Wow, I’m so late with this report. Work has picked up and all of a sudden, I’m incredibly busy. What’s more, we are already into March! I know February was a short month, but still – the year is going by fast. I still can’t wait for the day when life gets back to some sense of normalcy. In the mean time, dividends continue to work for me in the background. So, without further adieu, let’s see how much dividend income I earned in February 2021.

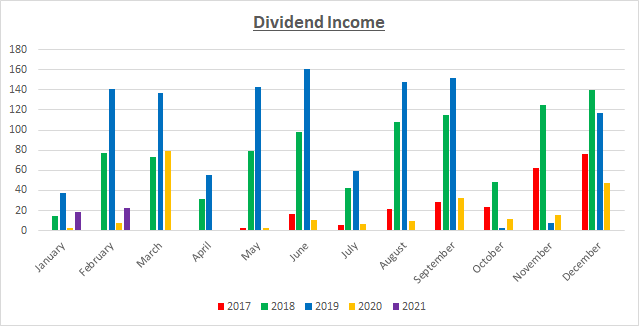

Dividend Income

In February 2021, I earned $22.94 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | AAPL | Apple | $0.85 |

| 2 | ABBV | Abbvie | $6.24 |

| 3 | HRL | Hormel Foods | $2.16 |

| 4 | O | Realty Income | $2.13 |

| 5 | PG | Proctor & Gamble | $2.44 |

| 6 | T | AT&T | $9.12 |

| $22.94 |

For what it’s worth, this is more dividends earned than the previous month. $22.94 is a respectable number and more than I had before. This amount will be re-invested in the dividend portfolio so I can experience the benefit of compounding.

Annual Income

Here is a graphical representation of the dividends earned in February in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | 2021 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | $18.18 | 718.92% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | $22.94 | 206.28% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | ||

| April | $0.41 | $31.47 | $55.39 | $0.33 | ||

| May | $2.85 | $79.33 | $142.69 | $2.23 | ||

| June | $16.89 | $98.51 | $160.47 | $10.29 | ||

| July | $5.99 | $42.32 | $59.68 | $6.67 | ||

| August | $21.95 | $108.44 | $147.73 | $9.72 | ||

| September | $28.72 | $111.15 | $151.66 | $30.19 | ||

| October | $23.21 | $48.09 | $3.00 | $11.46 | ||

| November | $62.11 | $124.92 | $7.18 | $15.84 | ||

| December | $76.51 | $140.24 | $116.51 | $47.57 |

Again, a very respectable 206%. Of course, this is far less than the 2019 figure, but I have every confidence that I will cross that threshold again eventually.

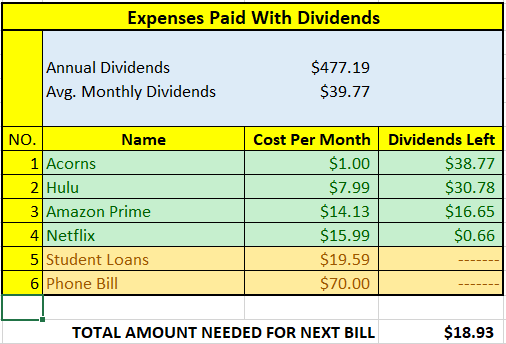

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $477.19. A month ago, my forward annual dividends was $419.89. This represents a healthy 14% increase from the previous month. I’ll take it.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$477.19 per year is $39.77 dividends per month, on average. At present, I earn enough in dividends to cover Acorns, Hulu Plus, Amazon Prime and Netflix. This is the first time I am able to cover Netflix! The next bill I am targeting is my student loans. That amount is $19.59 per month. The total amount needed until I can pay the next bill is $18.93 in dividends. With any luck, hopefully I can cover this bill by the end of the year.

The following is a list of expenses I am targeting:

YouTube Channel

Unfortunately, I’ve decided to put off going live on my YouTube Channel for now. Things may change. My mood may change. But, ultimately, I don’t feel like I have the time to devote to it or that I am comfortable going live. This is the closest I’ve been, and I’m sure one of these Saturdays, I might just say F*** it and go live, but as of right now, I’m leaving well, well enough alone, so to speak.

Side Hustle

This will likely be the subject of my next post, but to give you a preview, I’ve started a new side hustle that is bringing in a small amount of income. To figure out what that is, stay tuned to Dividend Portfolio updates.

Conclusion

There you have it. I apologize for getting this report out so late. Although other posts may come and go, one of the stable of this blog is the publication of my report religously on the first of the month. Unfortunately, I was uanble to do that this month. What’s more is that I’m heading into the busy season at work, but I still intend on publishing the next dividend income report promptly on the first (latest the second) of next month!

Additionally, I’ve continued to make progress with rebuilding my portfolio. And finally, although I sound like a broken record, I really do expect the condo decision to be finalized, one way or the other THIS month! I’ll announce what that is soon.

How was February for you? Let me know by commenting below.

Nice month DP! Congrats on being able to cover your Netflix bill! This is very exciting. The dividends just keep growing. 😀

My Dividend Dynasty recently posted…February 2021 Dividend Income

Thanks MDD. I’ll checkout your progress soon! I really anticipate being able to announce more important news within the next two weeks…so stay tuned.

A $57ish increase in forward income from last month to $477 is pretty impressive. You keep getting bumps like that every month and this snowball is going to get big fast.

SD Growth recently posted…Buys and Sells for the Week 3/12

Thanks SD Growth. I wasn’t even focused on that, but I hope you’re right.

Pingback: Dividend Income from YOU the Bloggers! – February 2021