It’s almost the end of January 2023 and I haven’t posted my vacation rental report for December 2022. My bad! I guess I was so excited for a new year that I forgot. In any case, better late than never. I hope that you find value in these reports. The vacation rental market is one that can make an investor a lot of money. But it can also lead to ruins if one is not careful. Whether I am up or down, making a profit or not, I plan on being completing transparent along the way. Who knows, maybe one day I will write a book about it. But, that’s not today. Today, I will simply report how the vacation rental did at the end of the month. Let’s go!

Vacation Rental Profit/Loss

In December, I expected my calendar was going to be mostly empty and reality did not disappoint. My goal in every month is to at least try to break even. Once again, I failed miserably. Let’s see how.

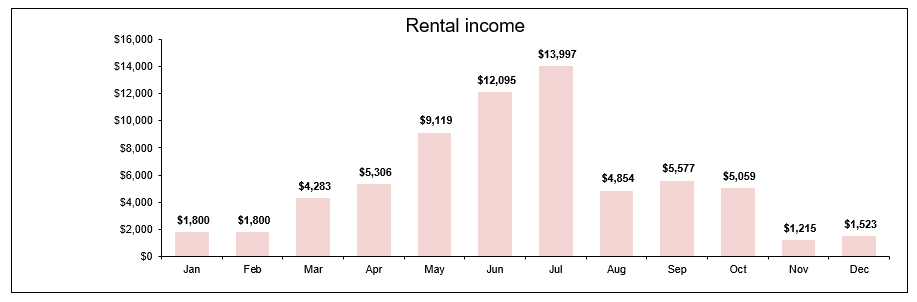

A. Vacation Rental Income

During the month of December, I earned $1523 in income broken down as follows:

I had two bookings in December and they were all during the last week into the new year. So, in terms of income, December was pretty light. However, I would take two bookings over zero bookings any day. It’s the slow season and I purposely chose not to take on any snowbirds in December because I wanted to see how the condo would do without snowbirds. Now that I know, I decided to take snowbirds in 2023. I didn’t have any in January, but I have a snowbird that’s booked in February. Lesson learned.

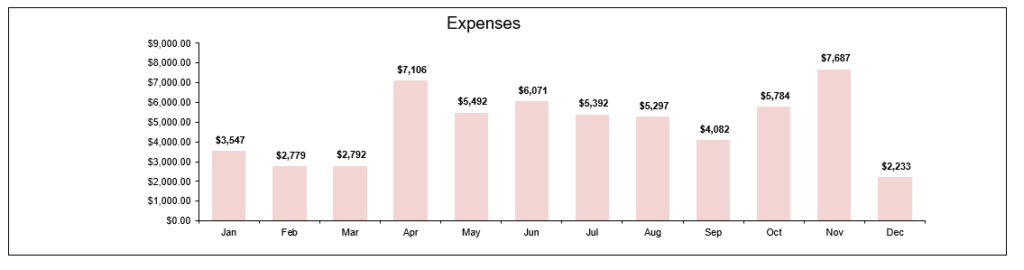

B. Vacation Rental Expenses

During the month of December, I incurred $2233 in expenses as shown below:

As you can see, my expenses were pretty typical in December. However, as you can also see, I wasn’t able to break given. As mentioned, in 2023, I will definitely look into getting snowbirds.

C. Profit/Loss Statement

So, as you can see, I incurred a loss of $710 for the month. It could be a lot worse.

In 2022, my gross income was $66,628. My total expenses were $58,621.The overall profit for 2022 was $8,367. Not bad. I incurred a lot of marketing expenses as well as one-time expenses (hopefully) to improve the property. In looking ahead to 2023, I anticipate that my overall expenses for the year will be less and so hopefully my profit will be more. Time will tell.

The numbers might look a lot less impressive when I do a cash-on-cash return calculation. But, I am happy with the performance of the investment for the first year. I was able to use the property several times over the course of the year, and my guests paid for the mortgage and all the expenses associated with the condo. Moreover, I learned a lot while managing the property myself. That’s a win in my book.

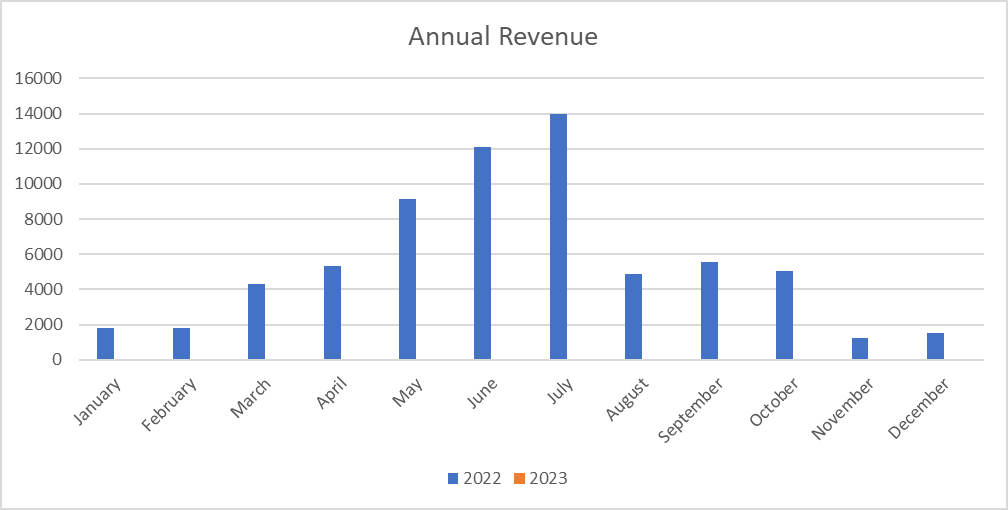

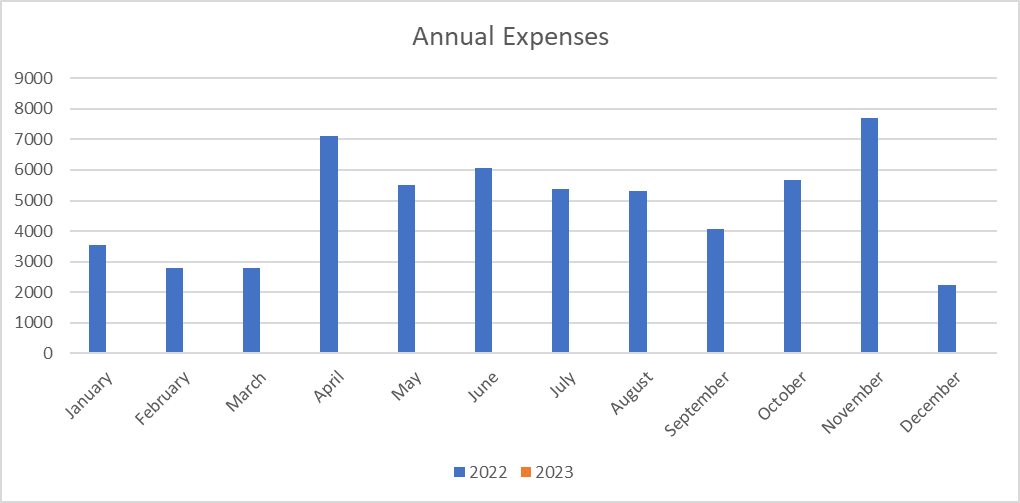

Annual Income and Expenses

As 2022 was my first year investing in a vacation rental, I don’t have any annual income to compare it to. However, for purposes of this section, here is a graphical representation of the revenues earned in December 2022 in relation to the revenues earned in previous years:

Here is a graphical representation of the expenses incurred in December 2022 in relation to the expenses incurred in previous years:

As you can see, the charts are exactly the same (except in style) as indicated above. This annual comparison section will make a lot more sense during the next vacation rental report when I am able to make a comparison. I will be able to see a trend not just from month-to-month, but also from year-to-year. I can’t wait!

Final Thoughts

What a year it has been! I ended the year with a profit of almost $10,000. I was able to successfully manage the condo from a different state, all on my own. I put a system in place that is largely automatic. I do take the time to respond to inquiries I get, but those are few and far between. Honestly, I absolutely love hosting! So much so that I am looking at buying another property in the next couple of months.

In addition to being able to make a profit, I was also able to use the unit myself. It’s possible that I could have made more if I simply invested the money I used to buy the condo into the stock market. But, I can’t sleep in bed with my stocks. I can’t go to the beach with my stocks. The condo is a physical asset that I get to enjoy and make money at the same time.

I learned a lot during 2022. I hope to cut back on some expenses in 2023, but I absolutely won’t sacrifice the quality of the accommodation I provide to my guests. Even if the end result is a loss, I aim to provide a 5-star experience every time.

2022 is over! Now, I work to make 2023 a better year!

What did you think of this post? Let me know your thoughts by commenting below.

Overall that’s a really good year since you still turned a profit and got to use the condo a few times as well. I imagine the after tax results will look even better. I had a feeling the snowbird route would be better but I’m glad you were able to test it out and have some lined up for February. All the best for the rest of 2023! Hard to believe January’s end is fast approaching.

JC recently posted…Dividend Increase | Fastenal $FAST #Dividend

Thanks JC. By the way, I just realize that I don’t take into account the fees my credit card processer charges in my expenses. I’ll have to double-check. I know that cost is passed to the guest, but I don’t want to ignore it. I’ll potentially include that for 2023 (or continue to ignore it) but we will see.

Thanks for the comment and the support as always.