Another month has gone by and we’ve completed the first quarter in 2023. A lot has happened, but I will fill you in during future posts. In any case, I am looking forward to rebuilding my portfolio as soon as possible. I hope to have it back to what it was before my recent selloff, but I want to ensure that the new condo I am purchasing can support itself. While I hope that will be the case almost immediately since we are about to hit the busy summer season, I am bracing for the fact that I will have to pay the mortgage on my own for at least one year. In any case, that’s not why you’re here. So, without further adieu, let’s see how much dividend income I received for March 2023.

Dividend Income

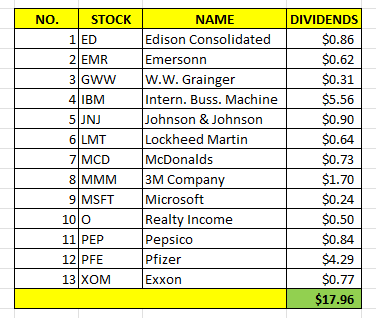

In March I earned $17.96 in dividend income broken down as follows:

$17.96 is not bad given the size of the portfolio, but I recognize the amount is small. In fact, just yesterday, I spent over $50 at bingo. I didn’t win. Hopefully, I will win at dividend growth investing. We shall see.

The goal is to rebuild the portfolio as soon as possible. There is a fair chance (perhaps 5O-5O) that I will at least increase the size of my minimum contributions after a couple of months of owning the newly purchased condo. My expenses will be a bit elevated the first couple of months, and so I want to ensure I have enough money for those anticipated expenses.

Finally, I will also try to save separately for another house purchase (in the next 2-3 years) outside of my dividend portfolio, so that way I wouldn’t have to touch the funds again, but who knows?

Wish me luck.

Annual Income

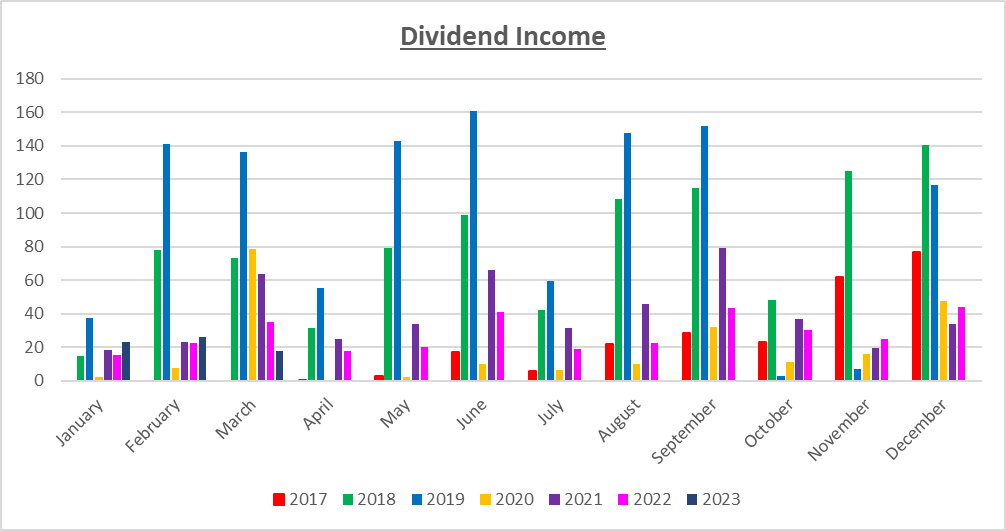

Here is a graphical representation of the dividends earned in March in relation to the dividends earned in previous years:

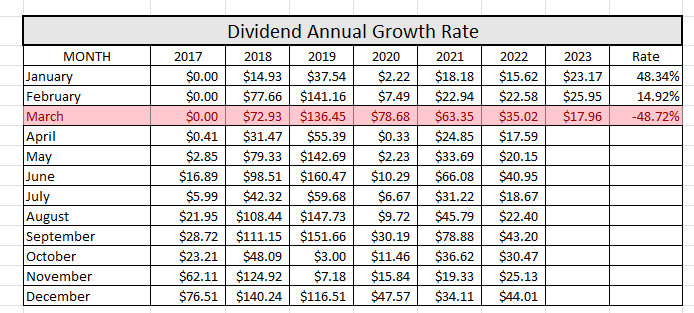

Here is the raw data:

As you can see, I earned 48.72% LESS dividends this year compared to last year. Of course, the reason for that is that I had to liquidate my stocks to fund the earnest deposit needed for my condo. The good news is that I hate seeing my account balance this low and my goal is to get it over $10k soon.

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $95.20! A month ago, my forward annual dividends was $86.02. This represents a 10.67% increase from the previous month. I’ll take it.

I am hoping to start increasing my monthly contributions to my dividend portfolio as early as May. I anticipate April to be a very expensive month for me personally, but it’s all an investment for the future. Only time will tell.

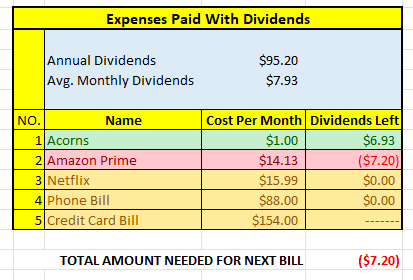

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$95.20 per year is $7.93 dividends per month, on average. At present, I earn enough in dividends to cover Acorns. I’ll take it.

The following is a list of expenses I am targeting:

I will need to reassess my expenses in about a month or two. My credit card debt is around $7000. My goal is to pay this off by the end of the year, so we will see. More to follow in future months regarding the expenses I pay with my dividend income.

Final Thoughts

There are important developments happening in April. So, be on the look out for future posts.

I wanted to get this out on April 1, but because that was April Fool’s day, I opted not to post on that day. The dividend income is small this month, but if things go well, I hope to rebuild my portfolio, perhaps as early as the end of the year. Perhaps!

Thanks for reading and for all the support. Hopefully, you had a good month in March.

What did you think of this post? Let me know by commenting below.