almost all your payers for the month. Just keep moving forward.

DivHut recently posted…Dividend Income Update August 2022

Thanks Div Hut. One of my friends doesn’t even own a TV so he comes over my place at times to watch shows. The subscriptions do add up, but I do get value in having access to them. I’m sure that will change in the future.

The goal is to definitely continually reinvest my dividends. I’m a bit impatient but I do know slow and steady wins the race.

Thanks for the comment.