Happy New Year! And, welcome to the last dividend income report for 2020. It goes without saying that 2020 was a crazy year and everyone I know is glad that it is over! During that year, I had to sell my stocks which impacted my dividend snowball strategy. Additionally, I had to move to a new location in order to reduce expenses. Oh, and yea, there was a global pandemic that has cost millions of deaths worldwide and which has forced governments to enable lockdowns. But, despite all the bad, there is hope for the future.

For starters, 2021 is here! Also, the dividend snowball machine is working, albeit slowly. And, there is a vaccine that will hopefully eradicate the virus. However, while it’s important to look forward, it’s also important to take a look at where we’ve been. So, with that said, let’s take a look at how much dividends I earned in 2020.

Dividend Income – From The Dividend Snowball Strategy

In December 2020, I earned $47.57 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | ED | Consolidated Edison | $3.12 |

| 2 | EMR | Emerson | $2.02 |

| 3 | GWW | W.W. Grainger | $1.41 |

| 4 | IBM | Intern. Business Mach | $3.81 |

| 5 | JNJ | Johnson & Johnson | $2.83 |

| 6 | KO | Coca-Cola | $3.18 |

| 7 | LMT | Lockheed Martin | $2.32 |

| 8 | MCD | McDonalds | $2.53 |

| 9 | MMM | 3M Company | $3.61 |

| 10 | MSFT | Microsoft | $0.88 |

| 11 | O | Realty Income | $1.56 |

| 12 | PFE | Pfizer | $2.81 |

| 13 | XOM | Exxon Mobile | $17.49 |

| $47.57 |

Almost $50! Although it’s a far cry from where the portfolio used to be, $47.57 is not a bad way to end 2020. With a new year comes renewed focus and drive. I will share my 2021 financial plan in another post. But, for now, I’ll just say that I plan on making 2021 a happy new year!

Annual Income

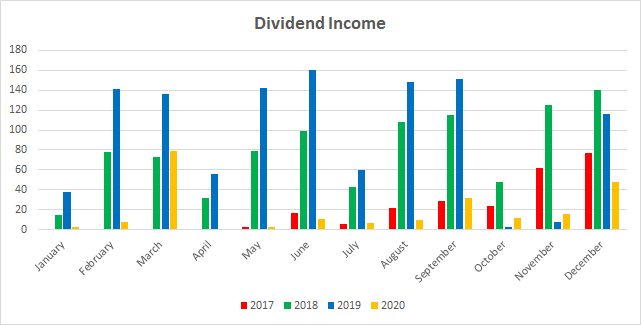

Here is a graphical representations of the dividends earned in December in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | -94.09% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | -94.69% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | -42.34% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | -99.40% |

| May | $2.85 | $79.33 | $142.69 | $2.23 | -98.44% |

| June | $16.89 | $98.51 | $160.47 | $10.29 | -93.59% |

| July | $5.99 | $42.32 | $59.68 | $6.67 | -88.82% |

| August | $21.95 | $108.44 | $147.73 | $9.72 | -93.42% |

| September | $28.72 | $111.15 | $151.66 | $30.19 | -80.09% |

| October | $23.21 | $48.09 | $3.00 | $11.46 | 282.00% |

| November | $62.11 | $124.92 | $7.18 | $15.84 | 120.61% |

| December | $76.51 | $140.24 | $116.51 | $47.57 | -59.17% |

Back in negative territory, but there is good news. If you look at the previous quarter, you will see that my portfolio earned 80.9% LESS in dividends than it did the previous year. Now, that number has improved such that for December, the portfolio earned 59.17% LESS in dividends than it did the previous year. So, although the percentage remains negative, it’s moving in the right direction. I am hopeful that I will be in positive territory in 2021.

Forward Annual Dividends

At the time of this writing, my forward annual dividends is $382.05. A month ago, my forward annual dividends was $352.89. This represents a healthy 8% increase from the previous month. I’ll take it.

Finally, the Dividend Tracker has been updated accordingly.

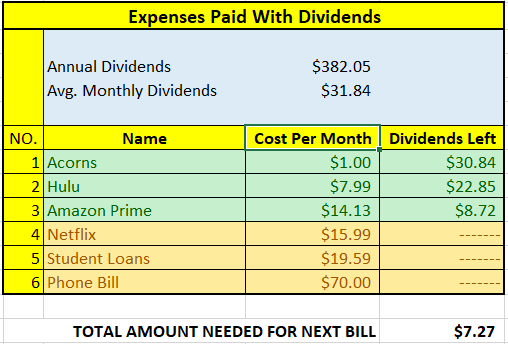

What Expenses Would My Dividend Snowball Strategy Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$382.05 per year is $31.84 dividends per month, on average. At present, I pay $1 per month to use Acorns. Also, my Hulu Plus bill is $6.41 per month. I earn enough in dividends to cover Acorns, Hulu Plus and Amazon Prime. The next bill I am targeting is Netflix. That amount is $15.99 per month. The total amount needed until I can pay the next bill is $7.27 in dividends.

The following is a list of expenses I am targeting:

Note: starting with my next dividend income report, I may be restructuring my expenses. So, stay tuned.

Adopt A Stock Project

As indicated in my November 2020 Dividend Income Report, I have evaluated whether to continue and/or modify the adopt a stock project. I’ve decided to discontinue the adopt a stock project for now. The reasons are several.

Based on how the project worked, I attempted to identify the most undervalued stock in my portfolio and then bought additional shares of that stock. I thought this was a good way of forcing myself to add extra funds to my portfolio to make the dividend snowball roll faster. However, the stock that has been consistently identified as undervalued was Exxon Mobile (XOM). That resulted in XOM being overweighed in my portfolio. So, by eliminated the adopt a stock project, my dividend portfolio will once again remain in balance.

Additionally, there are other things I wanted to focus on in 2021. This includes starting a YouTube channel (more on that later). So, for numerous reasons, I’ve decided discontinue the adopt a stock project.

YouTube Channel

I’m scared. You may recall that one of my 2020 Resolutions was to start a YouTube Channel. Well, that hasn’t happened yet. The idea of going on YouTube is scary as I am naturally a private person. But, after a whole year of procrastination, and analysis paralysis, I’ve decided to punch fear in the face and start my very first YouTube Channel.

After days of agonizing and brainstorming, I came up with a name. I am working on creating my first video shortly and finally uploading my first live video to YouTube. I will likely reference this blog on my channel and will also reference my YouTube channel on this blog.

The YouTube channel will focus on more than just building a dividend snowball, it will include other personal finance issues such as building wealth, getting out of debt, investing, etc. Regardless, wish me luck.

Conclusion – The Dividend Snowball Strategy Works.

Building a dividend snowball is not easy. It takes years of discipline and consistency. 2020 set the portfolio back a little bit, but it did not destroy the portfolio. Sometimes in reaching your goal, you may stumble or fall. It’s the getting back up that’s most important. I for one am very excited that 2020 is over. Now that 2021 is here, it’s time for the new me!

Believe it or not, I am still working on finalizing my personal goals for the new year. I will be sharing most of those with you in future posts. But, for now, I hope you enjoyed this post.

Finally, to all my readers, thank you very much for supporting this blog. Stay tuned as I hope to produce more valuable content throughout the year.

What did you think of this post. Let me know by commenting below.

Thank you!!1

Glad you liked it Crogan

Keep up the growth 🙂

P2035 recently posted…Y2021 Goals

Thanks P2035. Happy New Year to you.

I’m an old retired school teacher who never invested in anything beyond a Vanguard IRA I’ve had for years. I recently started building a small DGI portfolio for my son who is living with a disability so as to hopefully provide him a little extra financial support in his future.

Got to tell you DP, you are one of the very few financial blogs I follow religiously. I so very much appreciate your honesty when describing your ups and downs as you build your own portfolio; even this old codger has learned a lot from you! Thank you….

Can’t wait for your YouTube channel! I will be your first of many followers! Be well and good luck with your future!

Oh wow. Thanks SFLocal. That’s really inspiring and definitely good luck on the DGI portfolio for your son. It’s good to hear from supporters from time to time and I’m glad I was able to provide some value to you. As I work on building my channel, I hope to continue to provide value to my audience. So, I’m looking forward to you subscribing when I go live :).

Again, thanks for the well wishes and I hope you and your son have a Happy New Year!

Nice close to the year DP! Definitely looking forward to your YouTube channel . Best of luck in 2021! 😀

My Dividend Dynasty recently posted…December 2020 Dividend Income

Appreciate it MDD.

Thanks for the update. Keep pushing your dividend income forward DP. That’s all that matters. You’ll be back at the previous levels before you know it.

You’ll be shocked how great this year is going to be. I wouldn’t completely disregard your YT channel idea. It is a lot of fun. I am also on the shy side and it hasn’t been easy for me. But you bet that I am glad that I have done it.

Keep pushing forward and let’s see your dividend income cover more expenses. What interest rate are you paying on your student loans?

Bert

Thanks for the encouragement Bert. Interest rate on student loan is currently 2.625%. It’s a low interest rate currently under $7137 – not too bad at all.

Pingback: Dividend Income from YOU the Bloggers! - December 2020

Awesome report, Dividend Portfolio! I love that you cover what expenses your dividends pay for. I look forward to your YouTube video. Like you, I am a private person, so it’s something I have not considered yet. If I had more time and the skills, I would enjoy putting some videos together. And indeed, the dividend growth strategy does work. We both received dividends from KO in December. Keep it up!

Graham @ Reverse the Crush recently posted…Dividend Income January 2021 – Up 30% Over Last Year

Thanks RTC. KO is an awesome company by the way. It’s one of my original investments and one that I plan on keeping long term. I’ll definitely let the community know when I post my first video.