I am excited to write this dividend income report. Regardless if I break any records or not, I feel confident that my dividend portfolio is moving in the right direction. There are a number of reasons for such optimism. For staters, in May, I increased the contributions to my dividend portfolio. In addition, I recently achieved financial independence. I’ve been so excited that I also decided to add a total of 8 dividend stocks and ETFs to the portfolio. So yea, I’m a bit excited to write this post. Although I won’t see the dividends from the new stocks and ETFs for a few months, it’s just exciting knowing that the dividend seeds have been planted. All it takes is time, patience and financial discipline. But, that’s not why you’re here. So, without further adieu, let’s see how much dividends I earned in July 2023.

Dividend Income

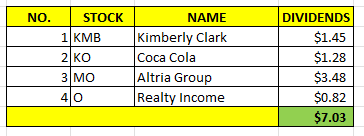

In July, I earned $7.03 in dividends broken down as follows:

Wow, that’s low. Of course, the balance in my dividend portfolio is low. I am currently writing this post at Starbucks and I spent over $9 on a Frappuccino and bagel with cream cheese. So, looking at just the small amount may be a bit unmotivating. But, and there is a but!

Dividend growth investing is a long-term strategy. That $7.03 bought that much more in shares, which will in turn produce more in dividends. Overtime, I will experience the magic of compound interest, which is described by Albert Einstein as the 8th wonder of the world. Specifically, Albert Einstein said the following:

Compound Interest is the eight wonder of the world. He who understands it, earns it. He who doesn’t, pays it.”

-Albert Einstein

Thank you Albert Einstein for making me feel better.

Annual Income

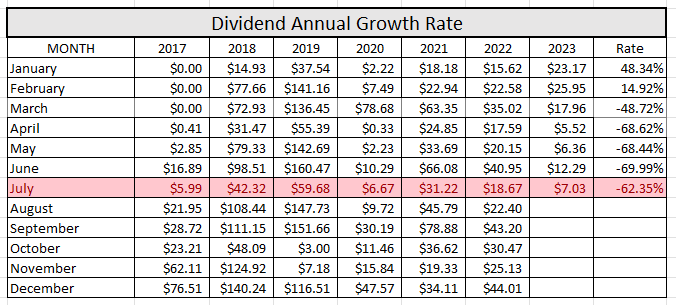

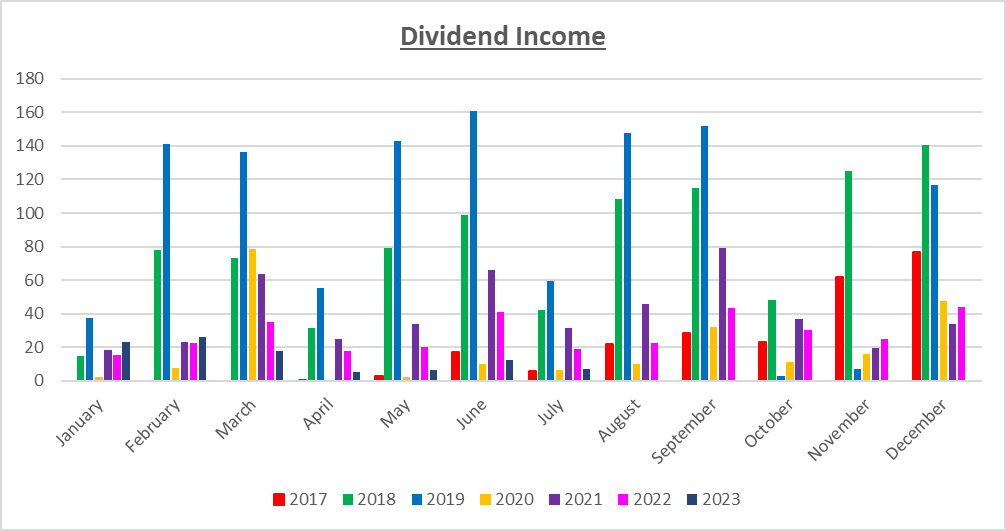

Here is a graphical representation of the dividends earned in July in relation to the dividends earned in previous years:

Here is the raw data:

As you can see, I earned 62.35% LESS dividends this year compared to last year. Of course, the reason for that is that I had to liquidate my stocks to fund the earnest deposit needed for my condo. The good news is that I hate seeing my account balance this low and my goal is to get it over $10k soon.

Forward Annual Dividends

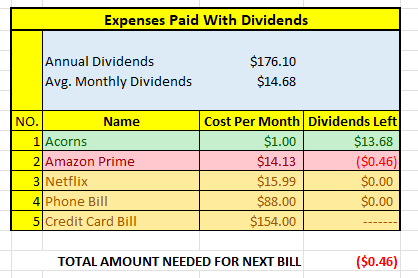

At the time of this writing, the forward annual dividends is $176.10. A month ago, my forward annual dividends was $136.28. This represents a 29.22% increase from the previous month. This double-digit increase is mainly due to my increased contribution to my dividend portfolio. More importantly, I fully expect the trend to continue in the next few months.

Finally, the Dividend Tracker, which hasn’t been updated in a while, has now been fully updated. As you can see from the tracker, I’ve made $98.25 in dividends since the beginning of the year. I may be including charts and graphs about the tracker in future posts, so stay tuned.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$176.10 per year is $14.68 dividends per month, on average. At present, I earn enough in dividends to cover Acorns. I’ll take it. As you will see below, I am $0.46 away from covering my next bill which is Amazon Prime!!!

The following is a list of expenses I am targeting:

The good news is that I should be able to cover Amazon Prime next month. Also, I’ll mention that the cost per month for my credit card bill is more than $154 (currently about $300). Since I’m far away from covering that amount with dividends, I won’t worry about updating this figure every month. Quite frankly, by the time I reach the point where I can payoff my credit card bill with my dividends, I will likely already have a zero credit card balance. As you may be aware, I track my credit card debt payoff on a monthly basis on this blog.

Final Thoughts

I was really excited to write this post. As you can see from the forward annual dividend amount, I made a relatively substantial contribution to my portfolio last month. Even though I will no longer have a job after about a month, I intend on maintaining this level of contribution for as long as possible.

However, I recently realize my expenses will increase by about $1000 a month, also starting next month. I may go into details in a future post, but sufficed to say that I may have to reassess my financial budget in about a month. Wish me luck.

How was July for you? Did you break any milestones? What did you think about this post?

Let me know your thoughts by commenting below.