I’ve been looking forward to filing this report for some time. The reason is simple. July is the busiest month of the year! For the first time since I owned the condo, my calendar has been 100% booked for the month. Sometimes, I’ll have someone check out on a Friday, and another guest check in the next day. But not in July. Hopefully, the trend continues next year, but for now, and as you will see shortly, I am very satisfied with the results. That being said, I am fully aware that the remaining months won’t be as hot. Moreover, we are closely approaching the off season, so this (or any) monthly report should not be taken in isolation. But, without further adieu, lets show much profit I earned in July 2022.

Vacation Rental Profit / Loss

Let’s see how much profit/loss I made for the month.

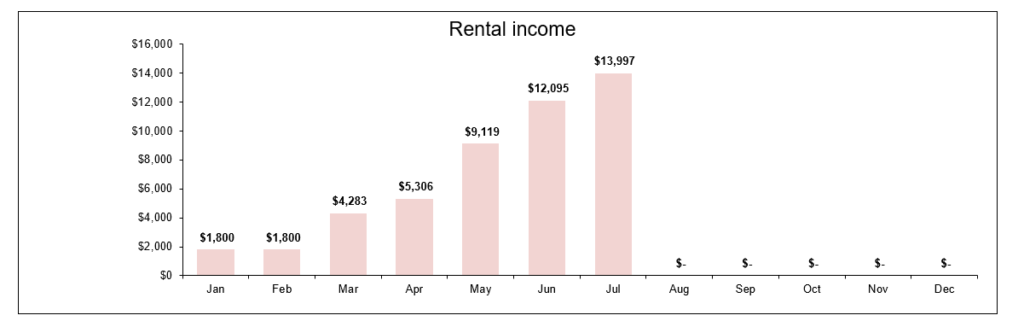

A. Vacation Rental Income

During the month of July, I earned $13,997 in income broken down as follows:

Wow! Let’s just take in the fact that I made nearly $14000 in revenue in one month! That’s just crazy to me. I mean, you see the value of my dividend portfolio. I made more revenue in one month than my overall dividend portfolio is worth.

Now I get the fact that this isn’t profit. But still, it’s an impressive number. I’ve never generated that kind of income from my job, or any side hustle, or any other investment before. It’s all very exciting! But, I know I won’t be on cloud 9 forever.

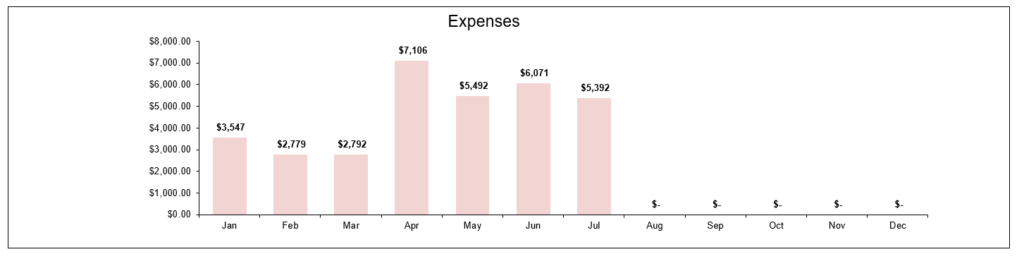

B. Vacation Rental Expenses

During the month of July, I incurred $5,392 in expenses as shown below:

My expenses in July were relatively normal. I pay my HOA every three months, and it just so happens that the third month was in July. So, it seems that every third month, my expenses will be around the $5000 mark, and otherwise around the $3000 mark.

As mentioned in previous posts, I plan on having elevated expenses this year. I want to replace my dryer and my refrigerator. The idea is that come 2023, I hope to only have regular expenses, barring any emergencies in maintenance or the weather (like a hurricane).

C. Profit/Loss

Based on the rental income and expenses for July, I incurred a profit for the month. The total profit was $8,606. I’ll take it. However, what’s more impactful to me is the overall profit since the year started. Year-to-date, the total profit experienced so far is $15,221. I am very pleased with the results so far.

If you recall, I am managing the beach condo all by myself, and so I don’t pay a property management company. Eventually, at the end of the year, I might decide to pay myself 10% of the profits for my efforts, but we will see. I’ll decide on that later on, but regardless, that seems like a good problem to have.

One of the things I’ve been toying with lately is to not take any money out, and save as much as possible to buy my next unit. This will be especially important in 2023. That way, I can update the property as much as I can this year, and then just save the profits next year. Time will tell.

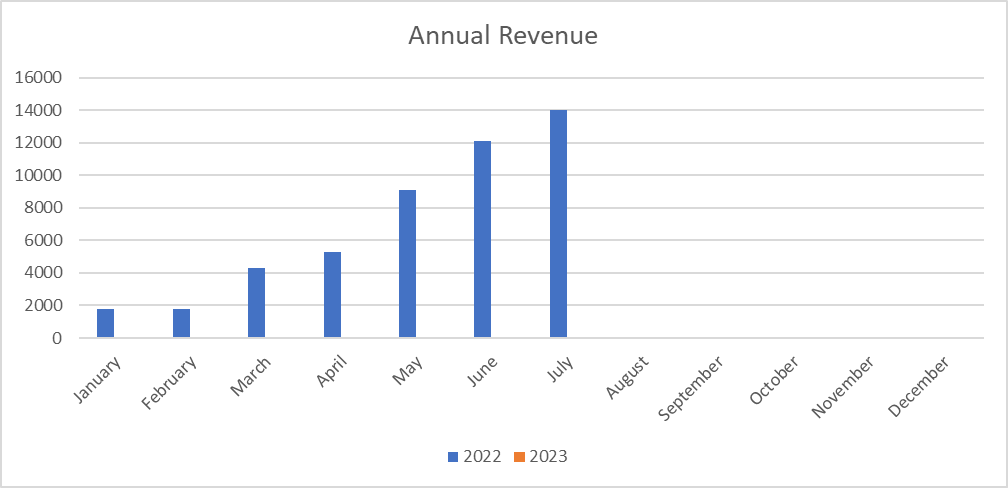

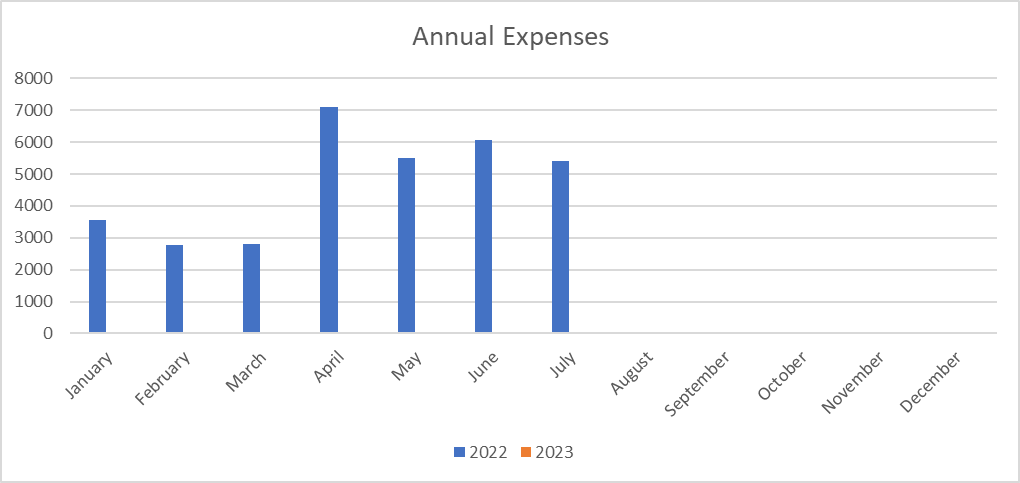

Annual Income/Expenses

As this is my first year investing in a vacation rental, I don’t have any annual income to compare it to. However, for purposes of this section, here is a graphical representation of the revenues earned in July 2022 in relation to the revenues earned in previous years:

Here is a graphical representation of the expenses incurred in July 2022 in relation to the expenses incurred in previous years:

As you can see, the charts are exactly the same (except in style) as indicated above. This annual comparison section will make a lot more sense come 2023 when I am able to make a comparison. I will be able to see a trend not just from month-to-month, but also from year-to-year.

Finally, I am mindful that as we are possibly heading to a recession, the vacation rental market might be one of the first industries to be negatively affected. So, I am under no illusions that I may not be able to rely on these revenues forever. In fact, there is no guarantee that I will be able to post higher numbers next year. But thankfully, I am still in a position to be able to afford the expenses on my own, if push comes to shove. It will be tough and I may have to live on beans and rice, but it is one of the reason why I chose this particular unit as the first one to purchase.

Conclusion

July was a beast of a month. But, it’s only downhill from here. In looking towards August, my calendar is NOT as full. In fact, I am struggling to earn enough in income to cover all the expenses. But, for now, I am thankful that my investment is paying off.

This has been such a great experience, that I am already contemplating how I can afford my next beach condo – without liquidating my dividend portfolio. I am confident that I can afford the down payment on my own in about 3 years, but I am impatient. So, I plan on exploring creative financing options. I also recognize it may not be the best time to buy. But I am taking everything into account.

I am still hoping to squeeze more profit in before we officially hit the slow season. But, even if I don’t make another penny this year, the results so far has exceeded my expectations.

What did you think of this post?

Let me know your thoughts by commenting below.

Looking good DP!

So looks like your base annual expenses are something like $44k? $3k for 8 months $5k for 4 months? How’s August look for bookings for you? I’m guessing it slows down probably around mid-month to where it’s just weekend warriors for the most part after that? It looks like your summer months should cover your annual expenses and it’s the offseason where you can make profit. If the back of the envelope math seems right.

JC recently posted…Dividend Increase | Illinois Tool Works $ITW #Dividend

Hey JC,

I guess that’s one way to look at it – and probably the best way. I will say though that part of the expenses include taxes and cleaning fees and that’s typically covered by the guest (not in the entirety). But, yes, that sounds about right. The good news is that, as of right now, the expenses include the mortgage debt associated with the condo. In the long run, when the mortgage is paid off, the expenses will be greatly reduced.

The other good news is that the condo, as of right now, appears to be paying for itself. You’re absolutely right in that I make enough money in the busy season to cover the bare expenses for the year, and then the rest is gravy. I haven’t pocketed any funds yet. Any funds I’ve withdrawn have been used to re-invest back in the unit. I still have more improvements to make. It’s going to be very interesting next year when I focus on keeping my expenses at a bare minimum.

Right now, I have enough funds to pay my minimum expenses through the off season (if somehow I get zero bookings then, or there’s a hurricane that shuts me down, etc) and that’s a great position to be in.

Regarding August, there are more gaps in my calendar, but that’s partly my fault. I chose to use the condo during a 4 day weekend and that lowers the revenue that could have otherwise been generated from renting the condo out. Making profit is a priority for me, and it makes a lot of business sense to only use the condo during the off season. But I had my reasons. But, so far, the end result is that August is shaping up to either be break even, or a slight loss for the month.

For what it’s worth, September is already shaping up to be a profitable month just based off the bookings I already have.

Thanks for the comment. I will continue to share my experiences, whether they are good or bad.