Welcome to the first dividend report of the new year. I have lots of plans for 2023 and some of the biggest ones will likely occur in the next two months. Specifically, I am actively looking to purchase another beach condo, hopefully one bigger (and thus more expensive) than the one I purchased before. I’ll be cashing out of my retirement accounts to do so. Hopefully, I won’t have to touch my dividend portfolio, but all options are on the table. Should I have to withdraw from my dividend portfolio, I pledge to replenish the amount asap! Dividend growth investing is a long-term strategy that I fully intend to invest in for as long as I can. So, without further adieu, let’s see how much dividends I earned in January 2023.

Dividend Income

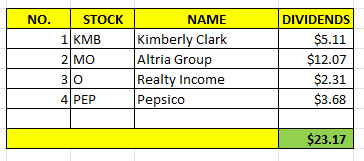

In January, I earned $23.17 in dividends broken down as follows:

That’s $23.17 dollars that was reinvested back into the dividend portfolio. That’s the beautiful thing about dividend growth investing. Overtime, I get the benefit of compounding growth. $23.17 is a small amount now, but over time it will grow exponentially larger! I can’t wait.

Annual Income

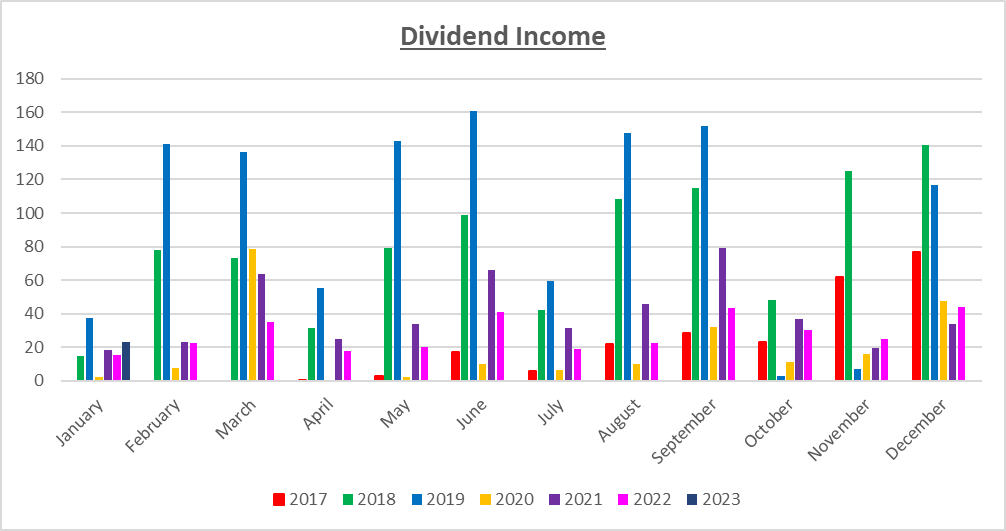

Here is a graphical representation of the dividends earned in January in relation to dividends earned in previous years:

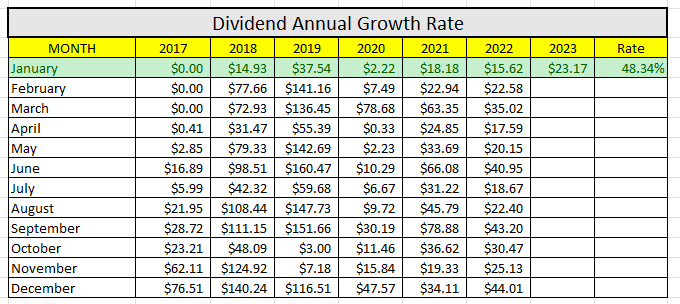

Here is the raw data:

Yes! As you can see, I earned 48.34% MORE dividends this year than I did last year. Granted, I am still down from my highs in 2019, but the portfolio is definitely moving in the right direction. This is huge motivation for me to continue to build. Again, I know $23.17 is small now, but that’s not the point! The point is the the discipline that comes with continually investing in a portfolio and watching the magic of compounding do its thing. I am beyond excited! It’s a great way to start the New Year!

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $400.35. A month ago, my forward annual dividends was $403.34. This represents a small 0.67% DECLINE from the previous month. What gives? Afterall, I didn’t have any withdrawal over the past month. Let’s discuss.

Although I report on my forward annual dividends every month, I realize that the only thing I was updating was simply the number of shares I own. What I wasn’t updating was any increase or decrease in dividends issued by the various companies. Quite frankly, because I hadn’t done it for a while, virtually every company in my portfolio reported an increase. All but one – namely AT&T! As you can see, I own 33 shares of AT&T. So that decrease in dividends really hurt the portfolio. Hence the small decline.

That being said, I won’t promise to always update the dividend increases or decreases. I have to do it manually and I’m lazy! I do update the shares (I’m used to it). However, I will try to do better with the dividend increases and decreases. No promises.

Finally, the Dividend Tracker has been updated.

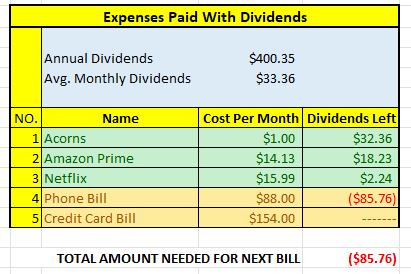

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$400.35 per year is $33.36 dividends per month, on average. At present, I earn enough in dividends to cover Acorns, Amazon Prime and Netflix.

The following is a list of expenses I am targeting:

As you can see, I removed my student loans from this list. That’s because my student loans were paid off earlier this month! Again, the year is off to a great start with respect to my financial situation.

Finally, I will need to reassess my expenses in 2023. For starters, I will likely be moving to live with mom for a bit. I anticipate that a lot of my expenses will be reduced once I rent out the house I am living in. My utilities, internet and lawn care add up to over $500 a month!!! I won’t have any of those once I move in with my mom. Honestly, I can’t wait to move.

Final Thoughts

The dividend portfolio is off to a great start! The only down side was the small reduction in forward annual dividend income. As mentioned, I will try to be more accurate with this section in the future.

There are a lot of changes coming within the next couple of months. During that time, I plan on putting in an offer on a beach condo. That may come as early as next weekend, definitely sometime in February. Unless my health turns for the worse, that’s the current plan. But, I won’t make this decision until I get an update from the doctor.

In addition, I plan to move in to live with my mom sometime in March. The house I am living in has been rented. I have a property manager that already found a tenant and she will be managing my house going forward. So, this will be one less thing to worry about. I will update the community accordingly.

So, I will take the small win and the strong start to New Year.

How was January for you? break any records? What did you think of this post? Let me know your thoughts by commenting below.

Looks like a good start to the new year for you. And that’s pretty cool that you’re looking at making the 2nd condo purchase, well at least an offer, so quickly. Do you have is narrowed down to a few different choices or is there really just one contender? January was a great month for our dividends as we crossed over $900 for our main account which is a huge step up. I’m pretty excited for 2023 whether we move forward on some opportunities and take the hit to our dividends over the near year or two or whether we forgo that and get back investing our excess cash flow each month.

JC recently posted…Dividend Increase | S&P Global $SPGI #Dividend

Thanks for the comment JC. I’ve got it narrowed down. I just gave my realtor my top 6 choices. I am planning on making offers over the weekend, but there is always next weekend if I don’t find anything I like.

Congrats on crossing the $900 mark and good luck with you upcoming decision in 2023. I know it’s not always ideal to have your dividends take a hit, but if opportunity is knocking on your door, you may want to answer. Good luck with whatever decision you make and I look forward to hearing all about it!